Reply To:

Name - Reply Comment

The great achievements of the 20th century in the demographic sector are increment of longevity, reducing infant mortality, an increment of life expectancy and decreased fertility rates, through medical science. However, this has caused to make an imbalance in the population pyramid and put more weight on the population seesaw by the rapidly aging population.

The great achievements of the 20th century in the demographic sector are increment of longevity, reducing infant mortality, an increment of life expectancy and decreased fertility rates, through medical science. However, this has caused to make an imbalance in the population pyramid and put more weight on the population seesaw by the rapidly aging population.

Sri Lanka is also recognized as a country experiencing a very rapid demographic transition among the countries of South Asia. Based on the latest United Nations estimates, the current population of Sri Lanka is 20,971,313 as of Tuesday, October 16, 2018. Approximately 9.67 percent of its population is above the age of 65 years and 24.6 percent of its population is between the 0-14-year-old age brackets of the total population.

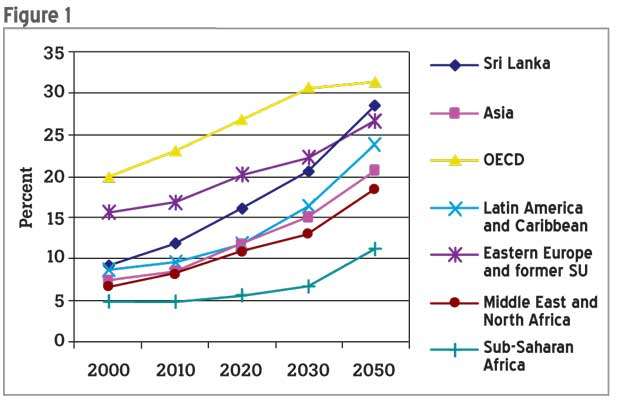

The early working-age bracket (15-24-year-old age) is 14.63 percent, 25-54 years is 41.58 percent and the 55-64-year-old bracket is 10.06 percent. (In 2016, the working-age population – those ages 15-64, is 48.53 percent). The estimated data showed that Sri Lanka’s population is aging faster than any other nation in South Asia, countries in Eastern Europe, the Middle East, Latin American and the Caribbean and African.

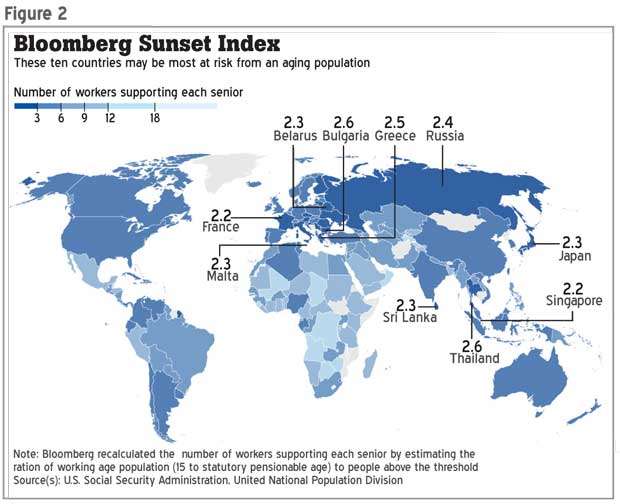

Figure 1 shows Sri Lanka’s and the world regional average percentage of population of over 60-year-olds in the 2000-2050 period. For example, in 2041, one out of every four persons is expected to be an elderly person in Sri Lanka. Furthermore, according to the estimation of the Bloomberg Sunset Index in 2016, our country is included as one of the countries having more risk from an aging population. Further, that index explained that Sri Lanka needed 2.3 workers to support each senior person currently.

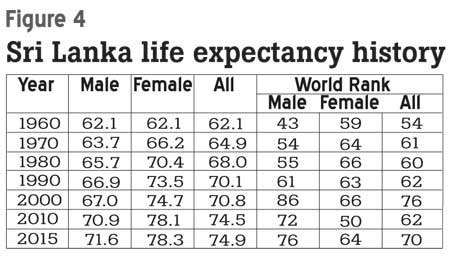

In the very near future, Sri Lanka is becoming a country having the oldest people in the non-developed world and also one of the fastest aging countries in the world, like a more developed country. The main drivers for the aging population are – life expectancy has been increased and the speed of the decline in fertility rates has been dramatically reduced. Further, the high ratio of retirement of baby boomers, who were born between 1946 and 1960 years, has also influenced to change the size and age structure of the population.

