Reply To:

Name - Reply Comment

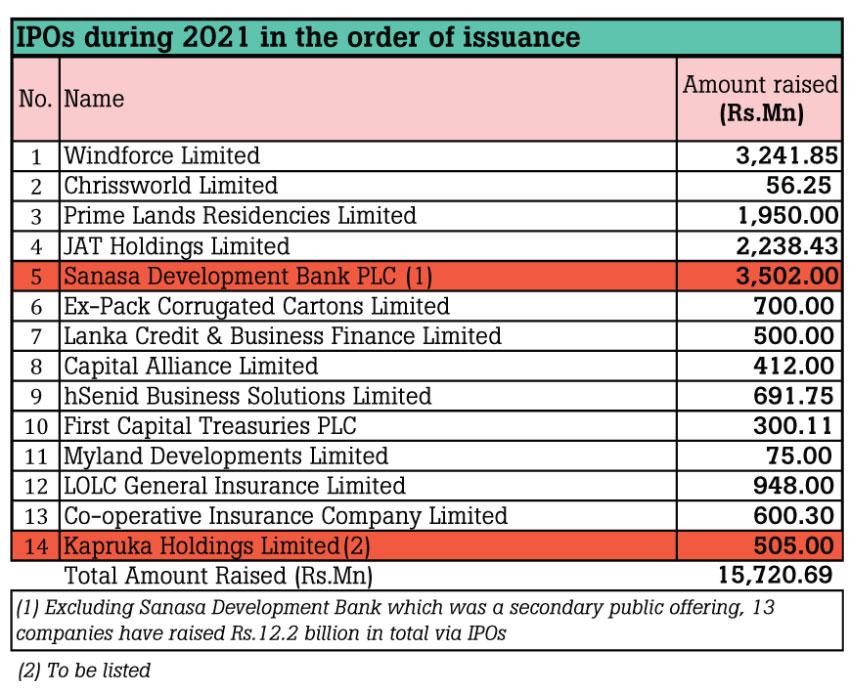

Year 2021 became a banner-year for Initial Public Offerings (IPOs) with 13 companies raising nearly Rs.12 billion in fresh equity on the Colombo Stock Exchange (CSE), while majority of them closed the year above offer prices last Friday.

There was an IPO rush in 2021 after the government announced a 50 percent tax holiday on corporate tax for companies for their financial years ending in 2021/2022, and reduced 14 percent corporate tax for the three years thereafter for those who went public on or before December 31, 2021.

There was an IPO rush in 2021 after the government announced a 50 percent tax holiday on corporate tax for companies for their financial years ending in 2021/2022, and reduced 14 percent corporate tax for the three years thereafter for those who went public on or before December 31, 2021.

However, with the tax concessions now gone, an element of uncertainly looms with regard to the future IPO pipeline this year.

Further analysts question whether listed entities could maintain valuations at their current levels this year with a potential sell-off that could happen with an anticipated market correction or due to a likely economic hard-landing from a potential debt default.

Sri Lanka’s stocks rallied during 2021, hitting several record highs during the year with its benchmark All Share Price Index (ASPI) ending 80 percent higher at 12,226.01, recording the highest growth in eleven years.

After retreating during the first two sessions this week due to concerns of dollar liquidity in the market, the stock recovered on Wednesday on the news that the country’s reserves clawed back to US$ 3.0 billion levels.

As the broader stock index closed at more than a decade high, the more liquid S&P SL20 advanced 60 percent during the year to close at 4,233.25, its highest ever close.

Broadly speaking, the stock market performance has been a bright spot in the economy, offering starkly divergent view from the economy on the main street, which was characterised by disruptions to business by virus related lockdowns, higher unemployment, rising poverty and hunger, soaring prices, and commodities shortages.

Among the IPOs from the start of the year, the renewable energy producer Windforce PLC raised Rs.3.2 billion offering 202.62 million shares at Rs.16.00 a piece in March. The company’s share closed at Rs.18.20 last Friday.

Coming in at second for the year, the third party logistics services provider, Chrissworld PLC raised Rs.56.25 million at Rs.7.50 a share. The company’s share closed at Rs.21.30 on Friday, recording a large premium to its IPO price. Meanwhile, the affordable luxury house developer, Prime Lands Residencies Limited raised Rs.1.95 billion offering Rs.10.40 a share, and the share was trading at Rs.11.20 last Friday as housing and real estate remained hot throughout the pandemic.

JAT Holdings PLC, the market leader in premium wood coatings came to the market in July raising Rs.2.24 billion at Rs.27.00 a piece. Its share closed below the IPO price at Rs.21.50 last Friday. Being the only corrugated cartons manufacturer to seek a listing on the CSE, Ex-Pack Corrugated Cartons raised Rs.700 million offering Rs.8.40 a share. Its share closed at Rs.21.70 on Friday.

Meanwhile, the licensed finance company, Lanka Credit & Business Finance PLC in October raised Rs.500 million issuing its shares at Rs.4.00 per piece, and the company’s share closed at Rs.3.90 on Friday. On December 3, hSenid Business Solutions Limited raised Rs.692 million being the first enterprise software related company to be listed on the CSE. The company’s share closed at Rs.34.60 last Friday, recording a huge premium to its IPO price of Rs.12.50. Meanwhile, LOLC General Insurance Limited raised Rs.948 million on December 16 offering its shares at Rs.7.90 a piece while on December 22, the e-commerce retailer, Kapruka Holdings Limited went for an IPO at Rs.15.40 a share to raise Rs.505 million.

While LOLC General Insurance Limited shares closed at Rs.20.40 after debuting last Friday, the listing of Kapruka shares is expected in January. Meanwhile, there were 15 companies, which raised another Rs.23.22 billion via rights issues during 2021, according to data available through November.

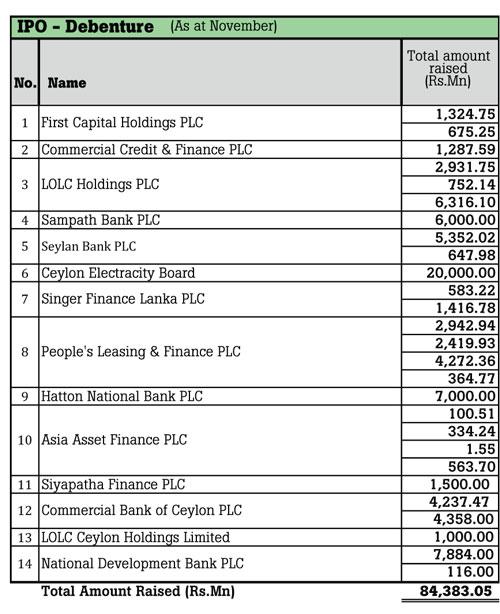

While 2021 was a stellar year for equity raising, it also proved to be a great year for corporate debt as 14 companies raised a mammoth Rs.84.38 billion via debenture issues through November.