Reply To:

Name - Reply Comment

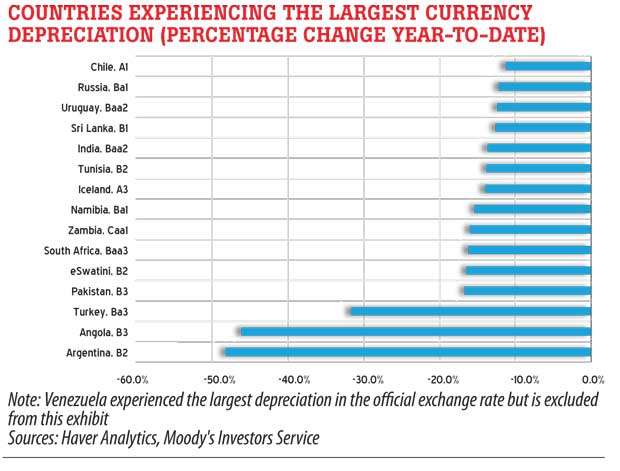

Moody’s Investors Service has placed Sri Lanka among the countries in the world with the largest fall in value of their currencies against the US dollar in 2018, and stressed that the implementation of reforms that address both fiscal and external imbalances will remain key to supporting sovereign credit profile of the country.

Moody’s has a ‘B1’, a speculative grade rating on Sri Lanka, with a ‘Negative’ outlook due to the country’s high government debt, very low debt affordability and fragile external payment position.

The current political deadlock has worsened the precarious economic situation the country is in as the rupee was seen depreciating sharply against the US dollar with foreigners pulling out their investments from Sri Lankan stocks and bonds. Sri Lanka was ranked twelfth out of fifteen sovereigns with the largest year-to-date currency depreciations.

Year-to-date the Sri Lankan rupee has depreciated by about 13.5 percent and at Rs.174.45/60 per dollar on Monday compared with previous close of Rs.174.30/50, data compiled by Reuters showed.

Argentine peso is the worst-hit currency to-date with its value falling by close to 50 percent. Meanwhile in South Asia, Pakistan was the worst-hit with its rupee falling in value by 15 percent year-to-date.

Indian rupee ranks next to the Sri Lankan rupee with about a 14 percent fall in its value against the dollar.

Moody’s earlier viewed the recent appointment of former President Mahinda Rajapaksa as the country’s Prime Minister as credit negative for Sri Lanka as the development increases political uncertainty.

On the contrary, Sri Lanka’s business community has silently welcomed the political shift that took place, and the wider public has also accepted the change which they were yearning for the last two years largely due to higher cost of living and taxes imposed by the government that came into power in 2015.

The Colombo Stock Exchange, which was mostly on a lackluster mode for the last two years, was reinvigorated with local investors led by high net worth individuals and institutions, triggering a buying spree.

But foreigners were the biggest sellers since Rajapaksa’s appointment.

Since Rajapaksa undertook the most crucial portfolio of finance ministry last week, there were signs of releasing dollars to the market to prop up the rupee, forex market sources said.

Rajapaksa also announced a reduction of taxes on several commodities and slashed fuel prices, although it could undermine fiscal consolidation, which is paramount in achieving macro-economic stability.

In a report released yesterday on global sovereigns, Moody’s predicted a stable outlook for sovereign creditworthiness in 2019, balancing the global economy’s continued but slowing growth momentum against rising uncertainty over longer-term economic and financial stability.