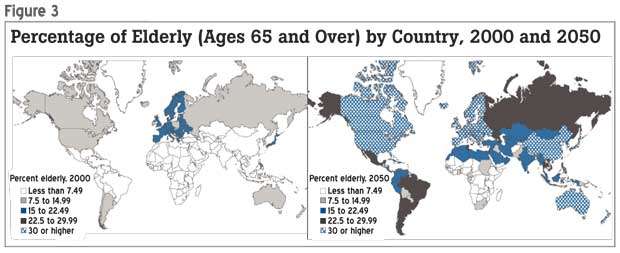

According to the data, the total fertility rate (the number of children that the average woman bears during her lifetime) fell below the replacement level of 2.1 by 1994 and it has continued to fall, reaching 1.7-1.9 in the 2000s but now increased to 2.05 in 2016. Further, the demographic profile-estimated population growth rate in 2016 is 0.8 percent and the estimated birth rate is 1.5 for the 2016 year. Figure 3 shows that during 2000 to 2050 or within the 50-year period, Sri Lanka’s population is set to age rapidly, with the proportion of old people increasing substantially.

As noted above, increasing life expectancy is one of the drivers of Sri Lanka’s population aging. Sri Lanka has a high life expectancy of 75.94 years, with a male life expectancy at 72.43 years and female life expectancy at 79.59 years higher than in most developing countries and the present trends indicate that life expectancy will reach the current average of the Organisation for Economic Co-operation and Development level of 77.8 years by 2050. Central to Sri Lanka’s demographic aging will therefore be an increase in the share of the old people, with the share of people aged 60 years and above projected to increase from the current 11 percent to 18 percent in 2025 and to 27.6 percent in 2050. According to demographic researchers, Sri Lanka become a super-aged country or more than 21 percent aged 65 or over in 2030.

The UN Population Division in 2015 estimated people aged 65 years and over per 100 working-age people that the old-age dependency ratio is expected to rise from about 10.9 in 2011 to 23.7 per 100 by 2030. The aging of the country’s population poses serious economic problems and social challenges that our country needs to be faced in the very near future.

According to the latest Word Fact Book, the estimated total dependency ratio in 2016 (proportion of population aged 65 years or more versus the proportion aged 15-59 years) in Sri Lanka is 51.47, with the elderly dependency ratio being 14.69, youth dependency ratio 36.79 and potential support ratio 7.5. But in 2050, according to the data of the population division of the UN, the total dependency ratio becomes 62.9 percent with the dependency ratio of elderly increasing to 34.7, youth dependency ratio reducing to 28.2 percent and potential support ratio being 2.9.

A discussion paper by Nicole Maestas, Kathleen Mullen and David Powell on the ‘Effect of Population Aging on Economic Growth’ estimates that a 10 percent increase in the fraction of the population ages 60+ decreases growth in the GDP per capita by 5.7 percent, due to the reduction in the GDP growth being driven by reductions in labour supply, as measured by worker per capita, hours worked per capita and labour earnings per capita. Aging people bring their experiences in the production but as more people age and retire and less people enter the workforce, it will cause a reduction in the total workforce and less people entering the workforce causes to reduce the aggregate production. In that sense, population aging acts as a decrease of economic growth. Therefore, Sri Lanka needs to import approximately less than 20 percent of workers from other countries to sustain the dependency ratio at 2016 level in 2030. This figure can be increased more in 2050.

Labour force growth slowdown

Due to the aging population, a slowdown in the labour force growth is an unavoidable outcome. The UN labour force projections show that the Sri Lankan labour force percentage was 64.4 percent in 2000 and in 2025 it will shrink to 62.0 percent and in 2050 to 55.1 percent. Population aging significantly changes the age composition of the labour force, with the share of workers younger than 30 years significantly shrinking and the share of those older than 50 years strongly increasing. With labour force growth being one of the sources of economic growth, the slowdown of labour force growth and its shrinking after 2025 may contribute to a slowdown in the GDP growth. The ageing population will not only create a shortage of young talent in the national labour force but also create a large-scale exit of experienced human capital from the national labour force reaching its traditional retirement age.

Some authors argue that an increase in elderly people tends to reduce the per capita income of the three generations – child, working group and retiree – and this will decrease the total consumption of the family. Further, when an aging population is increased, it causes a reduction in consumption because older people do not need to purchase luxury items because already they may have those items or they would like to buy only the essential items. On the other hand, the government needs to collect more taxes from the working people to sustain the retired people or older people of the country by reducing the purchasing power of them. This may cause to increase the inventories of the producers and it may tend to reduce the production because younger people do not have enough money to afford to buy luxury items. Therefore, the producers would like to reduce their productions. Hence, the country’s GDP can be decreased. This will lead to slow economic growth of the country.

