Reply To:

Name - Reply Comment

Fitch Ratings expects loan growth of Sri Lankan banks to accelerate from where it will end in 2020, reflecting better prospects for the banking sector and more broadly for the economy.

Loan growth, particularly private sector credit growth, is an effective gauge to ascertain the dynamism and the robustness of economic activities such as investments, business spending and consumption.

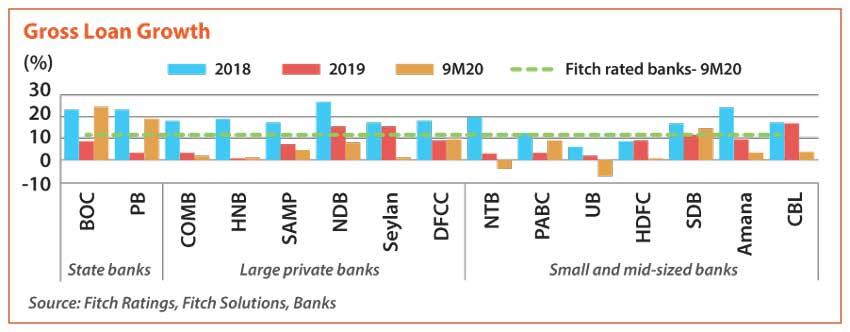

In a special report released last week on the banking sector, Fitch said the banks rated by them had expanded their loan books by a robust 11.4 percent in the nine months to September.

Fitch, however, is of the belief that State lenders would largely drive loan growth in 2021. Two of the largest State lenders have accounted for 83 percent of the incremental lending so far this year.

“Fitch expects moderately higher loan growth in 2021, driven by increased private-sector credit demand. We still expect state banks, driven by lending to the State or State-related entities, to account for a sizeable share of the incremental lending, though lower than in 2020,” the rating agency said.

According to the data available through October, Sri Lanka’s licensed commercial banks had expanded their private sector loans 6.4 percent or by Rs.59 billion in October. The credit in 10 months was a robust Rs.258 billion.

While the October credit growth lost steam due to resurgence of COVID-19, the forward data on services sector of Purchasing Managers’ Index (PMI) suggested that the momentum has regained as economic activities in the Western Province resumed from a brief halt in the first week in November.

Sri Lanka’s banks operate with adequate liquidity, much higher than what is required by the regulator, as they built up massive funding buffers during this year from customer deposits and foreign funding agencies.

Some raised money in the local capital market while State lending giants, Bank of Ceylon and National Savings Bank raised billions of rupees via issuing equity-like bonds to both bolster their capital bases and to continue the lending drive.

Banks do not raise capital over and above the regulatory minimum requirements unless they see the growth coming as idling capital left in buffers tend lose money for them.

Meanwhile, Fitch expects State banks to gain market share in the near to medium term, “as their asset growth outpaces the sector’s due to increased state lending.”

“Muted growth among the private banks has resulted in their market shares declining marginally in 9M20,” the rating agency added.

Sri Lankan banks’ asset quality has been improving since the September quarter amid pickup in loan growth while the relief measures backstopped borrowers from defaulting.

However, rating agencies, including Fitch maintain negative outlook on Sri Lanka’s banking sector over asset quality deterioration, erosion of capital and declining profits.