Reply To:

Name - Reply Comment

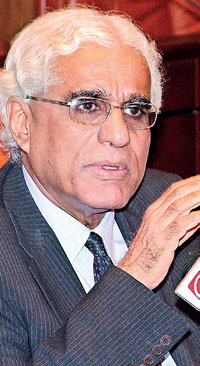

An official from the United States Treasuries is now in town to advise the Central Bank on improving the government securities (G-Sec) market and its auction process among other things, according to Central Bank Governor Dr. Indrajit Coomaraswamy.

An official from the United States Treasuries is now in town to advise the Central Bank on improving the government securities (G-Sec) market and its auction process among other things, according to Central Bank Governor Dr. Indrajit Coomaraswamy.

T h e o f f i c i a l h a s considerable expertise and experience in assisting developing countries in improving and promoting their G-Sec markets. The credibility of Sri Lanka’s G-Sec auctions was shattered as charges of auction rigging, at least in two instances this year and the previous year surfaced, which allegedly had allowed a connected party to the then Central Bank governor to make thumping gains. “We also have with us, a consultant, an advisor from the Unites States Treasury, who is looking at a number of things including the auction process, cash flow management, debt management strategy as well as on developing a good database,” said Dr. Indrajit Coomaraswamy. This is besides the new set of auction rules, which is expected to be implemented from the first quarter of 2017 (1Q17). The rules developed with the consultation of all senior officers of the Central Bank, who have worked in the public debt area, are now before the experts from the World Bank (WB) and International Monetary Fund (IMF) seeking their validation. “We want to get the validation of this auction system before we go live with it and we hope to do that in the 1Q17,” Dr. Coomaraswamy said. Further, the Central Bank will also introduce an electronic trading platform and a bond clearing house consisting of a central counterparty clearing and settlement facility for G-Secs.

The Monetary Board appears to think that the recent adjustments made to the tax structure will only have a one-off impact on inflation from November while the budget 2017 will also have a favourable impact on inflation. However, inflation is expected to remain stable at midsingle digit level in the period ahead