Reply To:

Name - Reply Comment

The Paris Club of creditor nations is ready to provide financing assurances to Sri Lanka, a key step needed to unlock a US$2.9 billion bailout by the International Monetary Fund (IMF), Reuters reported yesterday quoting two unnamed sources.

The exclusive news report quoting one of the unnamed sources said the informal group of bilateral lenders, sans India and China, is set to “soon” announce its support to the crisis-hit island nation to support its debt restructuring process and secure IMF funding to revive its economy.

The exclusive news report quoting one of the unnamed sources said the informal group of bilateral lenders, sans India and China, is set to “soon” announce its support to the crisis-hit island nation to support its debt restructuring process and secure IMF funding to revive its economy.

In a previous occasion, Paris Club lenders had agreed upon a 10-year debt moratorium and 15-year debt treatment process for Sri Lanka, though it was not considered a formal financing assurance, which could be utilised to unlock IMF funding for Sri Lanka.

India a couple of weeks ago gave its written financing assurance to the IMF agreeing to help Sri Lanka to make its debt sustainable and to resuscitate its economy.

“We confirm that India has indicated to the IMF management that it is committed to deliver financing/debt relief consistent with restoring the sustainability of Sri Lanka’s public debt under the prospective IMF-supported programme,” an IMF spokesperson said.

India remains Sri Lanka’s third largest bilateral lender.

India offered Sri Lanka a two-year moratorium on its debt and said it would support the country’s efforts to secure the US$ 2.9 billion loan from the International Monetary Fund,

Following that, China’s Export and Import Bank conveyed to Sri Lanka in writing offering a two-year moratorium on its debt and said it would support the country’s efforts to secure the US$2.9 billion loan from the IMF.

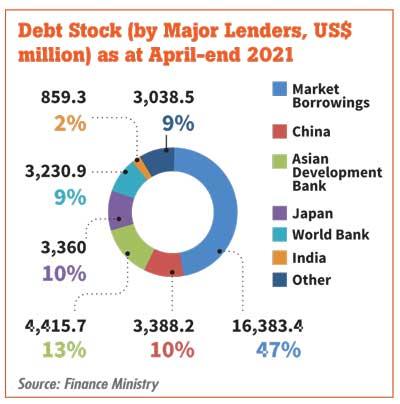

China is Sri Lanka’s largest bilateral lender. Official data from the Finance Ministry shows China accounting for only about 10 percent of the country’s US$ 35.1 billion in external debt at the end of April 2021. But some observers believe that figure may cover only government-to-government debt.

While the IMF has not yet provided any guidance on where it stands regarding China’s assurances to Sri Lanka, a top U.S. official visiting Colombo said this week that Beijing has not done enough.

“What China has offered so far is not enough. We need to see credible and specific assurances that they will meet the IMF standard of debt relief,” U.S. Under Secretary of State for Political Affairs Victoria Nuland told reporters in Colombo.

The U.S. is the largest member of IMF followed by Japan and China.

Sri Lankan authorities are hopeful of securing financing assurances from all of its bilateral lenders within next four weeks or at least within the first quarter of 2022, so that the country can tap into the IMF funding and other multilateral funding as soon as possible to resurrect its economy.

Sri Lanka announced a debt standstill on its foreign debt in April 2022 and defaulted on its debt for the first time in its history in May.