Reply To:

Name - Reply Comment

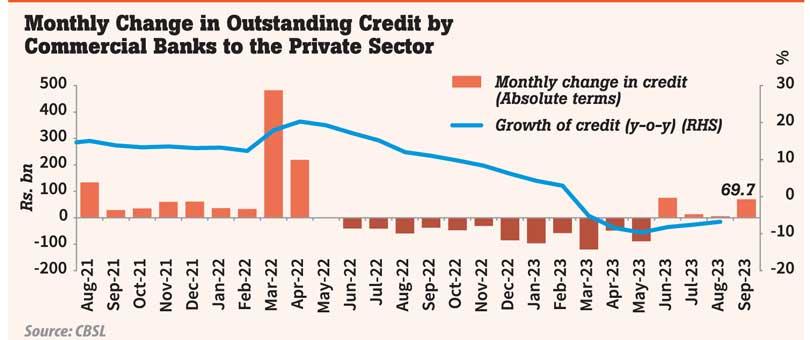

Credit to the private sector expanded for the fourth consecutive month in September, in line with the expectations of the Central Bank, which has slashed the policy rates significantly to spur growth.

As per the data released by the Centra Bank, private credit expanded by Rs.69.7 billion in September, significantly up from Rs.5.5 billion in August.

Credit to the government from the banking system declined by Rs.261.6 billion in September, amid the Domestic Debt Optimisation (DDO). However, credit to public corporations increased by Rs.7.8 billion.

After a full year of degrowth, private credit staged a recovery in June 2023 but the momentum was not maintained in the following months, as the borrowers appear to have adopted a wait-and-see approach, anticipating a further reduction in interest rates.

The Central Bank expects the demand for credit to grow by the end of this year, with the seasonal demand and a more meaningful recovery in private credit by the first quarter of next year, backed by a further decline in market interest rates, in tandem with the policy rate cuts.

“We have already seen a small recovery. I think most probably the recovery is slower when people are expecting the interest rates to come down further. There, the tendency is not to get the new credit but still trying to reprice their obligations and bring down the financing cost. That is what’s happening right now,” Central Bank Governor Dr. Nandalal Weerasinghe told the post-monetary policy presser

in October.

“But, once the interest rates are settled at a certain level and also economic activity picks up, then we are going to see people going to start increased investments, more consumption. With that the credit flow will turnaround,” he added.

“Even in the last quarter of this year, we probably will see seasonal demand towards November-December. We can definitely expect further expansion in credit in the first quarter of next year,” he further said.

The Monetary Policy Board of the Central Bank last month further reduced the key rates by 100 basis points, as it now looks to stimulate economic activity, after bringing the galloping inflation, which almost hit 70 percent in September last year, under control. With the October rate cut, the Central Bank has reduced the policy rates by 550 basis points cumulatively since June. Sri Lanka’s economy contracted by 7.8 percent in 2022 and 7.9 percent in the first half of 2023.