Reply To:

Name - Reply Comment

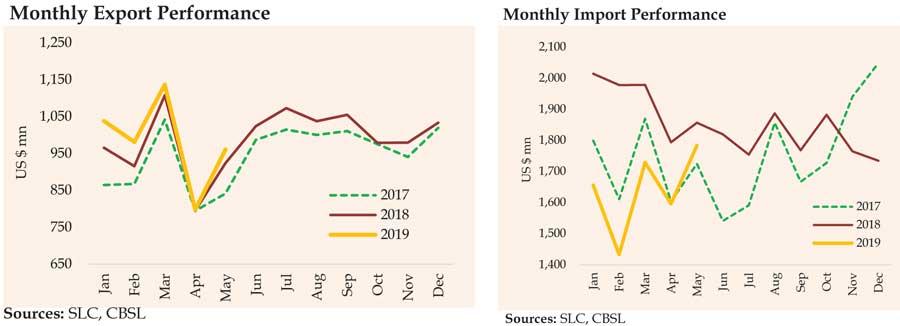

The trade deficit in the month of May narrowed significantly on the combined effect of the continued decline in imports and increase in exports, the data released by the Central Bank showed, yesterday.

The deficit in the trade account narrowed to US $ 823 million in May, from US $ 933 million a year ago, while on a cumulative basis, the trade gap contracted by US $ 1,633 million to US $ 3,3281 million during the first five months of 2019, in comparison to the corresponding period of 2018.

The earnings from merchandise exports in May rose 4 percent year-on-year (YoY) to US $ 961 million, as the earnings from both industrial and agricultural exports grew during the month.

The industrial exports, led by textile and garment exports, rose 4.5 percent YoY to US $ 741 million. The textile and garment exports grew 6.5 percent YoY to US $ 424.2 million amid the increased demand from the US, Europe and other non-traditional markets.

The rubber product exports, mainly consisting of tyres made out of natural rubber, rose 12.5 percent YoY to US $ 77.2 million, while the petroleum product exports fell 14.3 percent YoY to US $ 39.5 million, due to the lower export volumes and average prices of bunker and aviation fuel.

The export earnings from agricultural products, led by tea, rose 3 percent YoY to US $ 215.9 million with tea exports increasing 3.6 percent YoY to US $ 125.6 million.

Coconut exports rose 33.4 percent YoY to US $ 32.2 million but the export earnings from spices fell 12.8 percent YoY to US $ 22.6 million.

Despite the lifting of the European Union ban on Lankan fisheries exports, such exports fell 12.4 percent YoY to US $ 18.6 million.

Meanwhile, Sri Lanka spent US $ 1,783.7 million on merchandise imports in May, down 3.9 percent YoY, as the consumer goods imports fell almost 20 percent YoY to US $ 332.5 million, amid the restrictions imposed by the government on non-essential imports.

The expenditure on personal vehicles fell sharply by 60.7 percent YoY to US $ 58.7 million.

However, the fuel bill in May rose 15.5 percent YoY to US $ 402.8 million, due to the higher import volumes of refined petroleum and coal, despite the lower average import prices.

The expenditure on textile and textile article imports also rose 5.6 percent YoY to US $ 260.6 million, due to the increased expenditure on fibres ad yarn.

Under investment goods, the expenditure on machinery and equipment rose 2.7 percent YoY to US $ 206.8 million, while the imports of building materials increased, mainly driven by the higher imports of articles of iron and steel as well as machinery and equipment, led by transmission apparatus and office machines.

The foreign investments in the government securities market recorded a net outflow of US $ 64 million in May. On a cumulative basis, the net outflows in the government securities market amounted to US $ 90 million during the first five months of the year.

The foreign investments in the Colombo Stock Exchange (CSE), including the primary and secondary market transactions, recorded a net inflow of US $ 3.7 million during the month of May. On a cumulative basis, the CSE recorded a net outflow of US $ 20 million in the first five months of 2019. Long-term loans to the government recorded a net outflow of US $ 345 million in May, mainly due to the repayment of a syndicated loan of US $ 333 million.

Among other major inflows to the current account, tourism earnings fell sharply to US $ 71 million in May, as tourist arrival dipped over 70 percent YoY as a result of the April 21 terrorist attacks.

The cumulative earnings for the first five months stood at US $ 775 million.

Sri Lanka earned US $ 4.4 billion from tourism, last year.

Meanwhile, workers’ remittances in May fell 3.1 percent YoY to US $ 562 million. On a cumulative basis, workers’ remittances amounted to US $ 2,733 million during the first five months of 2019.