Reply To:

Name - Reply Comment

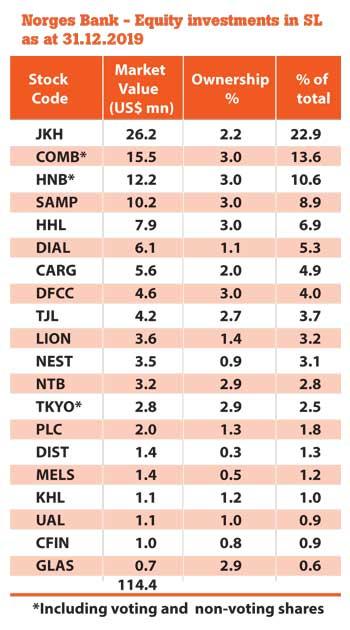

Norges Bank Investment Management, which manages Norway’s one trillion dollar Government Pension Fund Global, has increased its equity investments in Sri Lanka to US $ 114.4 million by the end of last year, compared to US $ 98.3 million at end-2018.

According to the official website of Norges Bank Investment Management, it has added five listed firms in Sri Lanka to its investment portfolio while disposing its stake in one listed firm.

At the end of last year, the fund had invested in 20 listed firms, compared to 16 at end-2018.

During last year, the fund had bought equities in DFCC Bank, John Keels Hotels PLC, Tokyo Cement Co. Lanka PLC, Melstacorp PLC and Central Finance Co. PLC, worth over US $ 11 million, while disposing a 1.62 percent stake in Access Engineering PLC.

The stake in John Keells Holdings PLC, the fund’s single largest investment in Sri Lanka, had been increased to 2.15 percent, from 1.52 percent at end-2018 and was valued at US $ 26.2 million.

Although the majority of the fund’s Sri Lankan investments continued to be in the financial sector, it had reduced its exposure to this sector from 46 percent in 2018 to 43.5 percent at the end of last year.

However, the fund had increased its stake in Commercial Bank of Ceylon PLC to 2.99 percent, from 2.81 percent, which is valued at US $ 16.7 million and its stake in Nations Trust Bank PLC had jumped to 2.94 percent, from 0.9 percent in 2018.

Meanwhile, the fund had reduced its holdings in Dialog Axiata PLC and Union Assurance PLC during last year.

The fund entered Sri Lanka by investing US $ 31 million in Sri Lankan stocks in 2015.

In 2019, the fund recorded its highest annual returns of 1,692 billion kroner (US $ 180 billion) in its history.

Equity investments were the top-performing asset class for the fund, returning 26 percent for the year, while fixed income investments returned 7.8 percent and unlisted real estate investments returned 6.8 percent.

The fund had holdings of more than 2 percent in 1,469 companies and holdings of more than 5 percent in 39 companies at end-2019.