Reply To:

Name - Reply Comment

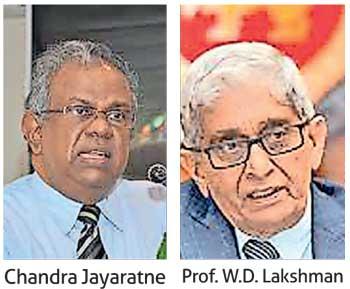

With a growing number of stakeholders and external parties, including the International Monetary Fund (IMF) and international credit rating agencies painting a gloomy picture on Sri Lanka’s debt sustainability, top private sector professional Chandra Jayaratne in an open letter has appealed to Central Bank Governor Prof. W.D. Lakshman to arrange a public participative intellectual debate on the present external sector and monetary management policies and practices.

Jayaratne, who was a Member of the Financial System Stability Consultative Committee of the Central Bank and a past Chairman of the Ceylon Chamber of Commerce, highlighted that a growing number of economists to bankers to consultants to other finance professionals are of the opinion that the way forward charted by the Central Bank to be counter-productive, untenable and impractical.

“They are in fact of the opinion that the way forward planned by the CBSL will damage the investor confidence and downgrade further Sri Lanka as an attractive destination for trade, services and logistics support; and will lead to deterring new foreign direct investments, retard the growth of the export of goods and services sector; and could further seriously impact on the monetary and exchange rate stability; and further challenge the capability to honour external debt commitments; and may even lead to the vision of Prosperity and Growth of Sri Lanka by 2025 to become a lost dream,” Jayaratne said.

He stressed that these opinions may come into question the public image of the Central Bank and its independence, professionalism and the intellectual integrity of the Governor himself as well as the Central Bank team.

Therefore, Jayaratne urged Prof. Lakshman to facilitate the proposed debate on a virtual platform, between the Central Bank team and invited economists, bankers and business managers with practical experience in business, consultancy and banking/finance in order to get more clarity on the way forward.