Business Main

SL wraps-up debt restructuring, setting country for rating upgrade

16 Dec 2024

0

0

Sri Lanka wrapped up its foreign currency debt restructuring last week with the announcement of the near full acceptance of the new bonds in exchange of the existing foreign currency bonds in default for over two years.

Publishing industry faces bleak chapter as VAT threatens survival

11 Dec 2024

0

0

Sri Lanka’s publishing industry yesterday raised serious concerns over the 18 percent Value Added Tax (VAT) imposed on books, which according to industry stakeholders has threatened the survival of the entire sector in the country.

Colombo Dockyard sees Japan’s Onomichi step back; seeks new investor

10 Dec 2024

0

0

Colombo Dockyard PLC is preparing for a major shift after Japan’s Onomichi Dockyard Company Limited, its majority shareholder, stepped away from the management this week, to allow the company to bring in a new strategic investor.

CEAT to take over Michelin’s Camso off-highway tyre division in US $ 225mn deal

07 Dec 2024

0

0

Transaction will include business with revenues of around US $ 213mn (Rs.62bn) in CY 2023 and global ownership of Camso brand Camso brand will be permanently assigned to CEAT across categories after a 3-year licensing period

Sri Lanka possibly losing two-thirds of border tax revenue due to corruption, says Shippers’ Council

05 Dec 2024

11

11

The Sri Lanka Shippers’ Council claimed that the government coffers could be losing as much as two-thirds of potential border tax revenue, due to corrupt activities by the officials in key border agencies.

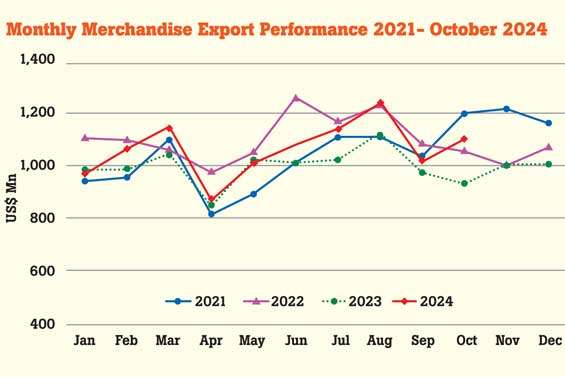

Sri Lanka’s merchandise export performance up 18% in October

04 Dec 2024

1

1

Sri Lanka’s merchandise export earnings in October 2024 climbed to US$ 1.097 billion, marking an 18.22 percent year-on-year increase, driven by higher earnings from key export categories, including apparel and textiles, tea, rubber-based products, coconut-based products, and spices and concentrates.

Colombo consumer prices fall deeper into deflation on cuts to fuel prices

02 Dec 2024

7

7

Inflation in the Colombo district fell further into deflationary territory in November, as expected by the Central Bank last week, as non-food prices fell sharply while food prices decelerated from a month ago.

THASL urges rethink of policies to unlock full potential of Sri Lanka’s tourism sector

30 Nov 2024

0

0

Sri Lanka’s tourism sector is in need of a robust set of policy, to allow it to unleash its full potential, The Hotels Association of Sri Lanka (THASL) said while asserting that the same old models on books may not work.

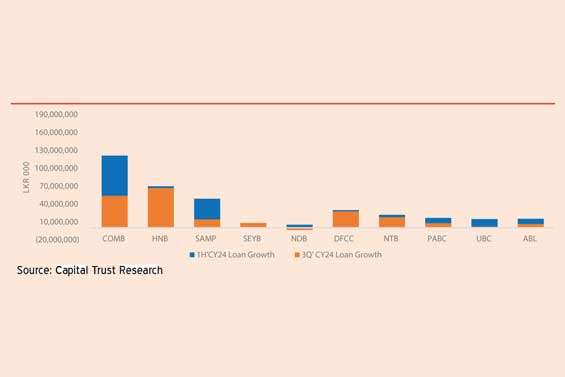

September quarter sees blowout corporate earnings

29 Nov 2024

0

0

The listed companies reported some robust top and bottom-lines in the three months through September 2024 supported by cooler prices and lower interest rates which helped them to bring back more customers and stretch their margins, Capital Trust Research said.

