Reply To:

Name - Reply Comment

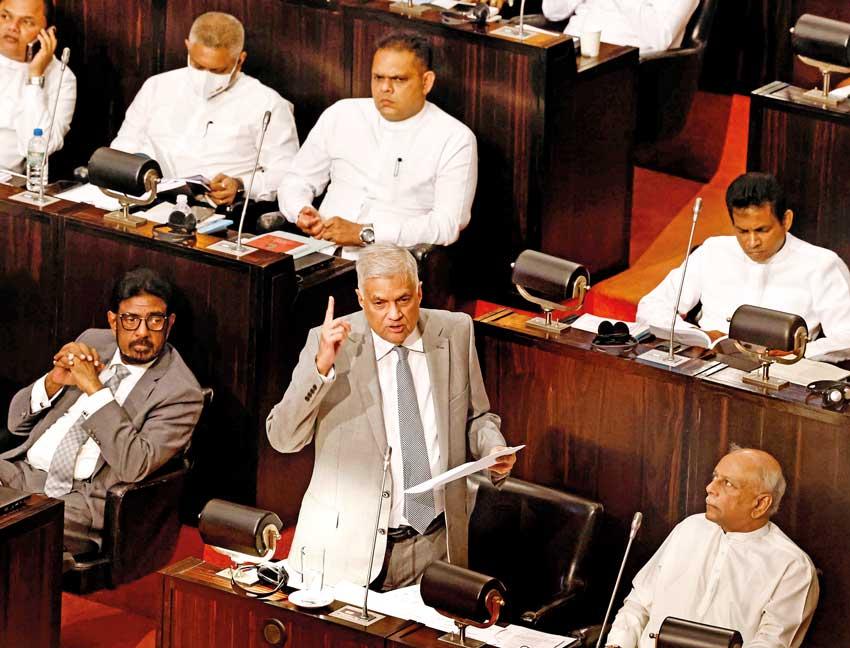

President Ranil Wickremesinghe presents Budget 2023

With an International Monetary Fund (IMF) deal yet to be sealed, Budget 2023 presented to Parliament yesterday stuck with the reform path Sri Lanka had embarked upon after the economy crashed in April, as a result of bad economic policies followed for decades.

In his preamble to the budget proposals, President and Finance Minister Ranil Wickremesinghe outlined the need for “massive economic reforms and restructuring” to lay the foundation for a new economy based on social market principles. “I would like to define the new economy that we are going to build as a social market economy or an open economic system of social protection,” said Wickremesinghe. In alignment with the IMF recommendations, Wickremesinghe said the government plans to reduce debt to less than 100 percent of GDP over the medium term, achieve economic growth of 7 percent and cut fiscal deficit to 7.9 percent in 2023, from an estimated 9.8 percent

this year. He said government revenue is expected to rise to 15 percent of GDP by 2025, from 8.3 percent at end-2021, with exports and foreign direct investment targets of US $ 3 billion each over the medium term. He also said the government is already targeting a primary surplus more than 2 percent of GDP in 2025 and expects it to improve upon this level thereafter. Sri Lanka in early September entered into a staff-level agreement with the IMF for a US $ 2.9 billion, four-year programme under the Extended Fund Facility.

However, the programme is contingent on Sri Lanka following the agreed reform path, securing financing assurances from its creditors and obtaining the approval from the executive board of the IMF.

The government had already presented revenue-generating proposals at three occasions prior to the presentation of Budget 2023, reversing the sweeping tax cuts that were introduced in end-2019. The revenue proposals mainly included changes to the income tax and Value Added Tax (VAT) while addressing tax policy gaps and rationalising tax concessions.

Hence, Budget 2023 did not contain any major revenue proposals, to the surprise of some, as speculation was rife that the government may introduce a wealth tax, which is part of the programme with the IMF, in Budget 2023.

The government expects to collect Rs.3,130 billion as tax revenue in 2023, as opposed to Rs.1,298 in 2021.

Fiscal stability through revenue consolidation typically remains a key ingredient in the IMF’s formula for economic recovery. Meanwhile, restructuring of state-owned enterprises (SOEs) is also a key reform Sri Lanka has to undertake under a prospective IMF programme to get his fiscal house in order.

Though Wickremesinghe mentioned a few SOEs such SriLankan Airlines, Sri Lanka Insurance, Sri Lanka Telecom, etc., which have been earmarked for restructure, he fell short of giving out further plans for the sector, which remains a massive burden to the national economy.

“At present, we are bearing the cost of 420 government institutions and enterprises. The annual loss of these major 52 SOEs is Rs.86 billion. I hope to table these lists of institutions in Parliament in two or three days. Has the country benefited from these institutions for many years? Or has the country suffered?” Wickremesinghe said. Meanwhile, the government allocated Rs.43 billion from Budget 2023 for social safety net programmes.

Wickremesinghe said the process of selecting welfare beneficiaries using new eligibility criteria would start in January 2023 and the eligibility list would be published.

“Payment under the new welfare benefit payment schemes are expected to start by April 2023. Until then, the existing welfare benefit schemes will be maintained,” he said.