Reply To:

Name - Reply Comment

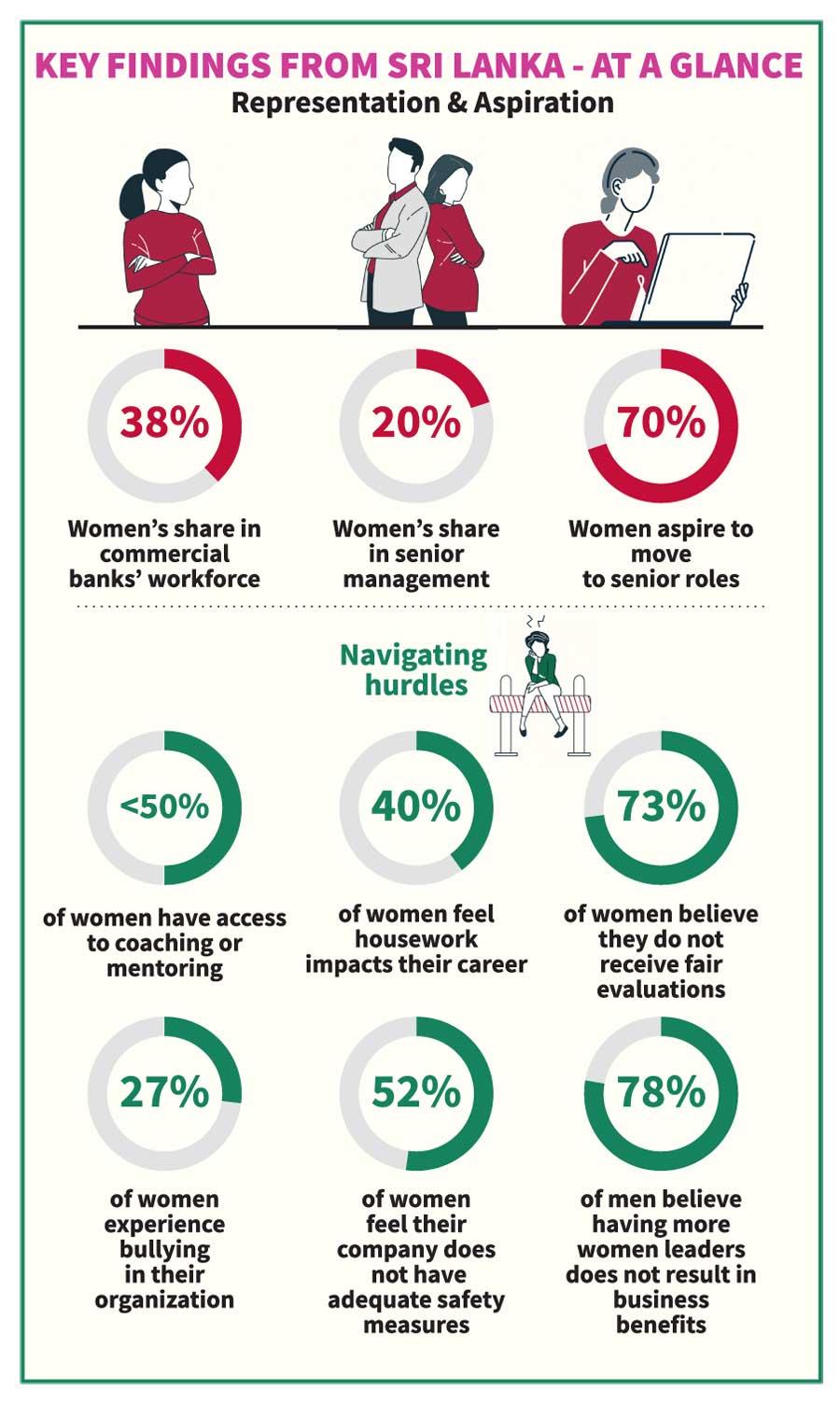

- Women comprise 46% of new recruits and 27% of board positions

- However, progression of women in sector does not match their career aspirations or progression compared to men

- Women representation drops from 40% at entry level to 27% in middle management and further to 20% in senior management roles

Sri Lanka surpasses all its South Asian counterparts in recruiting women at entry level in the banking sector, a recent report by the International Finance Corporation (IFC) highlighted.

Women comprised 46 percent of new recruits and 27 percent of board positions, making Sri Lanka the leader in board level gender diversity, according to the report.

Titled ‘Women’s Advancement in Banking in Emerging South Asian Countries’, the IFC, in collaboration with the Australian government, had assessed the private sector commercial banks in Bangladesh, Nepal and Sri Lanka.

The research in Sri Lanka was conducted across seven leading private commercial banks, representing 41 percent of the market share. The report showed that 38 percent of the workforce in these banks were represented by women and 70 percent of them aspire to move to senior roles.

