Reply To:

Name - Reply Comment

By Chandeepa Wettasinghe

In the backdrop of power cuts being announced this week, the Sri Lankan power regulator downplayed the effect that investors shunning opportunities in the power sector will have on the widely accepted possibility of power crisis starting from 2018 until the commissioning of a major power plant.

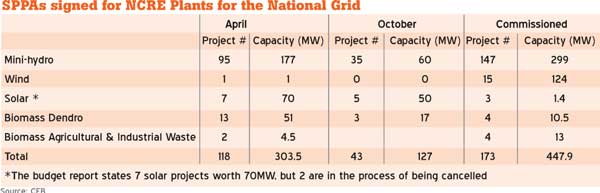

According to a high-ranked Power and Energy Ministry official who wished to remain anonymous, quoting from a Ceylon Electricity Board (CEB) report done for the 2017 budget, just 127MW in capacity through 44 private sector Standardized Power Purchase Agreements (SPPAs) of non-conventional renewable energy (NCRE) are in the pipeline. However, PUCSL had approved CEB’s 2015 and 2017 Least Cost Long Term Generation Plans on the condition that 1,230 MW in capacity would be commissioned by 2020, which would include 485MW in NCRE SPPAs.

“During the first few years, the 300MW gas plant, the 170MW diesel and the Uma Oya (120MW) will be enough,” Public Utilities Commission of Sri Lanka (PUCSL) Director General Damitha Kumarasinghe told a press conference yesterday.

The said gas plant is set to be commissioned in 2019, while the diesel plant is expected to come online in 2017 in the Southern Province, and the Uma Oya plant is expected to be ready in 2018. Kumarasinghe’s comments come at a time when the country’s largest power plant, the 900MW Lakvijaya Coal Plant, which supplies over 40 percent of the country’s capacity, is disconnected from the grid for the second time this year.

The coal plant has gone offline during an intense drought, which has placed constraints on power generation from the country’s hydro power assets, which altogether also account for over 40 percent of the country’s energy needs. The construction period for mini-hydro plants in Sri Lanka, which dominate the 127MW mix, had been between 18-24 months historically, while solar projects had taken around 8 months, in addition to feasibility studies, Environment Impact Assessments (EIA) etc.

The ministry official noted however that in this day and age, where the 500MW Sampur Coal Power Plant was delayed for 4 years—causing the possibility of crisis—and eventually cancelled and expected to be converted to natural gas due to environmental concerns, most projects could get delayed.

“There’s a lot of sensitivity now. People make a huge fuss even when a small thing happens to a river,” he said. He noted that even the finalized 100MW Wind Power Farm in Mannar has not received any funding. Scholars and environmental pressure groups rejected past EIAs, noting that the wind farms would cause the death of many migrating birds, which would affect the country’s ecosystem adversely.

Perhaps influenced by such pressure, but also combined with the 2016 budget move to cancel any SPPA commitments for which development has not begun by December 31, 2015—which was later delayed to December 31, 2016—the number of SPPAs in the pipeline drastically reduced from earlier this year.

The CEB data this April had shown that SPPAs for 119 NCREs were signed and in the pipeline, for a total capacity of 314 MW and 173 NCRE projects were in operation with a capacity of 448MW.

An investor who already operates mini-hydro plants, under the condition of anonymity, said that investments into the sector are low due to both policy uncertainties as well as due to CEB officials dragging the process of private sector power plant development, in favour of lobbying for mega CEB projects.

The mini-hydro power purchasing tariff for SPPAs was reduced this year, and Sri Lankan energy companies are engaged in more lucrative projects in Africa.

Both Power and Energy Ministry official, as well as the Sustainable Energy Authority Chairman had noted that even some of the remaining SPPAs had not yet started development. Kumarasinghe noted that the CEB has been instructed to draft an implementation plan to determine the timelines for the currently signed SPPAs. “We have asked for the implementation plan for these power plants, which is due on 28th of October. After that, everyone can see how they are developed,” Kumarasinghe said.

Power Sector Expert Dr. Tilak Siyambalapitiya has pointed out that the average energy cost alone could increase to Rs. 10.98 per unit under the new plan, compared to Rs. 7.68 per unit generated so far this year.

The country currently has a 3,900MW generation capacity, and CEB had projected peak time generation requirements to be 2,703MW by 2018 and 3003MW by 2030.

However, PUSCL had asked CEB to revise its calculations as it may have not included all possibilities in its demand projection methodology.