Reply To:

Name - Reply Comment

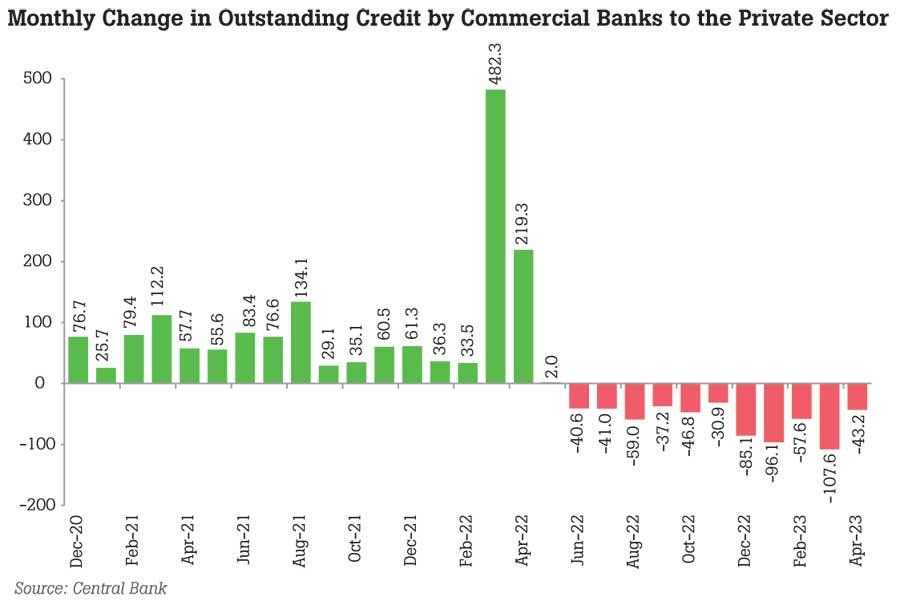

The months-long contraction in credit to the private sector somewhat moderated in April in a sign of bottoming out ahead of further easing in the interest rates in the months to come with the beginning of a monetary easing cycle set off last week.

Data showed that outstanding credit to the private sector by licensed commercial banks had contracted by Rs.43.2 billion in April, moderating from an outsized contraction of Rs.107.6 billion in March.

The March contraction came as a bit of a surprise as financial conditions, despite remaining ultra-tight, were beginning to see signs of easing from the start of 2023 even prior to the ease in monetary policy.

Central Bank last week surprised the markets with a 250 basis points cut in key rates as the rate setting committee determined that any more easing in financial conditions on its own could not happen without

policy support.

April marked the 11th consecutive month of private sector credit decline since the current streak of credit contraction set off in June last year in response to ultra-tight monetary policy, which followed the economic crash firing runaway inflation.

The inflation eased substantially in April and May, coming down from 50 percent levels which it hovered for months till March, offering the Central Bank the space to bring forward its easing cycle at least by a month or two.

Earlier, the consensus estimate was for the Central Bank to start cutting rates by the third or the fourth quarter. The IMF was adamant that the Central Bank stays on course until the inflationary forces clearly dissipated. But the faster than anticipated deceleration in the consumer prices helped officials to strike early as the pressure was building up for them to deliver on growth and economic wellbeing of people and businesses who have been battered for nearly two years from commodities shortages and cost of living crisis. However, the officials stressed that they expect a faster pass-through of last week’s cut in rates via the licensed banks by way of equally or higher decline in market lending rates.

The decline in lending rates could unshackle the animal spirits in the economy, setting off a period of recovery and growth in the economy, which will bring down prices and also increase the incomes of people. “The downward adjustment in market interest rates will accelerate in line with the envisaged single digit inflation, thereby supporting credit to the private sector and softening the pressures in the financial sector,” the Central Bank said on last Thursday.

“Credit to the private sector by licensed commercial banks (LCBs), including the SME sector, which continued to contract since June 2022, is expected to turnaround gradually with the easing of monetary conditions and the envisaged rebound of economic activity,” it added.

The language of the Monetary Board was in sharp contrast to a few months ago and it clearly marked a change of tone from the need to reestablish stability to a one with the need to support recovery and growth.

The same night, President Ranil Wickremesinghe in a televised speech announced that Sri Lanka had exited the economic crisis and the stage is set for an accelerated growth path.

The Central Bank also expects the economy to stage a rebound in the back half of the year from a projected contraction in the first half.

The following day, Finance Ministry announced they were going to scrap import controls on another batch of 300 to 400 items, which is aimed at supporting SME growth.

While the economic policy maneuvers are timely and are much needed to reverse the contracting economy for 18 months, they also signal an approaching election cycle.