Reply To:

Name - Reply Comment

By Nuzla Rizkiya

The Sri Lanka Gem and Jewellery Association (SLGJA) has renewed its call for urgent reforms as the domestic industry faces a downturn, driven by surging gold prices and policy challenges that have hindered growth.

Local jewellery sales have taken a sharp hit, while exporters are struggling with a tangled regulatory framework that has weakened their global competitiveness.

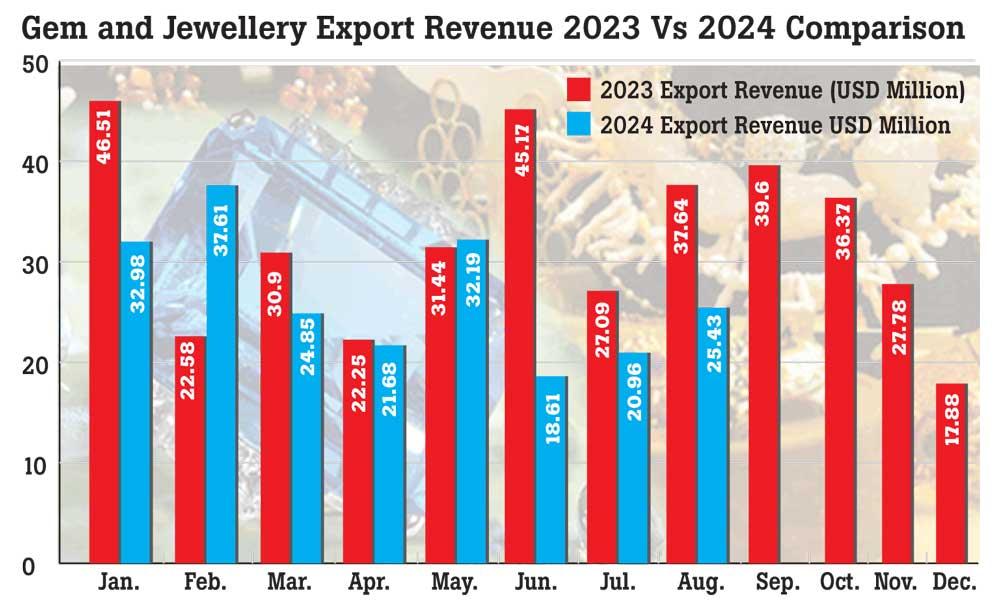

The impact of these challenges is evident in the sector’s export performance, with positive year-on-year (Y-O-Y) revenue growth reported only in February and May of 2024.

For the first eight months ended August 2024, the sector recorded cumulative revenue of US$ 214.31 million. This is a 18.69 percent Year-on-Year (YoY) decline in export performance when compared to the corresponding period of the previous year.

According to the SLGJA, the industry’s decline can be directly attributed to the inconsistency of government policies which has made it increasingly difficult for businesses to operate.

“The decline is due to a lot of policy changes, such as the high taxes that came into effect. The system has become more complicated now. This industry is very unique compared to other export sectors. The more you try to restrict and regulate it, people will find new locations overseas to do their business,” said SLGJA Executive Committee Member Sellakumar Kandasamy speaking to Mirror Business.

Access to raw materials is a key factor in the sector’s export performance, such as the sector’s reliance on imported rough stones, which account for 50-60 percent of Sri Lanka’s gem and jewellery exports.

However, dealers importing these materials face numerous obstacles at entry points, such as complex duty procedures and lengthy valuation processing, compelling them to find it more convenient to do their businesses elsewhere.

“The global prices are something beyond our control, but we do have control over our policies and procedures to create a good enabling environment for the business to survive. In local sales, over 40 percent of it happens with foreign buyer. So, reforms, especially in terms of taxes, will play a huge role in making our products more competitive for those customers,” Kandasamy said.

He further highlighted that the soaring gold prices will likely have the biggest impact on local sales compared to the export sector, with affordability becoming a major concern for consumers.

“The impact of the prices will definitely be passed on, even to the export sector. It ultimately depends on how the ultimate buyer needs. We don’t have an official way of buying gold in Sri Lanka and the industry predominantly works with scrap gold accumulated through pawning or what customers bring in” he explained.

To address these issues, the SLGJA has consistently advocated for consistent policies, tax reforms and greater cooperation from authorities to support the entire gem and jewellery industry.

“We submitted proposals to all parties before the election, but we are waiting to have meaningful discussions with the current government. To address these issues, we cannot have ad hoc decisions that only benefits one part of the chain. We need comprehensive reforms overall to achieve sustainable growth” Kandasamy asserted.