Reply To:

Name - Reply Comment

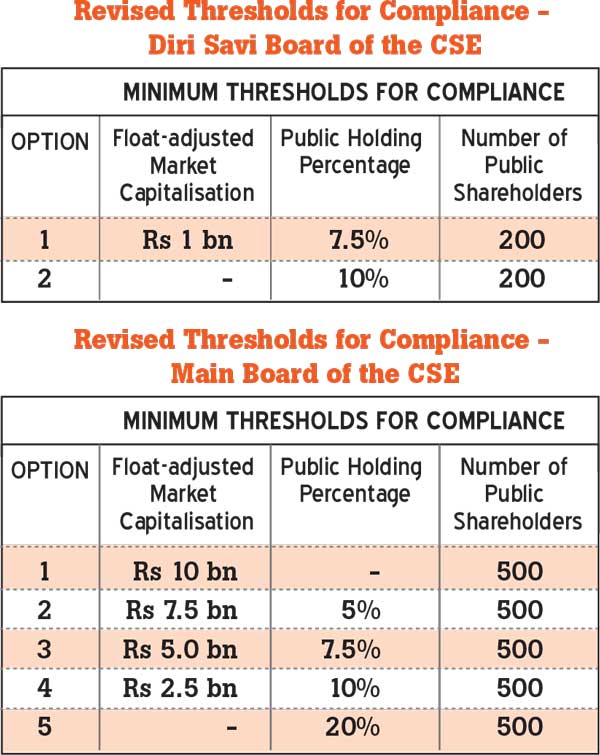

With just 44 days left on the deadline for publicly listed companies to adhere to public float requirements of the Colombo Stock Exchange (CSE), the Securities Exchange Commission (SEC) has moved to relax the regulations to some degree, probably in the face of lobbying from entities opposing them. “Taking the views of the market into consideration, the SEC in consultation with the CSE decided to review the rules. Subsequent to such review the SEC decided to revise the minimum public float requirements to provide listed public companies with a wider range of options to comply with the rules without compromising the objective of the rule,” an SEC statement said. During a meeting with all listed companies this April, SEC officials had noted that the regulator was willing to be flexible with the deadline, and to introduce alternatives to the existing minimum public float rules as a requirement for continued listing. The revised rules will be implemented on January 1, 2017, with a grace period extending till June 30, 2017. Entities listed on the Main Board, according to the latest revisions, will have 5 options of complying with public float requirements according to their market capitalization spread among public holding, but will have to maintain a minimum of 500 public shareholders. A company which has Rs.10 billion of its capitalization spread among public holding does not have to maintain a minimum public holding percentage. The minimum public holding requirement increases based on lower levels of public float capitalization, going up to 20 percent minimum public holding if the public float capitalization is below Rs. 2.5 billion.

Companies in the Diri Savi Board are required to have 10 percent of its shares held by the public, with a minimum of 200 shareholders, while companies with a public float capitalization of Rs.1 billion is allowed to reduce the limit down to 7.5 percent of the shares among 200 shareholders. Under past rules, Main Board companies were required to have a 20 percent public float among 750 shareholders or a 10 percent public float valued at Rs.5 billion market capitalization spread among 500 shareholders while Diri Savi Board entities were required to have a 10 percent public float among 500 shareholders. The now defunct rules came into effect on December 31, 2014, with two grace periods extending the deadline to December 31, 2016. However, as recently as yesterday, over 40 companies out of the total 295 listed were not in compliance with the former rules. Two of the 5 companies to delist over the past 2 years had cited the free float rules as a reason, while 7 companies have announced their intentions to delist and at least 3 companies have transferred to the secondary board over the rules as well. The CSE had rules governing the public float at the time of a company newly listing on it, but according to SEC officials, an oversight during the drafting of rules had left out minimum public float rules as a requirement for continuous listing. The SEC cites that the rules would promote a more liquid and transparent bourse. However, the majority shareholders of many companies that have delisted or have announced their intentions to delist had been adamant on their disinclination to dilute ownerships in their companies. Many heavyweights such as the John Keells Group had divested shares in their subsidiaries to remain listed, while others have continued to purchase shares above the rule limits from minority shareholders as the deadline approached.