Reply To:

Name - Reply Comment

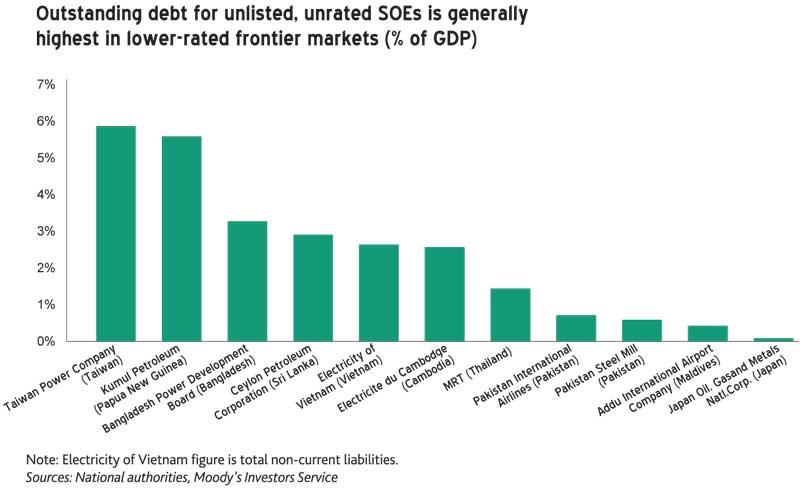

State-owned enterprises (SOE) liabilities are posing both explicit and implicit contingent risks to Sri Lanka and some other Asia Pacific nations such as Vietnam, Bangladesh and Papua New Guinea, Moody’s Investors Service said in a new report.

“While unlisted SOEs in frontier markets – including Papua New Guinea (PNG, B2 stable), Bangladesh (Ba3 stable), Sri Lanka (B2 stable) and Vietnam (Ba3 stable) – pose the greatest implicit liabilities, rated and unrated, listed SOEs in advanced economies and emerging markets also show signs of weak financial strength,” said Anushka Shah, a Moody’s Vice President

and Senior Analyst.

“In terms of SOEs’ explicit liabilities, these are primarily driven by government guarantees and have risen in a number of countries,” added Shah.

The rating agency pointed out that the contingent risk may be explicit in nature, such as when a government guarantees an SOE’s debt. The report pointed out that government guarantees are large and have risen in Malaysia, the Maldives and Sri Lanka.

“But SOEs are also, and more typically, the source of implicit liabilities, which arise from quasi- fiscal operations that are neither compensated through budgetary subsidies nor covered by explicit government guarantees,” Moody’s noted.

The rating agency pointed out that the management of these liabilities is key in assessing the probability of contingent risk materialization.

“In particular, government practices to calculate and quantify risks, and frameworks to control them, are important factors in gauging the probability of contingent liability materialization,” the report noted.