Reply To:

Name - Reply Comment

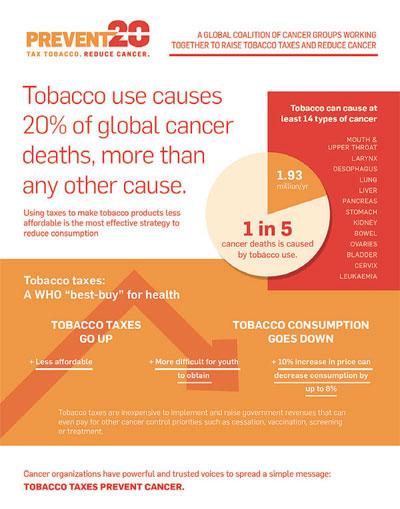

Tobacco use causes 20 percent of global cancer deaths, more than any other cause. One in five cancer deaths are caused by tobacco use, which is 1.93 million a year.

Tobacco use can make at least 14 types of cancer, namely, mouth and upper throat, larynx, oesophagus, lung, liver, pancreas, stomach, kidney, bowel, ovaries, bladder, cervix, leukaemia.

Apart from direct smoking, secondhand smoke too kills nearly 900,000 people every year, yet one-quarter of people globally remain exposed. Some groups, such as non-smoking women and those in lower socioeconomic strata, are often at higher risk of exposure and related burden. Exposure to secondhand smoking is associated with numerous adverse health effects, even among children and unborn babies, and causes substantial mortality and morbidity globally.

WHO - member countries have agreed to a target of reducing smoking prevalence by 30 percent by the year 2025.

Currently, however, the vast majority of countries around the world have not yet raised the tax on tobacco products high enough to meet that target. Concurrently, the tobacco industry works tirelessly to convince governments that raising tobacco taxes is bad for the economy.

Most tobacco users become addicted as a youth without knowing the health consequences that tobacco use will eventually inflict upon them in the future, causing a level of economic hardship that they would undoubtedly not have chosen for their families or themselves. Regardless of a country’s stage of economic development, the burden of tobacco falls disproportionately on the poor and is a source of both health and economic disparities.

The poor spend a larger share of their income on tobacco products, crowding out spending on necessities such as food, education, health and shelter.

The Prevent20 Coalition is engaged in influencing public opinion and government action on both cancer and tobacco control.

It is widely acknowledged that among all policy options available to the government, increasing the tax on cigarettes is the single most cost-effective measure for preventing and reducing smoking. It is because price plays a pivotal role in decisions to smoke by people - the less affordable cigarettes are, the less they will be consumed. Evidence confirms that a 10 percent increase in cigarette price causes smoking rates to fall between 4 percent and 8 percent on average. To reach the WHO target world average cigarette prices need to quadruple by 2025, requiring an average 7-fold excise tax increase. This scenario is attainable.

Hitting this target will result in at least, 173 million fewer smokers by 2025 due to increased cessation and reduced initiation. This will lead to at least 38 million fewer deaths. The global tax revenue will increase on average by over 160 percent by 2025, to an estimated 0.8 trillion international dollars annually.

Higher prices influence the demand for cigarettes in two ways - by influencing current smokers to quit or smoke less, and by preventing nonsmokers from ever starting.

Higher prices influence the demand for cigarettes in two ways - by influencing current smokers to quit or smoke less, and by preventing nonsmokers from ever starting.

When we start talking about tobacco taxation, we need to also discuss illicit tobacco trade as well. Many governments are swayed by the arguments of the tobacco industry that increasing cigarette taxes will encourage the creation of tobacco black markets that are outside the reach of the tax department. We know that much of the research linking illicit tobacco trade with tax increases is backed by the tobacco industry. Growing evidence suggests that these industry-commissioned studies overstate the illicit cigarette trade problem.

Most cigarettes traded illicitly are products of legitimate tobacco manufacturers that profit from selling these cigarettes to smugglers and use illicit trade as a counter-argument against tobacco control policies.

Today, the primary argument that the tobacco industry uses to oppose new tobacco control regulations is that it will cause a dramatic increase in cigarette smuggling.

However, these industry arguments should be treated with particular caution. Studies paid for and presented by cigarette manufacturers are generally not independently-verified or peer-reviewed and, unlike academic research studies, are not replicable. Growing evidence suggests that these industry-commissioned studies typically grossly overstate the illicit cigarette trade problem.

Because the industry’s illicit trade estimates cannot be trusted, governments need to seek for other rigorous and industry-independent estimates. Illicit trade estimates that are not influenced by the tobacco industry are rare. In addition to obtaining reliable information on illicit cigarette trade, those who tackle the problem need to understand that the illicit cigarette trade has one powerful and perhaps unexpected ally: the tobacco industry.

It is estimated that 98 percent of illicit cigarettes traded globally are products of legitimate tobacco manufacturers. This proportion might seem unbelievable unless one understands that tobacco companies are among the main actors benefiting from the illicit cigarette trade.

Smuggling helps the tobacco industry generate higher profits by enabling them to pay tobacco taxes in jurisdictions with lower levies or to not pay taxes at all. It is well documented that the tobacco industry’s various business strategies to expand tobacco sales facilitated the illicit cigarette trade. Worldwide, transnational tobacco companies have been found guilty of organizing illicit tobacco trade, and have paid billions of dollars in penalties.

Governments can take effective and proven steps to prevent the illicit cigarette trade. Much of the problem can be addressed by strengthening tax administration and enforcement.

However, because the tobacco industry and the smugglers work internationally, the ultimate steps to eliminate illicit cigarette trade and hold the responsible entities accountable will require global cooperation.

The Protocol to Eliminate Illicit Trade in Tobacco Products is a platform for such a global effort. When in force, the Protocol would help to prevent illicit trade by securing the supply chain, including through tracking and tracing cigarette packs; requiring companies to exercise due diligence; and by strengthening law enforcement, including through international cooperation.

Countries have committed to reducing premature mortality from non-communicable diseases (NCDs) by 2030 as sustainable development goals are the first development goals at the international level that explicitly include a target on NCDs. Tobacco use is a key risk factor that greatly contributes to the NCD burden, and countries have also committed to meeting the WHO’s target of reducing smoking prevalence by 30 percent by 2025.

The optimum taxation level will vary from country to country and we should use a number of data points to estimate by how much tobacco taxes should be increased to reduce smoking prevalence by 30 percent by 2025.

Source of information: Campaign for Tobacco Free-kids and

Tobacco Atlas