Reply To:

Name - Reply Comment

By First Capital Research

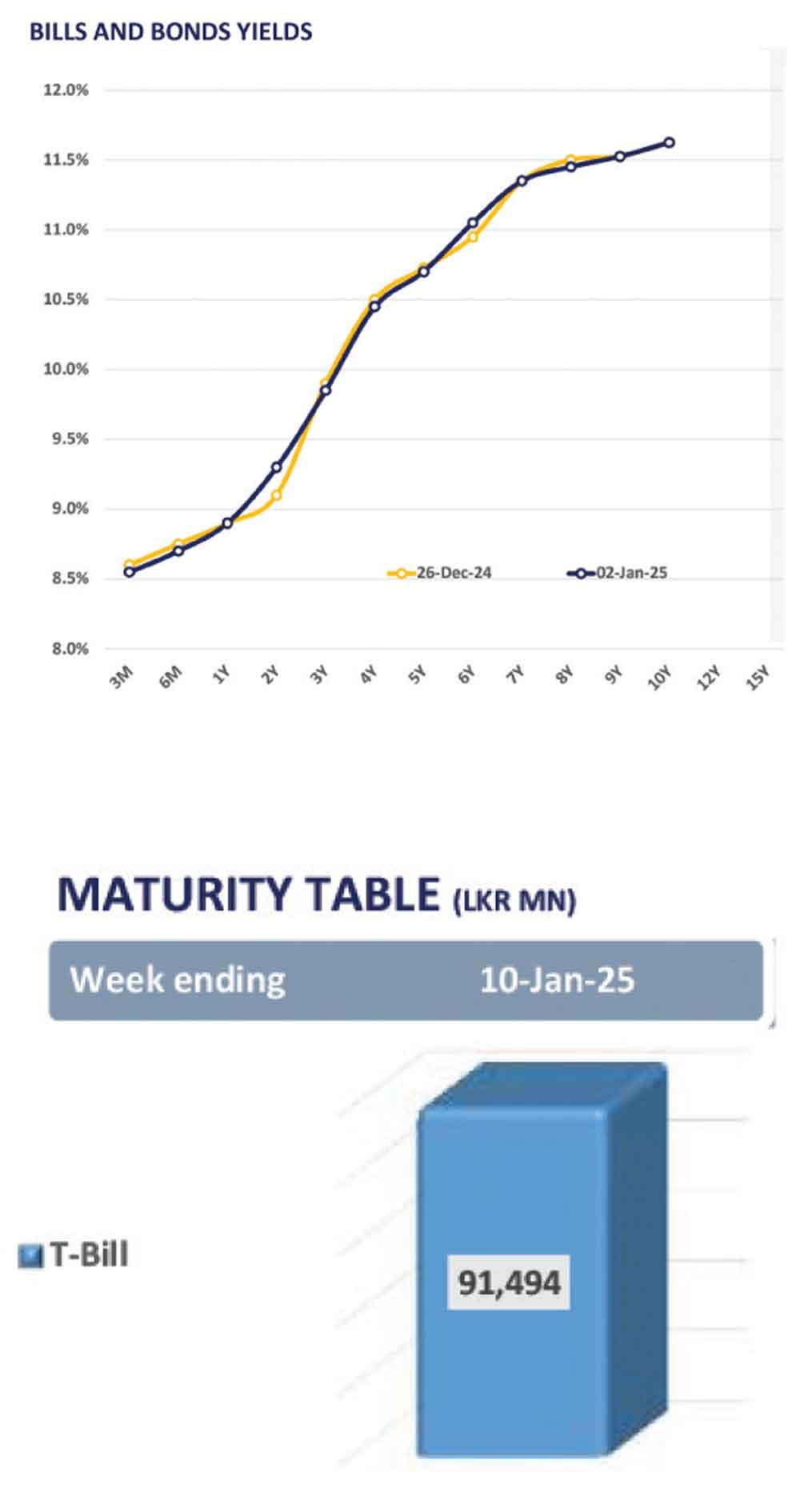

Opening the 1st trading day for the year, the secondary market saw a mixed interest yesterday, resulting in a shift in the yield curve.

Opening the 1st trading day for the year, the secondary market saw a mixed interest yesterday, resulting in a shift in the yield curve.

