Economy

IMF external liquidity support still a possibility: S&P

10 Jul 2014

0

0

External liquidity support is still very much a possibility for Sri Lanka from the International Monetary Fund (IMF) or from any other bilateral lender if such a requirement arises, according to a US-based credit rating agency.

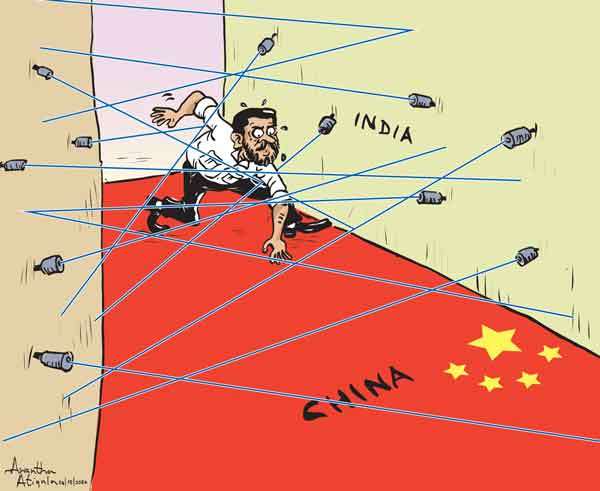

Lankan banks tighten defences against cyber attacks

02 Jul 2014

0

0

Despite Sri Lanka currently not being in a state of war and not facing foreign invasion, the country is ceaselessly engaged in cyber warfare, and a gap in the lines may bring the country’s economy to its knees, Central Bank Governor, Ajith Nivard Cabraal said.

Southern unrest shatters middle east tourist confidence

20 Jun 2014

1

1

The recent unfortunate incidents that erupted in Aluthgama and Beruwala areas will have an adverse impact on the country’s tourism sector in the backdrop of Middle East being the fourth largest inbound tourist market for Sri Lanka, according to tourism industry stakeholders.

Policy rates unchanged; April credit growth at 3.3%

19 Jun 2014

0

0

The Monetary Board of the Central Bank yesterday decided to maintain the policy rates unchanged for the month of June despite the private sector credit growing at a slower pace of 3.3 percent in April, compared to 4.3 percent in March.

Auto importers cry foul at new valuation method on imported vehicles

19 Jun 2014

0

0

The Ceylon Motor Traders’ Association (CMTA), an industry body consisting of automotive franchise holders, cried foul at the recently implemented valuation method on imported vehicles and urged the authorities to immediately withdraw the new method.

New tank farm, bunkering terminal facilities to open at H’tota port

11 Jun 2014

0

0

The new tank farm complex and the bunkering terminal of the Magam Ruhunupura Mahinda Rajapaksa Port (MRMRP) in Hambantota is set to be opened on June 22 by President Mahinda Rjapaksa, a media statement by the Sri Lanka Ports Authority (SLPA) said.

Emerging markets should be prepared for Fed tightening

05 Jun 2014

0

0

Central Bank Governor Ajith Nivard Cabraal said he would not expect the US Federal Reserve to take account of its actions on developing economies when time comes for the end of quantitative easing and every emerging market should be prepared for Fed tightening.

FDIs in 1Q doubles; minister confident of achieving elusive US $ 2bn target this year

30 May 2014

0

0

Despite failing to achieve the target of US $ 2 billion in foreign direct investments (FDIs) last year, Investment Promotions Minister Lakshman Yapa Abeywardena said they are confident of their ability to exceed the mark of US $ 2 billion this year.

Pakistan likely to expand FTA trade with Sri Lanka

29 May 2014

0

0

Pakistan, Sri Lanka’s second largest trade partner in the region, has indicated interest in expanding its free trade agreement (FTA) trade with the island, creating growth in bilateral trade, which already exceeds the US $ 460 million mark, according to Sri Lanka’s trade ministry.

Sri Lankan tea players to benefit from world’s aging population: report

27 May 2014

0

0

Sri Lanka’s tea sector players are likely to benefit from the new demand coming from the ageing population in the global market place, particularly from countries such as Japan, Europe and the US, according to a recent study by the Business and Information Division of the Ceylon Chamber of Commerce.

CB Governor admits challenges, assures no retrenchment

05 May 2014

3

3

Sri Lanka’s Central Bank Governor urged top banking and non-banking sector officials to “put their thinking caps on” in order to ensure that financial sector consolidation can be a seamless transition into something new, exciting and sustainable.

Finance sector consolidation not an ad-hoc move: Cabraal

02 May 2014

1

1

Consolidation of the banking and non-banking sectors is not an ad-hoc arrangement but is part of an overall strategy and is being done at the most suitable time for the country, Sri Lanka’s Central Bank Governor, Ajith Nivard Cabraal said.

CB keeps policy rates unchanged

23 Apr 2014

0

0

The Monetary Board of Central Bank yesterday decided to keep the policy rates unchanged with government and state-corporations borrowing less, which in return has created a favourable environment for private credit to pick up, the Central Bank said.

March vehicle registrations up on Feb effect

21 Apr 2014

0

0

Sri Lanka’s vehicle registrations in March rose 16 percent to 26,921 units over February, though the increase was mainly due to the less number of days and more holidays in February, according to a monthly analysis of vehicle registrations by research and stock brokerage firm, JB Securities Limited.

Focus should now shift to long-term targets: Cabraal

09 Apr 2014

0

0

Sri Lanka is on course to achieve macro-economic targets in the near-medium term, and focus must now shift towards longer-term targets up-to and beyond 2030, according to Central Bank of Sri Lanka (CBSL) Governor, Ajith Nivard Cabraal.

March tourist arrivals up 17.5%

07 Apr 2014

0

0

Sri Lanka’s tourist arrivals rose 17.5 percent Year- on-Year (YoY) to 133,048 in March 2014, with Russia, China, Saudi Arabia and the UAE leading the list, data released by the country’s tourism authority showed. Arrivals in the first three months of the year were up 24.8 percent YoY to 421,501.

Retrenchment unavoidable in consolidation

17 Mar 2014

0

0

Job retrenchment and streamlining of cost structures are likely to be an inevitable by-product of consolidation in the banking and finance sector, according to Association of Professional Bankers of Sri Lanka President and Sampath Bank Managing Director, Aravinda Perera.

Auction yields slump for third consecutive week

25 Feb 2014

0

0

Moody’s raises Sri Lanka’s rating

25 Feb 2014

0

0

ASPI crosses the 15,000 mark for the first time

25 Feb 2014

0

0

Moody’s raises Sri Lanka’s rating

25 Feb 2014

0

0

Probe underway as child dies after surgery at J’Pura hospital

25 Feb 2014

0

0

Over 370 jumbos perish in 2024

25 Feb 2014

0

0

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)