Reply To:

Name - Reply Comment

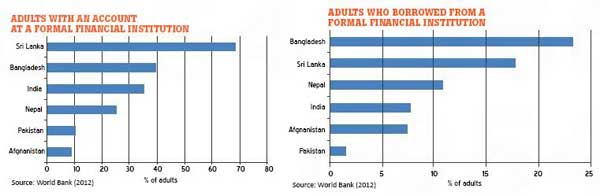

Sri Lanka has the highest level of financial inclusion in South Asia with easy access to finance, according to a recently published Asian Development Bank Institute (ADBI) working paper.“In South Asia, only 33 percent of adults have an account at a formal financial institution—the second lowest share of the world’s regions, higher only t han Sub-Saharan Africa,” t he paper authored by Dr.Saman Kelegama and Ganga Tilakaratna noted.

Sri Lanka has the highest level of financial inclusion in South Asia with easy access to finance, according to a recently published Asian Development Bank Institute (ADBI) working paper.“In South Asia, only 33 percent of adults have an account at a formal financial institution—the second lowest share of the world’s regions, higher only t han Sub-Saharan Africa,” t he paper authored by Dr.Saman Kelegama and Ganga Tilakaratna noted.

In Sri Lanka, 68 percent of adults have an account in a financial i nstitution, compared to 38 percent in Bangladesh and 35 percent in India.In the aspect of borrowing, Bangladesh led with around 23 percent of adults while Sri Lanka came in second with over 16 percent.33 licensed commercial banks and license specialised banks operated in Sri Lanka at the end of 2012 with 6,487 bank branches and 2,538 ATMs.

In 2006, 82.5 percent of the households in Sri Lanka were accessing either these formal financial institutions or semi-formal ones such as micro-financing institutions (MFIs), while 98 percent of the households had access to these i nstitutions by 2009. 38 percent of the households had access to both forms of institutions in 2006, which increased to 64 percent in 2009, while 84 percent of the households were accessing multiple financial institutions for their borrowing or saving needs, an increase from an already high 60.2 percent.

On average, households were accessing 3 financial institutions in 2009, compared to 1.9 in 2006.The access was not limited to higher income levels, with around 68 percent of households in the bottom income quintile having had accessed multiple financial institutions, compared with more than 90 percent in the top- income quintile.While these data suggest a higher level of financial inclusion, the report cites an increase of household debt among those that borrow from multiple financial institutions.

“Although debt levels are still at moderate levels, given the increasingly high level of multiple borrowing in the microfinance sector, careful monitoring of multiple borrowing and repayment capacity of borrowers is needed to minimize any adverse effects on borrowers as well as on institutions,” it said. The paper highlighted the reason for this financial inclusion being mainly due to the availability of a range of services for various segments of society, such as different savings products, loan facilities, pawning, insurance and money transfer systems as well as good infrastructure, small size, population density, high literacy and low levels of poverty.

Recent measures, such as the provision for 10 percent credit for agriculture, opening of more rural banking branches, having the post office conduct financial services, events, mobile banking units, and technology have also contributed to financial inclusion.Despite the inclusion of so many avenues for management of finances, people have not been making maximum utility, leaving a banking system with underutilized infrastructure.

“Use of debit and credit cards, phone banking, and e-banking are still at a relatively low level in Sri Lanka,” the report stressed.It asked for further development financial literacy at a policy level, so that people would make use of these services and manage their finances to gain the maximum benefit, and concurrently introduce measures such as SMS banking in native languages to further promote banking in rural areas and reduce transaction costs.The report also asked for the transfer of non-formal methods such as the ‘seettu’ system and several MFIs to the formal sector as well as for the registration of MFIs with the Credit Information Bureau.