Reply To:

Name - Reply Comment

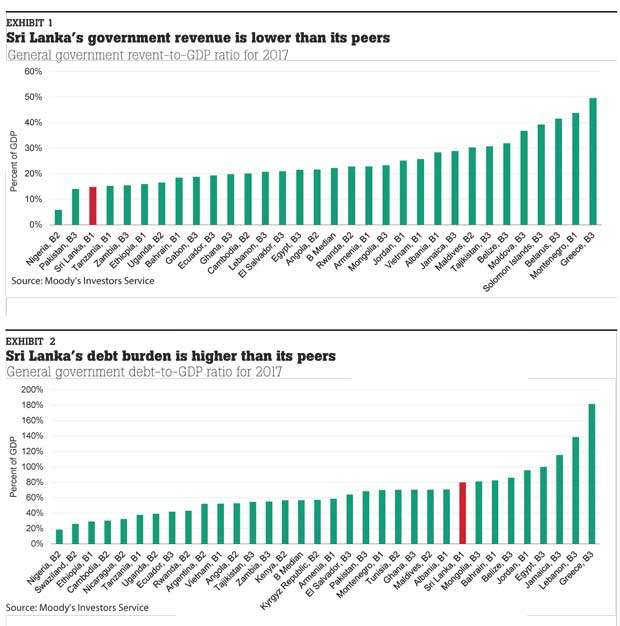

Moody’s Investors Service yesterday said the new Inland Revenue Act (IR Act) developed to build weak state revenues would help to gradually bridge the massive hole in the fiscal account and reduce the external vulnerability marred by heavy public debt in the medium term.

Moody’s, with the new act coming into place, estimates an increase in state revenue of 0.5 percent of gross domestic product (GDP) in 2019—the first full fiscal year since the new tax law in effect.

According to the Finance Ministry estimates, the new IR Act will bring additional Rs.60 billion per annum by way of removing various tax exemptions and introducing new taxes such as Capital Gains Tax.

“With a very large debt burden and weak debt affordability weighing on its credit profile, successful implementation of revenue reforms will help foster fiscal consolidation,” Moody’s said. Along with the IR Act, Sri Lanka will also introduce a new taxpayer identification number system.

“In conjunction with an automation of tax administrative efforts, such initiatives will help to raise tax compliance, broaden the current narrow tax base and improve the composition of the revenue base by raising the share of direct taxes,” Moody’s noted.

The new IR Act is expected to increase the share of direct taxes to 40 percent of GDP from the existing 20 percent.

Moody’s has a B1 speculative credit rating on Sri Lankan sovereign and the rating agency said the new IR Act is credit positive.

Sri Lanka is currently in an International Monetary Fund (IMF) programme in which reforms that contribute to fiscal consolidation are central to meeting the IMF targets.

The next tranche from the IMF of its US $ 1.5 billion three-year extended fund facility is now overdue.

While several of the IMF’s monetary, fiscal and reserves targets are on track, the Sri Lankan government has delayed in delivering on the promised energy pricing formula and the reforms into loss-making state-owned enterprises (SOEs) due to political challenges.

While the government has just announced its restructuring plans to the debt-laden national carrier, SriLankan Airlines, other SOEs remain a massive drag on the path to fiscal consolidation.

The higher oil prices in the global markets have already unsettled the state utility providers and the absence of a cost-reflective pricing formula has unnerved the government. Moody’s estimates the government revenue to rise 0.4 percentage point to 15.2 percent of GDP in 2018 and increase a further 0.8 percentage point to 16 percent of GDP in 2019 with the new IR Act.

“Meanwhile, we expect government expenditures to remain flat at 20 percent of GDP. As a result, we forecast the fiscal deficit to narrow to 4.8 percent of GDP this year and shrink to 4.0 percent of GDP in 2019, from 5.2 percent in 2017,” the rating agency stated.

Sri Lanka aims to reduce the fiscal gap to 3.5 percent of GDP by 2020, which is possible on stronger economic growth and higher revenue.

Moody’s also expects the economy to grow by 4.7 percent this year, picking up from 3.1 percent in 2017. As weather conditions normalize, a rebound in agriculture production and exports will boost growth this year.

A rebound in real GDP growth will be essential to help support future revenue gains.

Meanwhile, the rating agency also estimates Sri Lanka to reduce its public debt burden to about 74 percent of GDP by 2021 from 79.3 percent of GDP in 2017.

“Still, the government debt will remain well above the median of about 55 percent of GDP for B-rated sovereigns and will remain high for an economy of Sri Lank