Reply To:

Name - Reply Comment

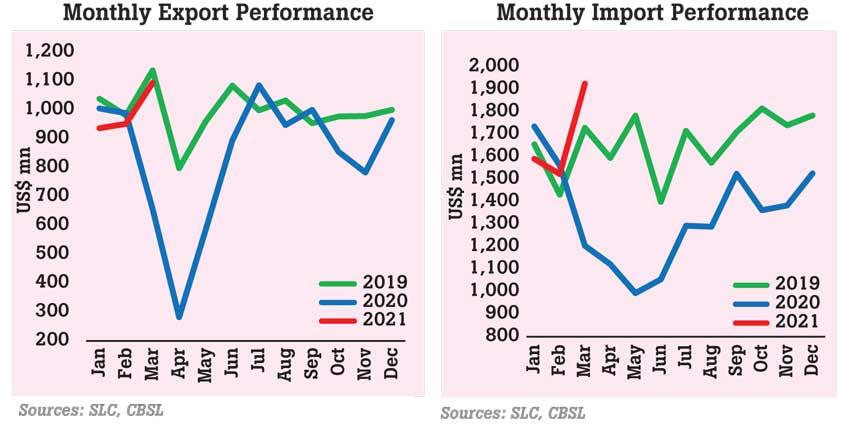

Trade deficit in March widened for the first time nearly in a year as imports recovered almost at the same pace as exports partly driven by seasonal demand, leading to a widening of the trade deficit in the first quarter, the latest data released by the Central Bank showed.

In March, trade deficit rose to US$ 832 million compared US$ 549 million deficit recorded one year ago, amid earnings from merchandise exports growing 66.7 percent Year-on-Year (YoY) to a six-month-high of US$ 1.1 billion while expenditure on imports rose by nearly 60 percent YoY to US$1.9 billion in the month.

“The deficit in the trade account widened in March 2021, for the first time since April 2020. Both exports and imports were significantly higher in March 2021, compared to March 2020 as well as February 2021,” the CB said.

The cumulative deficit in the trade account in the first quarter widened to US$ 2 .059 billion from US$ 1.85 billion recorded over the same period in 2020, driven by US$ 538 million rise in import expenditure that outpaced US$ 332 million increase in export income in the period.

The high import prices also contributed to the deterioration in the trade account in March. Terms of trade, which is the ratio of the price of exports to the price of imports, declined by 6.3 percent in the month as import prices rose at a faster pace than export prices compared to a year ago.

The largest contributing factors for the widening of the trade deficit were US$ 112 million increase in import expenditure on machinery and equipment, US$ 88.1 million rise in textiles and textile articles and US$ 84 million increase in chemical products.

Meanwhile, rise in exports was coming from a low-base effect seen in March last year when the country embraced travel restrictions as it entered the first-wave of the pandemic.

Industrial exports rose by 56.2 percent YoY to US$ 829.8 million in March, as textile and garment export rose by a nearly 50 percent YoY to US$ 467.2 million in the month almost reaching pre-pandemic levels.

Further, export earnings from rubber products rose by 74.5 percent YoY to US$ 95.2 million while earnings from gems, diamonds and jewellery imports recovered by 228.5 percent YoY to US$ 27.7 million.

“Earnings from export of petroleum products declined on a year-on-year basis due to the significant reduction in volumes of aviation fuel and bunkering fuel supplied to aircraft and ship arrivals, despite the increase in the average prices of these export products. Earnings from leather, travel goods and footwear export declined in March 2021 both on year-on-year and month-on-month (MoM) basis,” the CB noted.

Export earnings from all subsectors related to agricultural goods rose in March both in YoY basis and MoM basis.

In particular, export income from tea rose by nearly 100 percent to US$ 124 million while income from spice exports rose by a record 199 percent to US$ 38.6 million in the month.

The cumulative merchandise export income rose by 12.6 percent YoY to US$ 2.98 billion in the first quarter of the year.

Despite the import restriction measures in place, expenditure on merchandise imports increased significantly in March by 59.8 percent YoY to US$ 1.92 billion, which was the highest monthly import value since March 2018.

Import expenditure on consumer goods rose by 42.1 percent YoY to US$ 379.6 million in March. This was mainly due to 86.4 percent YoY growth in sugar and confectionery imports, which hit US$ 50.8 million, followed by rise in non-food consumer goods such as home appliances and telecommunication devices, which rose by 191.3 percent YoY and 448.1 percent YoY to US$ 31.8 million and US$ 40.6 million, respectively.

Although crude oil was not imported in March due to maintenance work at the refinery, expenditure on fuel increased by 46.1 percent YoY to US$ 347.2 million due to higher import volumes and prices of refined petroleum and coal.

Average import price per metric tonne of refined petroleum increased to US$ 589.45 in March compared to US$ 532.75 recorded in February 2021.

Meanwhile, import expenditure on investment goods increased by 75.8 percent YoY in March and by 37.1 percent MoM to US$ 416.3 million.

“The increase in investment goods (both YoY and MoM) was driven by expenditure on machinery and equipment and building material imports, while expenditure on transport equipment also increased. Import expenditure on machinery and equipment increased (MoM) with higher imports of machinery and equipment parts, computers, turbines, transmission apparatus, whereas import expenditure on building material increased (MoM) with higher imports of cement and articles of iron and steel. Railway equipment, agricultural and road tractors, and tankers and bowser imports categorised under transport equipment, also picked up in March 2021 when compared to February 2021,” the CB elaborated.

The cumulative import expenditure on investment goods increased by a modest 6.7 percent YoY to US$ 1.05 billion in the quarter.

Meanwhile, in terms of the country’s major inflows to the current account, workers’ remittances, continued rise recording 24.4 percent YoY growth in the month and 16.7 percent YoY growth in the quarter.

In the first quarter of 2021, inflows from workers’ remittances reached US$ 1.86 billion.

In addition, marginal net foreign investment outflows from capital markets were recorded in March 2021.

Accordingly, a net outflow of US$ 6 million was recorded in the rupee denominated government securities market in March, resulting in a cumulative net outflow of around US$ 5 million during the quarter.

A net outflow of US$ 21 million was recorded from the secondary market of the CSE in March. However, on a cumulative basis, the CSE recorded a net outflow of US$ 91 million during the quarter.