Reply To:

Name - Reply Comment

The Monetary Board of the Central Bank, which met Wednesday to assess the current monetary policy stance decided to keep the key policy interest rates at the prevailing historically low levels as they were of the belief that the current policy stance is sufficient to deal with the fresh challenges posed by the third COVID-19 wave, and stressed that the pressure seen on the consumer prices is only transitory.

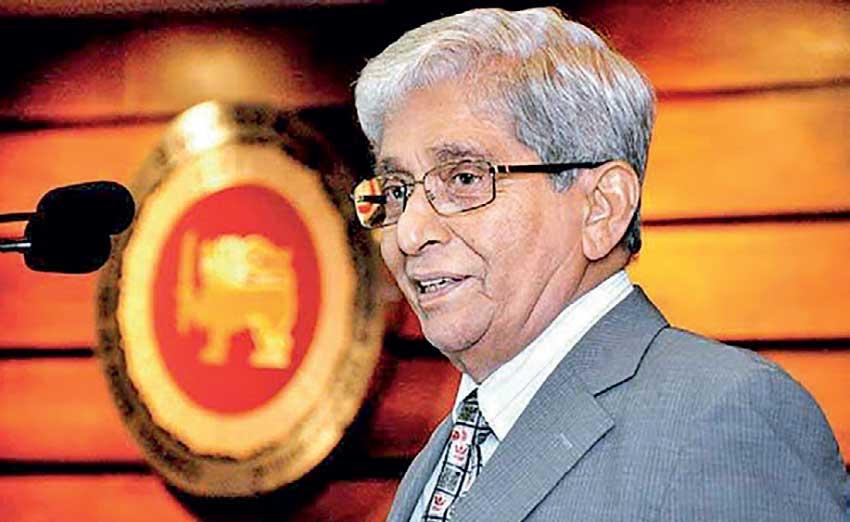

Hence, Central Bank Governor Professor W.D. Lakshman advocated for the current loose fiscal policy to remain in place to support the virus-hit economy, and the monetary policy would provide the necessary support to maintain that stance.

The Monetary Board met for the fourth time this week under significantly different conditions from the last time they met as the country is confronted with massive economic challenges starting from mid-April with the resurgence of the virus, derailing economic activities.

“In the context of the prevailing low inflation environment and well anchored inflation expectations, and the renewed challenges posed by the third wave of the COVID-19 pandemic, the Board remains committed to maintaining the current accommodative monetary policy stance to support the sustained revival of the economy,” a Central Bank statement said.

As a result, the rate setting committee left the benchmark interest rates—Standing Deposit Facility Rate or the rate at which excess liquidity in the banking system is absorbed at 4.5 percent and the Standing Lending Facility Rate or the rate at which the Central Bank injects liquidity into the banking system at 5.5 percent— steady, a stance they adopted in July 2020.

While there could be near term price pressures from supply side disruptions caused by virus related restrictions, the Central Bank maintained that inflation would broadly be maintained between their desired range of 4 to 6 percent in the medium-term.

There were some concerns regarding inflation raising its ugly head in the recent months as both supplier prices as well as consumer prices showed uptick in the run up to the New Year. But that could subside as consumption activity has nearly been killed by the restrictions on daily lives, putting a damper on the demand.

Meanwhile, the Monetary Board was seen buoyed by the continuously increased credit flows into the private sector as seen from the credit disbursements in the first three months, which reached over Rs.112 billion in March alone.

However, the new conditions could derail the credit momentum significantly as people and businesses that accumulated borrowings are now struggling to make good on their loan repayments while the Central Bank is now engaged with the financial sector to mete out some form of relief to affected borrowers.

While the current wave of the virus is destructive, the Monetary Board is of the view that implications to the economy would be less severe than in the previous two waves due to selected restrictions on business and mobility, the ongoing vaccination drive and the work-from-home arrangements practiced by

more people.

However, the issues may run deeper than that as the current restrictions have broad-based implications on economy, specially on sections which are predominantly powered by consumer demand. Besides vaccination drive is nowhere near its desired level and the work-from-home arrangement is an option for only the office-based staff.