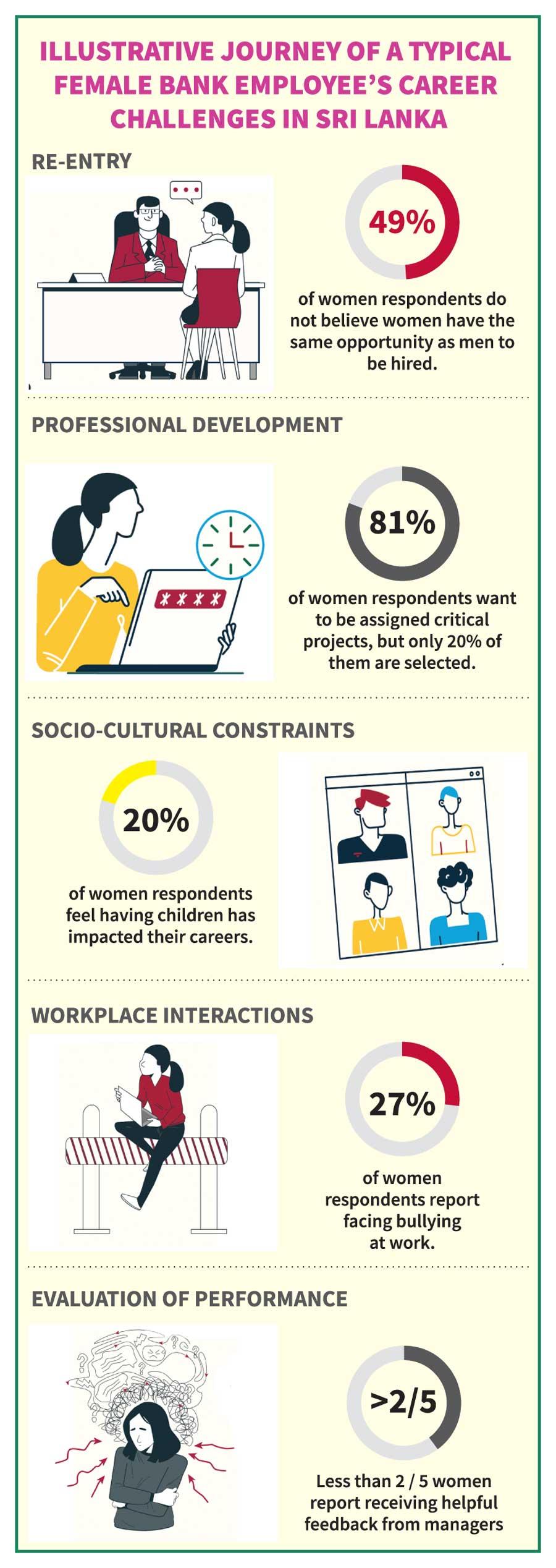

However, progression of women in the sector does not match their career aspirations or progression compared to men, the findings of the report revealed. This is in spite of Sri Lanka being very close to gender parity in recruitments and workforce, compared to the global averages.

The research data showed that women representation drops from 40 percent at entry level to 27 percent in middle management and further to 20 percent in the senior management roles.

Barriers such as lack of fair evaluations, sociocultural constraints and non-conducive work environments are identified to curtail women’s growth prospects in the country.

Moreover, more than 50 percent of middle managers, many employees and senior managers in Sri Lanka were sceptic about the importance of female leadership for business, the report stated.

Seventy-eight percent of the men, who were consulted, did not believe that having more women leaders resulted in business benefits.

The previous global research has indicated that commercial banks, with at least 15 percent of women in the senior management, achieve up to 33 percent higher return on equity.

According to the IFC, three key challenges stand out for Sri Lanka. The first is sociocultural constraints: where social expectations place a disproportionate burden of unpaid care work (such as managing housework and childcare responsibilities) on women. Many women exit the industry, due to this burden after marriage and/or parenthood. The study showed that 40 percent and 20 percent female respondents, respectively believe managing housework and having children have or will negatively impact on their career.

The second is lack of fair evaluations. While two of the six surveyed banks in Sri Lanka report having instituted clear performance assessment criteria, others are yet to introduce mechanisms to make performance evaluations more objective or enhance accountability to weed out biases in the evaluation process.

The third is non-conducive work environment. Less than half of the female respondents (49 percent) report feeling confident at work. Many women report facing micro-aggressions such as being frequently interrupted when speaking. The banks and policymakers have initiated many steps to improve women’s participation and progression but the success of the existing efforts is limited by a lack of buy-in from the banks’ leadership, the IFC said.

“Addressing the multifaceted challenges faced by female bankers requires comprehensive and collective action, rather than isolated interventions. We must tackle these barriers—whether policy, process or culture related—in a targeted manner, creating an inclusive banking sector and driving greater economic growth,” IFC Regional Director for South Asia Imad N. Fakhoury said. Accordingly, Sri Lanka needs a stronger commitment from the leaders in the banking industry to create inclusive workspaces, the report highlighted.

The IFC recommended targeted efforts such as commitment and accountability for gender diversity, equitable and safe workplaces, supportive ecosystems, etc. to bolster women’s advancement in commercial banking. (NR)