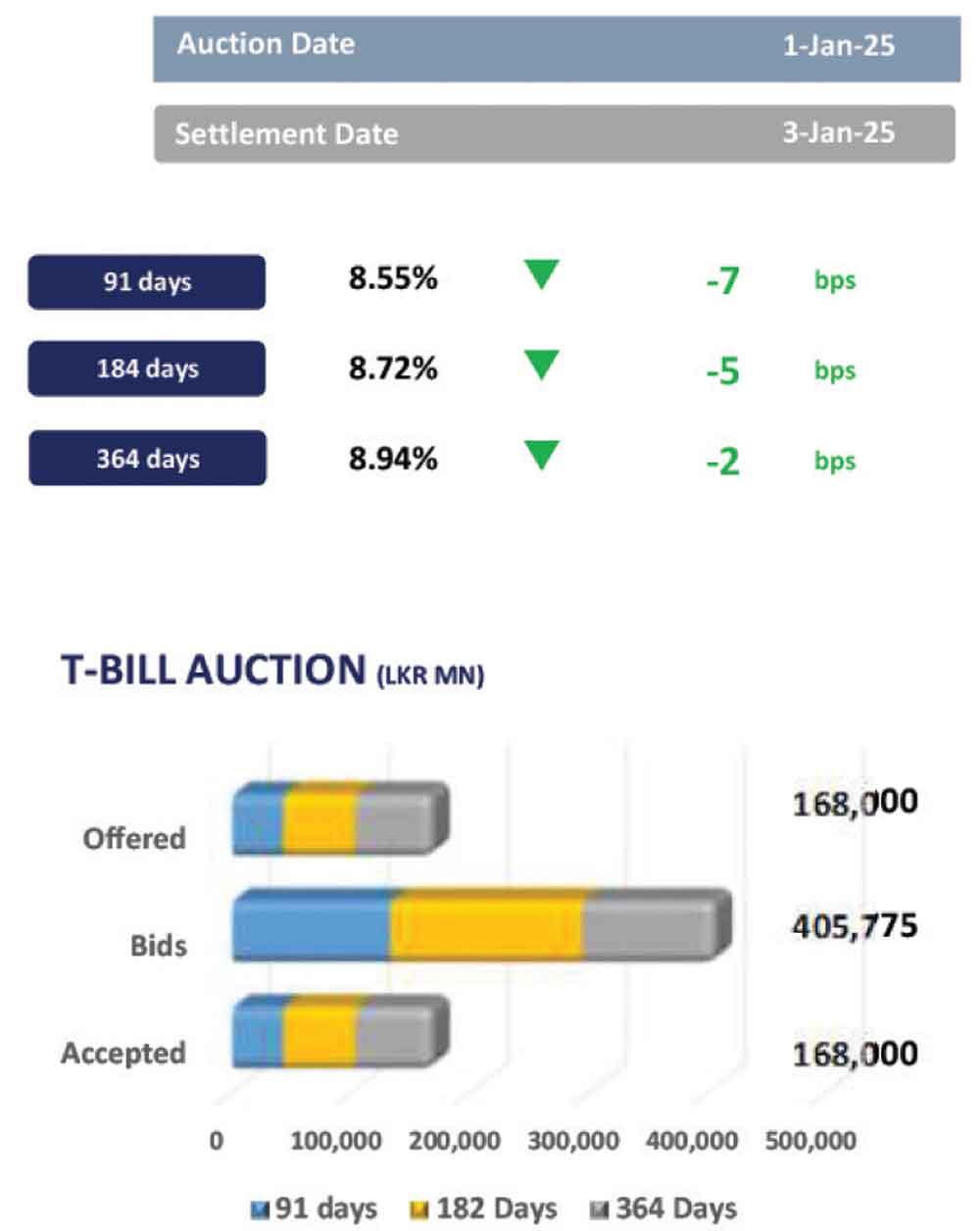

Mid tenors attracted interest during the day as trades were seen among 2027, 2030 and 2031 bonds. Accordingly, 15.09.2027, 15.10.2027 and 15.12.2027 registered trades between 9.75%-9.85%. Moreover, 15.05.2030 closed transactions at 11.02% and 15.10.2030 hovered between 11.08%-11.15% during the day. Also, 01.12.2031 closed trades at 11.30%. On the external side, LKR depreciated against the greenback for the 2nd consecutive day, closing at Rs. 293.4/USD compared to previous day’s closing of Rs. 293.0/USD. Similarly, the rupee depreciated against other major currencies including the GBP, EUR, AUD and CNY. Meanwhile, during the year 2024, the rupee has appreciated sharply against the USD by 9.7%.

