Reply To:

Name - Reply Comment

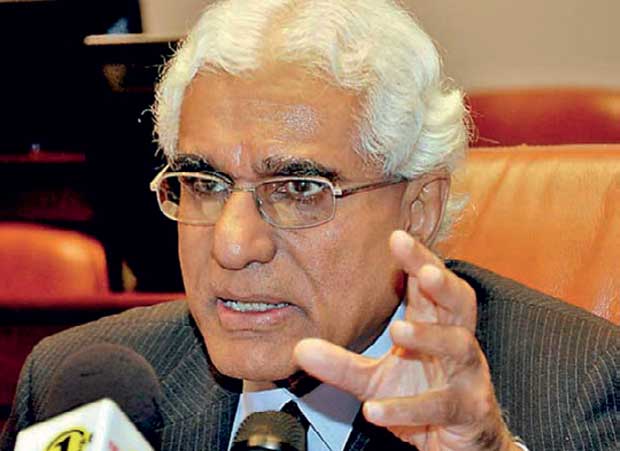

Neither confirming nor denying the speculations that UK-based Lyca Group is nearing a deal to purchase the ETI Group’s assets, Central Bank Governor Dr. Indrajit Coomaraswamy told Mirror Business that the Central Bank is still processing an investment proposal submitted by the ETI directors.

“The directors of ETI have submitted an investment proposal. This is being processed by the CBSL to ensure that any deal supports the interests of the depositors, credentials of the investors are sound and laws of the country are complied with,” he said in an email response to a Mirror Business query, on Tuesday.

Meanwhile, ETI Group finance company Swarnamahal Financial Services PLC (SFS), in a stock market filing said “the proposed investment has not yet been materialized or approved by the Central Bank of Sri Lanka”.

Speculation was rife on Tuesday that the key executives of Lyca Group have arrived in Sri Lanka to seal the deal with ETI Group, where Lyca Group will purchase the television and broadcasting business, cinemas and hotels under ETI Group.

It is believed that Lyca will make the purchase through another corporate entity based in Singapore and the deal is being facilitated by the controversial Malaysian businessman, Sudhir Jayaram.

Jayaram is also involved in a large-scale property development project in the heart of Colombo, on which various concerns have been raised over by the Cabinet Committee on Economic Management, chaired by the prime minister.

There were news reports about Jayram being apprehended at the Katunayake airport for allegedly attempting to take foreign currency out of Sri Lanka, undeclared.

Meanwhile, media reports on Tuesday said Raynor Silva of Hiru FM and TV famed, has also made a bid to purchase the ETI Group assets.

The Central Bank, in the first week of January, appointed a three-member panel comprising former Central Bank Assistant Governor Sepala Ratnayake, former Bank of Ceylon Senior Deputy General Manager P.A. Lionel and former Bank of Ceylon Assistant General Manager H.M. Thilakarathne, to return the troubled ETI Group finance companies to normalcy, within a period of six months.

ETI Finance, which has an asset base of Rs.33 billion, has 33,000 depositors with Rs.33.5 billion in deposit, while its subsidiary SFS, which has an asset base of Rs.2.5 billion, has 2,300 depositors with Rs.2.4 billion in deposits.