Reply To:

Name - Reply Comment

Despite the International Monetary Fund (IMF) funding is set to ease immediate liquidity pressures, the continuing fiscal consolidation challenges would further increase the Sri Lanka’s debt burden and the debt-to-GDP ratio would continue its upward path during the next two years, Moody’s Investors Service cautioned.

In a brief note issued soon after the receipt of staff level agreement on a reform-full US $ 1.5 billion extended fund facility (EFF) from the IMF, the global rating agency expressed its doubts over the government’s ability to bring about such fiscal reforms as some of them look a tall order to implement.

The government however raised the value-added tax with effect from May 2 as prior action in the backdrop of pending approval for loan from the IMF executive board in June. “We forecast a further increase in the government’s debt burden and debt/GDP ratio this year and next, leaving Sri Lanka vulnerable to a shift in financing conditions,” Moody’s said in its latest report titled, ‘IMF programme will ease Sri Lanka’s liquidity pressures, but not its fiscal challenges’.

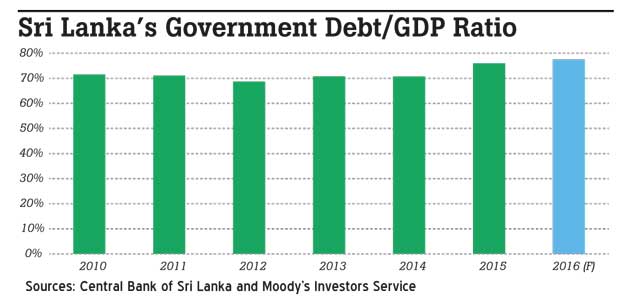

Sri Lanka’s debt-to-GDP which was gradually falling from over 100 percent 10 years ago hit a low of 71 percent in 2014 but rose to 76 percent a year after. Now the Moody’s forecast the ratio to touch slightly below 80 percent by the end of 2016 (See chart).

“At 76 percent of GDP, government debt was high compared with similarly rated sovereigns,” Moody’s said.

Sri Lankan authorities were waiting until it strike a deal with the IMF to access international capital markets and also to raise external funds through bi-lateral and multi-lateral funders.

Soon after securing the IMF support, the government expressed its desire to raise US $ 1.5 billion in sovereign bonds from the planned US $ 3 billion and another US $ 500 million in a syndicated loan, shortly. Besides, the Central Bank Governor Arjuna Mahendran in April said he received clearance from China to issue Chinese currency denominated bonds to raise between US $ 500 to US $ 1 billion at below 5 percent.

While all these facilities come at commercial rates, what the policy makers should ideally do is to ensure policy consistency and credible fiscal consolidation to restore investor confidence to attract long term foreign direct investments.

However fiscal and structural reforms such as tax increases, curtailing social welfare and subsidies and privatising of state-owned enterprises, though seem ideal to put the economy on a sustainable footing, they remain politically challenging.

The IMF estimates the Sri Lankan government’s reliance on market financing to cover large financing needs in 2016 at 28.7 percent of GDP.