Reply To:

Name - Reply Comment

Sri Lanka’s debt relief from its recent agreement is expected to be 19.8 percent in net present value (NPV) terms, based on a 5 percent discount rate, lower than the 30 percent NPV reduction projected in the government’s baseline scenario, Verité Research said.

In September, Sri Lanka announced a renewed agreement with the international bondholders, using the International Monetary Fund’s (IMF) Debt Sustainability Analysis (DSA) as a framework to estimate the relief. However, Verité Research said the baseline scenario outlined by the government does not align with the official economic data and projections.

“The debt relief terms with the official creditors have not been disclosed. Based on the agreement with the international bondholders, the comparability of treatment criteria could have Sri Lanka receiving less than 20 percent in NPV reduction from the official creditors as well,” Verité Research said.

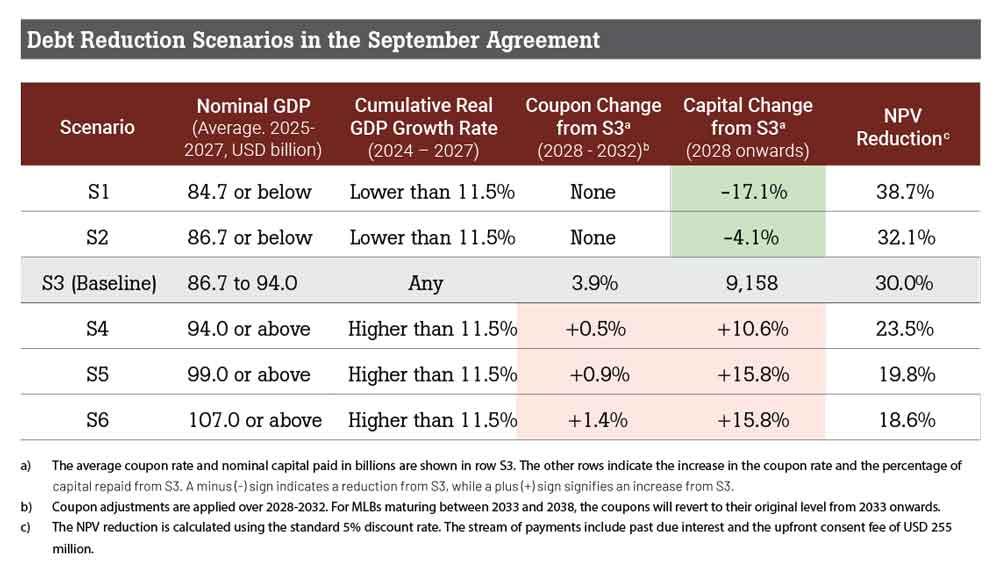

The government’s public communique references Scenario S3, labelled as the “IMF baseline”, as the expected outcome for Sri Lanka. The alternative scenarios S1 and S2 represent an economic downturn, while the scenarios S4 to S6 represent the exceeding growth expectations.

“But those expectations are incorrect. Because our calculations show that S3 (the baseline scenario in the September Agreement) could only occur if Sri Lanka’s average growth rate between 2025-27 falls below 2.2 percent,” Verité Research said.

The official data from the government and IMF currently project an average growth rate of 2.9 percent for Sri Lanka between 2025-2027. According to Verité Research, this means Scenario S5, not S3, is the more likely outcome for the country.

“The S5 scenario is the second lowest debt reduction scenario, with a NPV reduction of 19.8 percent on a discount rate of 5 percent,” Verité said.