Reply To:

Name - Reply Comment

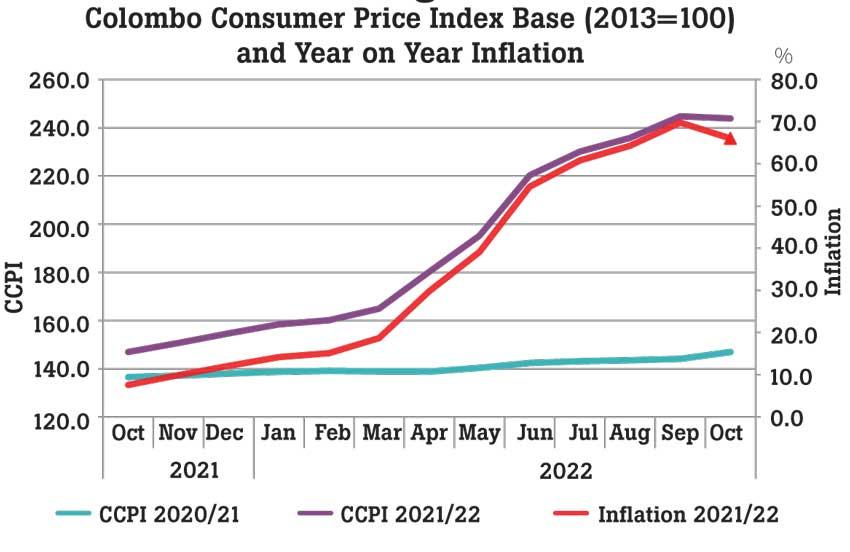

Inflation in the Colombo district made an about turn in October exactly, possibly signalling the beginning of the end of the current spell of runaway inflation, which set off exactly a year ago when the global commodities prices started rising, caused by the surge in demand amid the supply chain bottlenecks and emergence of foreign currency shortages in the domestic market.

The inflation measured by the Colombo Consumer Price Index (CCPI), authorities’ preferred indicator of consumer prices, rose 66 percent in October from a year ago, decelerating from 69.8 percent in September, after the Central Bank raised interest rates to sky-high levels early this year, in its relentless pursuit to tame the prices through demand destruction policies.

However, the job is not even nearly done, as the country is still grappling with runaway prices. The Central Bank’s job will only be completed when the annual increase in inflation is brought down to its desired level of between 4 to 6 percent, which is expected to happen in 2024. To tame the inflation, the monetary authority has raised policy interest rates by 900 basis points so far this year. While the October inflation print may have come as somewhat a consolation, the Central Bank is unlikely to take its foot off the monetary brakes for some time until the evidence shows that the decline in prices is durable.

There were signs that the prices might have peaked in September, as the monthly prices, particularly in the food basket, showed some cooling.

The overall consumer prices declined 0.4 percent in October from a month earlier while the food prices also fell by 2.0 percent after decelerating for three consecutive months.

However, the annual food prices are still at hyperinflationary levels, with such prices at 85.6 percent, decelerating from 94.9 percent peak in September. This has caused a significant segment of the population to cut down on their food intake while pushing the poor and vulnerable into starvation.

The earnings reports of companies for the September quarter showed a broad-based softening in demand, due to the escalated cost of living and deep economic downturn.

However, in the last few weeks, there was some easing in the prices of certain essential goods, after the foreign currency conditions in the domestic market improved somewhat, enabling imports and stirring some demand.

However, the prices still remain manyfold higher from where they were, after the rupee collapsed, shedding nearly 100 percent of its value. Meanwhile, the non-food inflation also eased with the October prices, slightly decelerating to 56.3 percent, from 57.6 percent. The monthly prices also slowed significantly to 0.7 percent, from the 5.5 percent increase a month earlier, as there weren’t any new utility or energy price revisions after September. The so-called core prices, measured barring the often-volatile items such as food, energy and transport, rose by 49.7 percent in October from a year ago, coming off from a peak of 50.2 percent in the year through September.