Reply To:

Name - Reply Comment

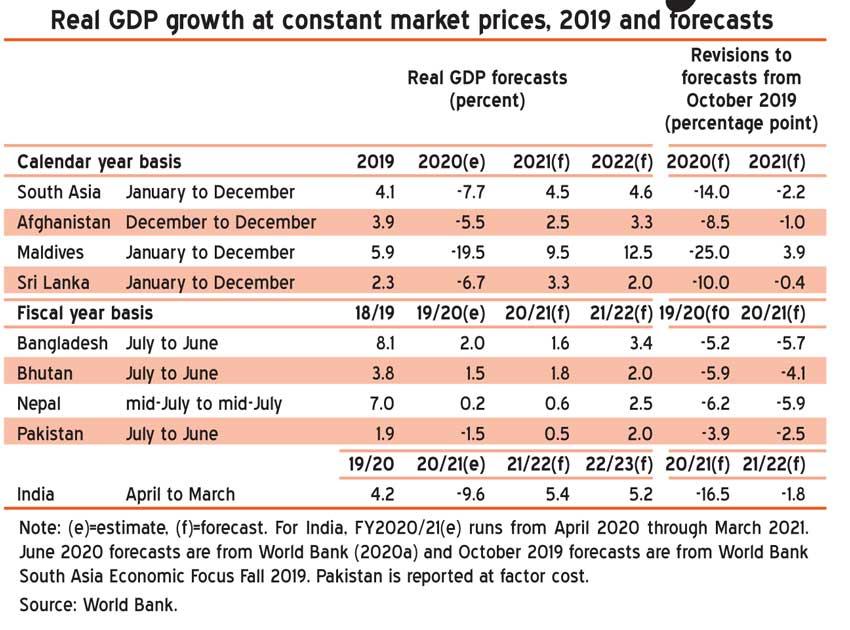

Hit by COVID-19-related disruptions, Sri Lanka’s economy is projected to shrink by 6.7 percent this year, recording the third highest economic contraction among the South Asian region economies, after the Maldives (-19.5) and India (-9.6), the latest World Bank report titled ‘South Asia Economic Focus’, released yesterday said.

“The COVID-19 crisis has substantially clouded the outlook and exacerbated an already challenging macroeconomic situation. The economy is expected to contract by 6.7 percent in 2020, with all key drivers of demand affected: exports, private consumption and investment,” the report stated.

Sri Lanka’s economy contracted unexpectedly by 1.6 percent in the first quarter of 2020—a first in 19 years— despite economic activity in the last two weeks of March being affected by the islandwide curfew.

However, since January, Sri Lanka was experiencing some supply chain disruptions, which may have had an impact on the apparel, construction and tea industries.

The World Bank in its ‘Global Economic Prospects’ report in June forecast 3.2 percent GDP contraction for Sri Lanka, this year.

Sri Lanka grew 2.3 percent in 2019, lower than expected at the beginning of the year, largely due to April terror attacks.

“COVID-19-related disruptions will lead to a sharp contraction in Sri Lanka’s economy in 2020. A significant increase in poverty is expected, due to widespread job and earnings losses. With already narrow fiscal buffers before the pandemic, additional spending and reduced revenues, due to COVID-19, will put additional pressure on fiscal sustainability,” the report said.

“Over the medium term, growth is expected to recover slowly. However, macroeconomic vulnerabilities will remain high, with depleted fiscal buffers, high indebtedness and large refinancing needs,” it added.

The World Bank expects Sri Lanka’s current account deficit to remain low at 2.2 percent of GDP this year, thanks to low oil prices and strict import restrictions, which should largely offset the reduction in receipts from garment exports, tourism and remittances.

However, the global lender pointed out that Sri Lanka’s refinancing risks would remain high with the annual foreign exchange debt service requirements estimated at 7-8 percent of GDP over 2020-2022. Sri Lanka’s fiscal deficit is projected to expand further to over 11 percent of GDP in 2020, driving an increase in debt levels.

“Reflecting these challenges, the US$ 3.20 poverty headcount is projected to increase from 8.9 percent in 2019 to 13 percent in 2020,” the report noted. It pointed out that the construction and services sectors, including tourism, have been important sources of job growth in Sri Lanka in recent years and the outbreak will likely harm the prospects of many low-skilled workers.

It also said the government’s move to provide employment to 60,000 graduates and 100,000 individuals from low-income families, to support livelihoods, would prove to be insufficient and add further strain on public finances.

The report also pointed out that a fall in remittances could adversely impact poor households that rely on them as an important source of income.

In 2019, worker remittances accounted for 7.8 percent of Sri Lanka’s GDP. In April, the World Bank forecast 19 percent decline in remittance earnings for Sri Lanka.

However, workers’ remittance earnings have recorded only 1.5 percent decline in the first eight months of 2020, to US$ 4.35 billion, compared to the first eight months of 2019.

Highlighting the risks and challenges for the country, the report stated that a longer than expected outbreak of COVID-19, that would extend the horizon and depth of related economic disruptions, would be a key risk to the country’s economic outlook. “… a longer downturn could push many small and medium enterprises from illiquidity to insolvency and the poverty rate could rise even higher, as more people suffer income losses. Low growth would also put additional strain on public finances,” the report said.

The World Bank also stressed the need for Sri Lanka to strike a balance between supporting the COVID-19-hit economy and ensuring fiscal sustainability, as the country is highly exposed to the global financial condition with Sri Lanka debt repayment profits, requiring the country to access financial markets frequently.

“A high deficit and rising debt levels could further deteriorate debt dynamics and negatively impact market sentiment.”

Meanwhile, the World Bank forecasts Sri Lanka’s fiscal deficit to widen sharply to 11.1 percent this year, from 6.8 percent in 2019, the debt-to-GDP ratio to exceed 100 percent from 86.8 percent in 2019. The World Bank expects Sri Lanka’s debt-to-GDP levels to remain elevated over 100 percent levels in 2021 as well as in 2022.

Due to the decline in demand, Sri Lanka’s inflation is expected to remain below 5 percent in 2020 and 2021.