Reply To:

Name - Reply Comment

Sri Lanka is sitting on US $ 8.0 billion worth of foreign financing from multilateral and bilateral partners to be utilised during the next three to five years, while the country is negotiating several other deals to the tune of US $ 2.5 billion worth of balance of payment (BoP) support during the remainder of the year, in a bid to ward off undue pressure on the currency and foreign reserves.

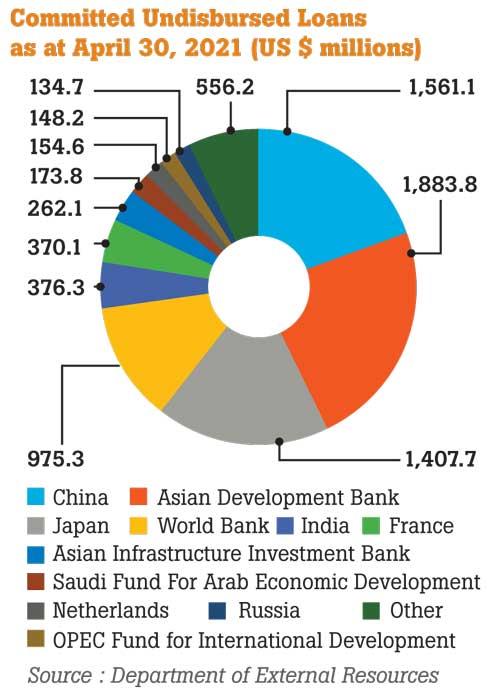

According to the Finance Ministry, the Sri Lankan government has already committed for foreign loans worth of US $ 8,003.9 million as of April-end, mostly concessional in nature, as they are targeted for multiple development projects and programmes.

According to the Finance Ministry, the Sri Lankan government has already committed for foreign loans worth of US $ 8,003.9 million as of April-end, mostly concessional in nature, as they are targeted for multiple development projects and programmes.

Often budgetary support in nature, these loans would be utilised for identified projects in the next three to five years in carrying out the government’s public investment programme, the ministry said.

What is referred to as the committed undisbursed balance (CUB), 20 percent of it is earmarked for roads and bridges, 19 percent for water supply and sanitation and 14 percent for ground transport sector.

The Asian Development Bank leads with the largest share of the CUB to the tune of US $ 1.9 billion, China with US $ 1.6 billion, Japan with US $ 1.4 billion, the World Bank with US $ 975 million and India with US $ 376 million, making the top five lenders.

During the first four months, Sri Lanka took receipt of foreign financing worth of US $ 856.4 million, of which US $ 855.8 million were loans and the balance US $ 0.6 million came in as grants.

The bulk or US $ 500 million came by way of a BoP support facility from the China Development Bank (CDB) in April 2021, with the release of the second tranche of the US $ 1.2 billion of the Foreign Currency Term Financing Facility, which the CDB approved in March 2020 for Sri Lanka.

This made China the leading bilateral foreign financing partner so far during this year, as it in total has granted US $ 514.9 million worth of loans during the first four months in 2021, followed by Japan with US $ 42.1 million.

China became the leading bilateral lender in 2020 also, as it gave the first tranche of the Term Financing Facility of US $ 500 million.

Earlier this week, Money, Capital Market and State Enterprise Reforms State Minister Ajith Nivard Cabraal said they expect inflows to the tune of US $ 2.5 billion from multiple sources as BoP support to alleviate the near-term pressure on the external sector, which was exacerbated by the COVID-19-related restrictions.

Meanwhile, brushing aside claims to the opposite made by various quarters, the Central Bank on Monday reiterated that it had already lined up funding to settle the upcoming sovereign bond settlement of US $ 1.0 billion, on July 27.