Reply To:

Name - Reply Comment

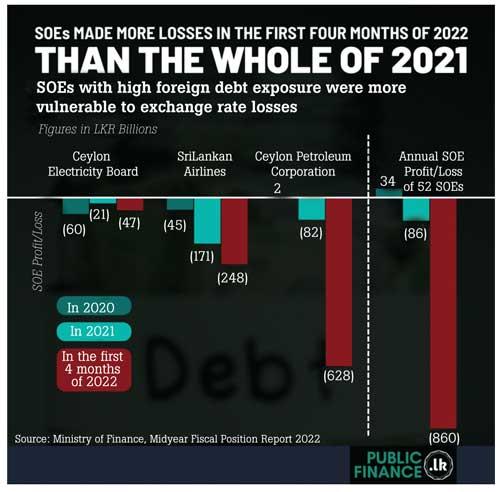

The cumulative losses of 52 key state-owned enterprises (SOEs) during the first four months of 2022 topped the total annual loss recorded in 2021, with Ceylon Petroleum Corporation (CPC) contributing 73 percent of the total SOE losses, driven by foreign exchange losses.

During the first four months of 2022, the Rs.860 billion cumulative loss of the 52 key SOEs outweighed the annual loss of Rs.86 billion in 2021 and Rs.34 billion profit reported in 2020, according to the data parsed by PublicFinance.lk, a platform for public finance-related information in Sri Lanka.

During the first four months of 2022, the Rs.860 billion cumulative loss of the 52 key SOEs outweighed the annual loss of Rs.86 billion in 2021 and Rs.34 billion profit reported in 2020, according to the data parsed by PublicFinance.lk, a platform for public finance-related information in Sri Lanka.

Severely impacted by the depreciation of the rupee, CPC’s loss widened to Rs.628 billion in the four months, far exceeding its annual loss of Rs.82 billion reported in 2021. The foreign exchange losses of CPC stood at Rs.550 billion in the period, which is 21 times higher than the Rs.26 billion reported in the same period in 2021.

Although the government has reintroduced a cost-reflective pricing formula to assure operational sustainability of CPC, the Treasury noted that a multitude of issues remain to be addressed. “The primary concern is the legacy debt of CPC that is predominantly in foreign currency, resulting in frequent foreign exchange losses for the entity, which in turn results in additional fiscal stress for the government and financial stress for the state-owned banks. As a result, CPC has negative equity of Rs.986 billion as at end-April 2022,” it noted.

Meanwhile, SriLankan Airlines (SLA) and the Ceylon Electricity Board (CEB) were the other two key contributors to the

increase in losses.

SLA incurred a loss of Rs.248 billion for the four-month period when compared to the Rs.171 billion annual loss recorded in 2021. Similarly, the CEB incurred a loss of Rs.47 billion for the four months, compared to an annual loss of Rs.21 billion 2021.

In addition to the fiscal losses, SLA also has external liabilities that need to be honoured under the challenging operating circumstances where revenue is adversely affected by the decline in tourism and fuel costs have escalated along with the finance costs.

SLA has Rs.618.67 billion in liabilities, including interest-bearing facilities such as a sovereign- guaranteed US $ 175 million international bond, Treasury-guaranteed bank loans from state banks, aircraft leases and debt with trade creditors, primarily with CPC.