CB shifts to single policy rate while effectively cutting rate by 50bps

28 Nov 2024

20

20

While shifting towards a single policy interest rate structure, the Central Bank yesterday introduced what it calls the overnight policy rate (OPR) as its primary monetary policy tool and set it at 8.00 percent, effectively delivering a 50-basis-point cut in the monetary policy, as it targets the call money rate often used in the interbank market, which closed at 8.55 percent the day before.

SL launches ISB exchange following cabinet approval

27 Nov 2024

0

0

Sri Lanka yesterday reached a significant milestone in its debt restructuring agenda with the official launch of the exchange of its outstanding International Sovereign Bonds (ISBs), totalling approximately US$12.55 billion as of November 25, 2024.

Government agrees to stay within main ‘guardrails’ of IMF programme: Senior Mission Chief

25 Nov 2024

0

0

The Sri Lankan government has reached an agreement with the International Monetary Fund (IMF) to proceed with its US$ 3 billion Extended Fund Facility (EFF) programme, consenting to adjustments while adhering to the programme’s main “guardrails.”

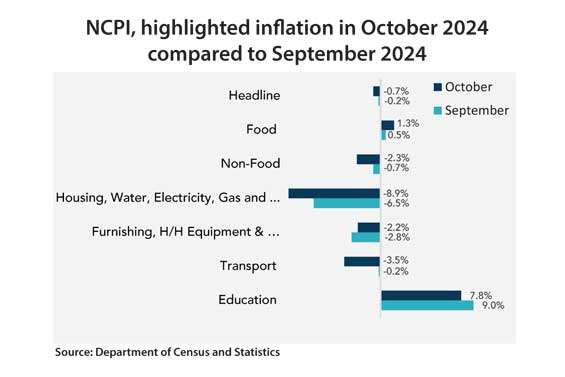

National consumer prices continue to decline by 0.7% in October on lower fuel prices

22 Nov 2024

0

0

Consumer prices measured by the National Consumer Prices Index fell further into negative territory in October after the index tipped into deflation in September due to repeatedly cutenergy prices.

Strategic branding key to SL’s success in India’s wedding market: Vandana Mohan

20 Nov 2024

4

4

Access to information and strategic branding are pivotal for Sri Lanka to emerge as a premier wedding destination for Indians, according to Vandana Mohan, India’s first female event manager and founder of the Wedding Design Company.

Data consumption surges 11% despite decline in fixed broadband subscriptions: CAL

19 Nov 2024

0

0

Sri Lanka witnessed an 11 percent increase in data consumption in the first nine months of this year, despite the decline in fixed broadband subscriptions, according to Capital Alliance (CAL) Research.

Strong mandate is positive, says Standard Chartered Global Research

18 Nov 2024

1

1

Standard Chartered Global Research, the research arm of Standard Chartered views the National People’s Power (NPP) coalition’s sweeping victory in Sri Lanka’s parliamentary elections as a positive development, presenting a rare opportunity to undertake long-overdue structural reforms and advance fiscal consolidation.

Plantation stocks surge amid favourable market conditions

15 Nov 2024

0

0

Majority of Sri Lanka’s plantation companies have witnessed a significant upturn in stock prices from October onwards, driven by a combination of favourable global market trends, strong sector fundamentals and overall investor sentiment.

Sri Lanka’s rupee to remain on a ‘very comfortable terrain’ in coming years: SLBA

14 Nov 2024

14

14

Sri Lanka’s rupee is projected to remain on a ‘very comfortable terrain’ in the coming years, with the gross foreign exchange reserves standing to top the US $ 12 billion mark before the capital repayments to the creditors begin in 2029, according to a top banker.

Vehicle prices will rise initially, then gradually decrease: President

14 Nov 2024

14

14

Netflix to raise prices as new subscribers soar

14 Nov 2024

14

14

CBSL identifies 21 companies engaged in prohibited schemes

14 Nov 2024

14

14

Trump launches cryptocurrency with price rocketing

14 Nov 2024

14

14

SEC extends deadline for corporate finance advisor licensing

14 Nov 2024

14

14

Vehicle prices will rise initially, then gradually decrease: President

14 Nov 2024

14

14

Gota,Ranil,Hema Premadasa not occupying govt. houses

14 Nov 2024

14

14