Reply To:

Name - Reply Comment

Fitch Ratings has signalled that it may move Sri Lanka’s Issuer Default Rating (IDR) out of ‘Restricted Default’ (RD), once the country completes its commercial debt restructuring, which the agency believes would restore its relationship with the international financial community.

Sri Lanka’s post-default rating would depend on Fitch’s assessment of its credit profile following the restructuring, the rating agency said in a commentary yesterday.

In September 2023, Fitch upgraded Sri Lanka’s Long-Term Local-Currency IDR to ‘CCC-’, reflecting the completion of the domestic debt optimisation plan for local-currency debt.

However, the rating agency warned that, even if the debt restructuring is successfully completed, it expects Sri Lanka’s government debt to remain relatively high.

The International Monetary Fund (IMF) projects that Sri Lanka’s gross general government debt-to-GDP ratio will gradually decline to about 103 percent of GDP by 2028, from approximately 116 percent in 2022, following both local and foreign-currency debt restructuring.

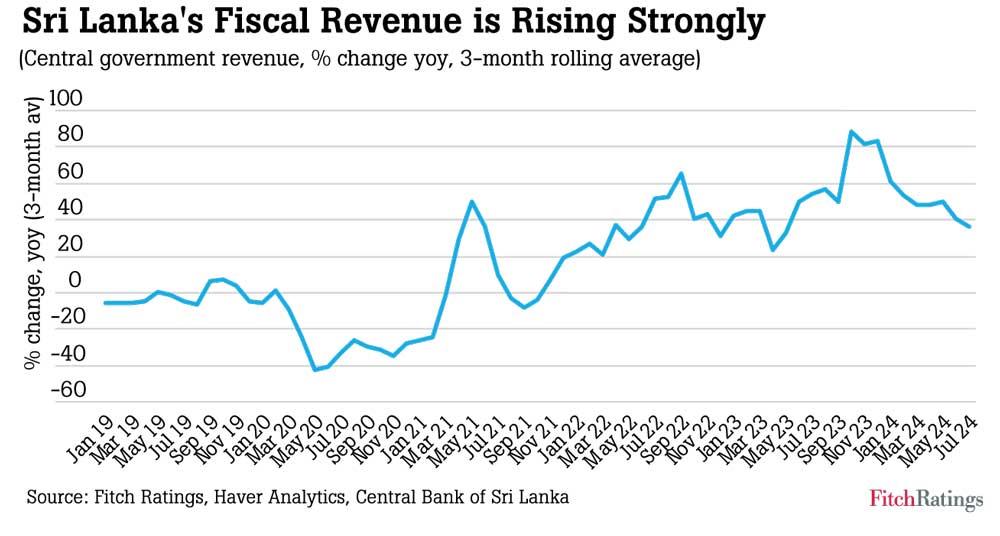

Fitch pointed out that the government’s revenue-to-GDP ratio remains low but the recent revenue-raising measures, implemented since May 2022, are starting to show results. Revenue collection through July 2024 rose by about 43 percent year-on-year, well above the nominal GDP growth rate of 9.5 percent in the first half of 2024. Fitch’s baseline forecasts project the revenue-to-GDP ratio will rise from 11.4 percent in 2023 to 15.5 percent by 2026.

However, these projections could change if the new government introduces fiscal reforms.

“The IMF programme’s targets offer some flexibility for changes in the government’s fiscal policy approach,” Fitch noted.

The rating agency also highlighted the potential impact of Sri Lanka’s upcoming parliamentary election on November 14.

“The president’s capacity to push through policy changes may depend partly on the election outcome. The JVP and its allies held relatively few seats in the outgoing legislature but the trends from the recent presidential election suggest significant changes in the make-up of the new chamber,” Fitch said.

Despite these uncertainties, Sri Lanka’s economy remains on a recovery trajectory. Real GDP growth was 5.0 percent year-on-year in the first half of 2024, rebounding from a 7.3 percent contraction in the same period of 2023. Fitch expects the economy to grow by 3.9 percent in 2024 and average 3.6 percent growth over 2025-2026.

The external liquidity pressures have also eased, with the foreign-exchange reserves rising to US $ 6.0 billion in August 2024, a 66 percent increase year-on-year (YoY).

However, Fitch warned that “the speed of the recovery in reserves is likely to be set back when Sri Lanka resumes external debt-service payments”.

Meanwhile, Fitch said the Sri Lankan government’s confirmation of its commitment to the IMF programme and the terms of debt restructuring agreed with the international sovereign bondholders in September has reduced risks to the debt treatment process, despite the outcome of the presidential election on September 21.

On October 4, Sri Lanka’s Finance Ministry announced that consultations with the IMF and the country’s Official Credit Committee had been successfully concluded, reaffirming the commitment to the principle of comparability of treatment between the official creditors and bondholders. The ministry stated that the preliminary agreement was compatible with the IMF programme’s terms.

“We view this as a positive sign for the restructuring process’ prospects,” Fitch said.

Fitch has maintained Sri Lanka’s Long-Term Foreign-Currency IDR at ‘RD’ since May 2022, as the government continues to suspend servicing its foreign-currency debt.