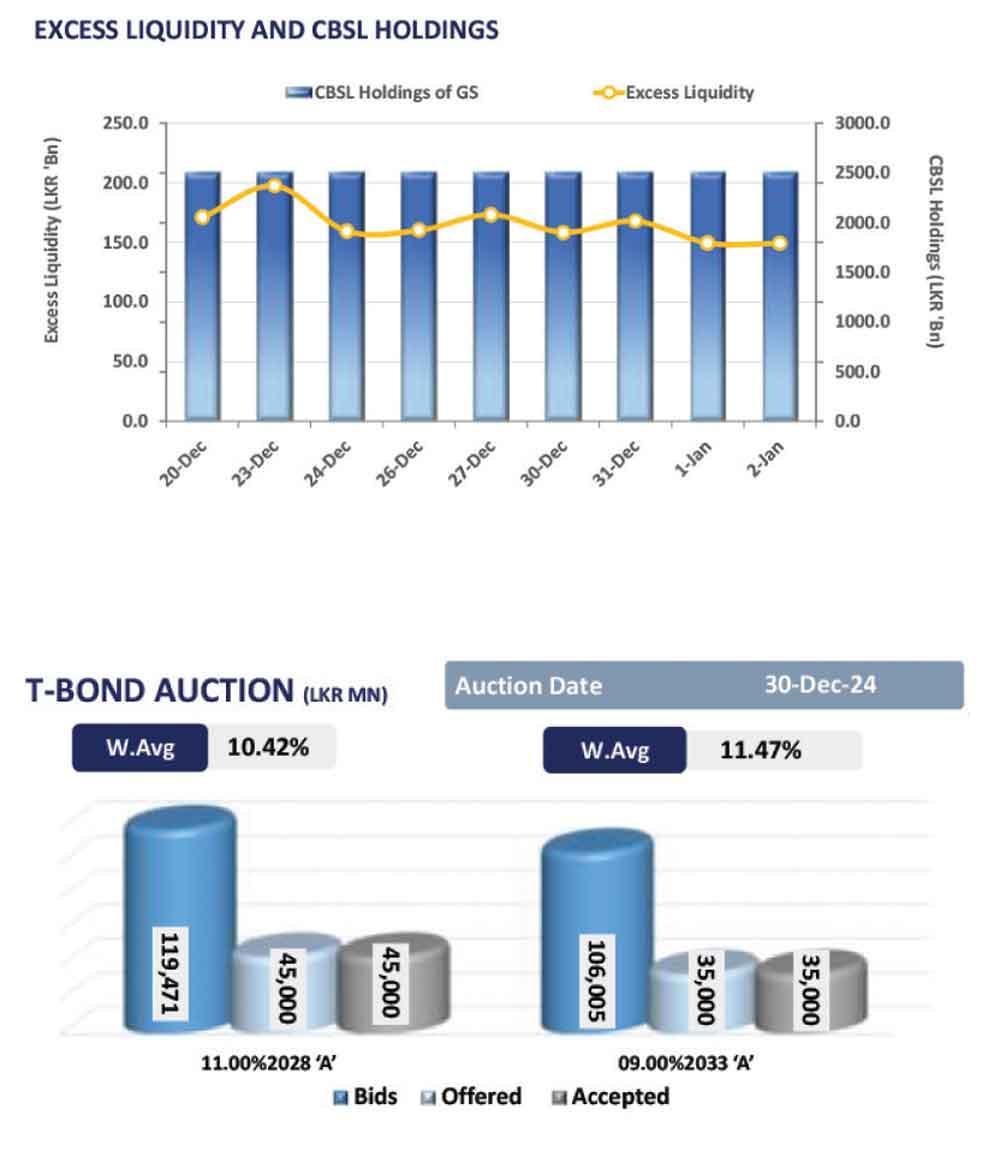

Meanwhile, the overnight liquidity level remained broadly stable at Rs. 149.36bn compared to yesterday’s level of Rs. 149.50bn. Moreover, CBSL Holdings continued to remain stagnant at Rs. 2,515.62bn during the day.

On the external side, LKR depreciated against the greenback for the 2nd consecutive day, closing at Rs. 293.4/USD compared to previous day’s closing of Rs. 293.0/USD.

Similarly, the rupee depreciated against other major currencies including the GBP, EUR, AUD and CNY. Meanwhile, during the year 2024, the rupee has appreciated sharply against the USD by 8.9 percent. Meanwhile, the overnight liquidity level remained broadly stable at Rs. 149.36bn compared to Wednesday’s level of Rs. 149.50bn. Moreover, CBSL Holdings continued to remain stagnant at Rs. 2,515.62bn during the day.