Reply To:

Name - Reply Comment

By Chandeepa Wettasinghe

Former Central Bank Governor Ajith Nivard Cabraal yesterday denied that any wrongdoing related to bond auctions had occurred during the period from 2008 to 2014, as alleged by the prime minister.

“I am categorically denying that. I think it’s an outright lie in order to show a different situation from what it is. Since they have been caught with their hands in the till, these same people are shouting at others that there are other rogues,” Cabraal told a press conference yesterday.

The Presidential Commission of Inquiry (PCoI) appointed to investigate into the irregular treasury bond issuances in 2015 and 2016 had concluded in its report that frauds had occurred during that period, according to a public statement made by President Maithripala Sirisena.

Former Central Bank Governor Arjuna Mahendran was held responsible for leaking information to Perpetual Treasuries—a firm connected to his son-in-law—allowing Perpetual Treasuries to buy an unprecedented extra volume of bonds at low prices and later dump them into a public retirement fund, a public scholarship fund and government financial institutions at high prices.

However, Sirisena said that the PCoI also had outlined that bigger losses were made by the retirement fund—the Employees’ Provident Fund—during the period starting from 2008 when similar frauds and other mismanagement had taken place.

Cabraal was the Central Bank Governor from July 2006 to January 2015 under the previous government after which, under the current government, Mahendran took up the remainder of Cabraal’s second term ending in mid-2016.

Prime Minister Ranil Wickremesinghe, who took the Central Bank under his portfolio in January 2015, too had supported the public auction system—under which framework the treasury bond frauds in 2015 and 2016 occurred—and had alleged that irregularities had taken place under the previous direct placement system.

These same sentiments were repeated by Wickremesinghe last week after Sirisena made his statement.

Cabraal yesterday however said that the ‘auction cum direct placement’ process practiced while he was governor was a method time-tested for 18 years (by 2015) and that its effectiveness was proven in a report compiled by the Auditor General in 2016 at the behest of the then Finance Minister Ravi Karunanayake.

“The Auditor General has done a specific examination at the order of the finance minister and came out and said that there was no such thing as what happened in this particular instance,” Cabraal said.

The Auditor General’s audit report had only conclusively stated that the interest rates in the direct placements between the 2008 and 2014 period were at or below market rates, which was a positive development.

The Auditor General had highlighted enormous time constraints and the lack of required documents and cooperation from the Central Bank when conducting the audit, while noting that internal controls and decision-making process in the Central Bank for bond issuances had been inadequate.

Meanwhile, Cabraal yesterday charged that the prime minister should be held responsible for the bond frauds as well.

“What appears is that the prime minister has aided and abetted before and after the scam. Before, by taking the Central Bank under his wing and by appointing Arjuna Mahendran as Governor and after, by insisting that no fraud had occurred, hiding the COPE report compiled when D.E.W. Gunasekara was the COPE Chairman and by influencing parliament to be dissolved,” Cabraal said.

He said that if action was taken under the basis of the first COPE report, which inquired into the bond fraud in February 2015, Mahendran would not have been able to facilitate the second and larger bond fraud in March 2016.

Cabraal said that Sirisena too should shoulder some responsibility for allowing these to transpire.

Cabraal added that the president had made a statement first before releasing the PCoI report, in order to soften the blow for the government.

“We believe that the statement made by the president is a damage control statement to limit the damage to people in the government, both the UNP and SLFP,” he said.

He also said that the president made no reference to a meeting at the Central Bank related to the bond scam, attended by Karunanayake, Public Enterprise Development Minister Kabir Hashim and Development Strategies and International Trade Minister Malik Samarawickrama.

Cabraal said that the bond frauds were responsible for the economy now functioning under a low growth, high interest rate, high inflation scenario with limited investor confidence.

Meanwhile, former Securities and Exchange Commission Chairman Dr. Nalaka Godahewa said that the Rs.11.5 billion undue profits made by Perpetual Treasuries is nowhere near the public loss made due to increasing interest rates and other macroeconomic effects.

“The loss was Rs.1 trillion, equal to the total taxes levied by the government in a year,” he said.

Dr. Godahewa said that the government, which came into power with a promise to curb corruption, should pursue legal action against the perpetrators of the 2015 and 2016 bond fraud zealously, as it has pursued action against the individuals who were alleged of conducting fraud at a much smaller scale under the previous regime.

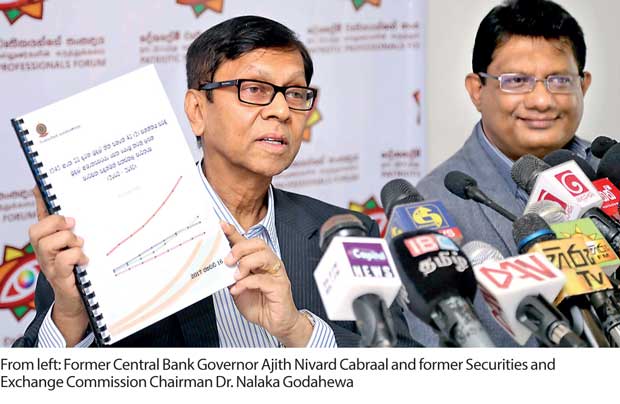

Caption