As a cultural value, older people in our country have relied heavily on their family for personal care and material support. Today, however, such support is under pressure from trends that include falling fertility rates (which means fewer children as caregivers), changing cultural norms, increased longevity of the elderly and migration of rural young people to cities as well as foreign countries and away from elderly relatives.

Then, the Sri Lankan government needs to impose more taxes by considering the care of aging people of the country by providing the healthcare services because aging leads to increasing the demand for care that addresses chronic health conditions or welfare services from the working people and to sustain the pension system to compensate the increment of the expenditure. Increasing age is related to higher health risks, ranging from diminishing motor and sensory functions to a greater incidence of non-communicable diseases such as heart disease and cancer. But chronic conditions such as diabetes, cancer and heart diseases can progress to disable the elderly people or the disable levels can be dropped or the disability rates will remain stable in the future. Also, those in retirement tend to pay lower income taxes or can get full waivers from the taxes because they do not work. Therefore, reducing the taxes directly provokes an increase in the deficit in the government budget.

Therefore, it is better to forecast that our children will not provide care to their older parents due to work pressure or personal or family engagement or sometimes they may live in other cities or countries in the world. When the government gets more taxes, it can be reduced – the market demand and finally the domestic market can be more compressed.

And also, the government would not like to increase the tax to a higher tax bracket. It would be unwilling to increase lower tax brackets too. Therefore, the government needs to consider increasing the indirect taxes from business organisations. Then the organisations need to earn profits by increasing the prices of the goods that caused to reduce the demands for the goods. Again that would cause to create a more compressed market and reduce the total GDP of the country. According to the data, the women percentage of the elderly population is high in Sri Lanka and the female advances in life expectancy than male, which may create a more widened gap between the male and female elderly percentage. The elderly women are generally more likely to be disabled, widowed, living alone and to have fewer financial resources compared with the elderly men at any given age.

Therefore, the government needs to consider more facilities for female elders.

On the one hand, when the retirement age is fixed and the life expectancy increases, there will be relatively more people claiming pension benefits and fewer people working and paying high income taxes.

Those who are not entitled to pension benefits tend to depend on their savings or their children’s income for their day-to-day living. This can influence the economy at macro level with a decline in the total domestic savings and investment.

Also, those who are entitled to obtain the pension may be able to get that benefit rather than their actual service years. A reduction in savings caused by an increase in the proportion of the elderly in the population means a relative increase in the numbers who draw down assets, thereby reducing the total private saving. Major government transfer programmes – social security and health programmes (pharmaceutical benefit scheme and medical care) are expected to blow out over time in favour of the elderly.

Per capita income decline

The saving rate decreases for the retirees as saving becomes the source of their spending. Hence, the ageing population will increase the dependency ratio in a family. An increase in child dependency in a family will lead to a significant decline in the per capita income of the child generation alone. On the other hand, as the dependency ratio increases, the working people need to earn more revenues to bear the expenditures. Therefore, dual employment practices – full time or part time – can increase in the future.

Therefore, when more women enter full-time employment or part-time employment or do not live near their elderly parents, will lead to getting help from professional people to look after their elders or to get home care facilities, paying money. In the very near future, we will not be able to get informal housemaid services but once we are able to get professional services, it will also increase the overall expenditure of the people. The involvement of the female in the labour force can be considered negatively influencing the fertility rate too. Therefore, human resource and fertility rate are negatively correlated. Thus, the government needs to pay its attention to child and elder care facilities and to enhance the scope and efficiency of transport facilities for the working and older people to reach their work places and to increase accessibility to essential services for the elderly people.

The summarized main economic impacts of an aging population can be noted as follows:

Most of the researchers argue that there is a negative relationship between population aging and economic growth but some researchers claim the existence of a positive effect. For example, older individuals tend to save more because they do not need to consume items other than daily needs. Therefore, they tend to save more and so there tend to be more resources available for investment. It will impact economic growth like in Japan. Further, an increase in the number of older people will create a bigger market for goods and services linked to older people, such as retirement homes and other elder people supportive services. A decline in the birth rate means there is a small number of young people. This will save the government money by reducing expenditures on education, health, etc. But it depends on the net cost of the retired people – if it is lesser that the net cost of young people.

However, there is a pretty good problem to occur. This happen in many ways, including importing workers and exporting jobs, cross-border economic activities, volunteerism, extending retirement when our people live longer, healthier lives, they may able to continue to work, contributing to society well beyond the official retirement age and creating new market opportunities to companies from various sectors. Hence, our policymakers need to pay undivided attention to the following micro aspects of economics, caused by an aging population.

(Dr. N.N.J. Navaratne is Senior Lecturer, Department of Human Resources Management, Faculty of Management and Finance, University of Colombo)