Financial News

Union Bank records lower 1Q profits amid higher provisions; records surprise growth in loans

17 May 2022

0

0

Union Bank of Colombo PLC reported disappointing results for the three months ended March 31, 2022 (1Q22) on the back of higher provision made on account of loans and other financial assets, but recorded a surprise growth in new loans amid tough conditions.

NDB reports subdued 1Q profits over multifold increase in provisions

17 May 2022

0

0

The profit cratered at National Development Bank PLC (NDB) in the quarter ended March 31, 2022 as the bank’s provisions against possible loans and other losses rose many-fold in expectation of dourer financial conditions going forward.

HNB Finance positions to optimise synergies from Prime Finance’s acquisition

12 May 2022

0

0

HNB Finance PLC has further strengthened its customer operations and branch network by absorbing and bringing under its brand the 7 branches of Prime Finance PLC. This strengthens HNB Finance’s total presence to 77 branches and positions the company to optimise the synergies stemming from its merger with Prime Finance.

ComBank Digital wins AFTA award for ‘Best Frictionless Credit Evaluation Initiative’

12 May 2022

0

0

A facility provided by the Commercial Bank of Ceylon for personal loans to be applied online, has been adjudged the ‘Best Frictionless Credit Evaluation Initiative’ in Sri Lanka by the Asian FinTech Academy (AFTA).

ComBank to reward new Arunalu, Isuru account holders with gifts in April and May

09 May 2022

0

0

Commercial Bank of Ceylon has announced that all customers who open new ‘Arunalu’ children’s savings accounts or ‘Isuru’ minors’ savings plans in April and May will be rewarded with a gift, adding further value to the benefits the account holders will enjoy during and beyond their childhood.

People’s Bank promotes LankaQR facility in Kurunegala

09 May 2022

0

0

The Central Bank of Sri Lanka launched another Lanka QR promotional programme in the Kurunegala city and People’s Bank also participated in this programme to raise awareness about the LankaQR payment system via the People’s Pay app.

ComBank adjudged as Best Corporate Bank and Best Retail Bank in Sri Lanka

06 May 2022

0

0

Commercial Bank of Ceylon has won the titles of Best Retail Bank Sri Lanka 2022 and Best Corporate Bank Sri Lanka 2022 at the annual awards of the UAE-based Global Business Review magazine, which recognises and rewards excellence in companies across sectors.

LOLC Life records highest number of MDRT champions

06 May 2022

0

0

LOLC Life Assurance, an associate company of LOLC Holdings PLC, declared 56 members of its sales team as qualifiers for the Million Dollar Round Table (MDRT) membership including three Court of The Table (COT) winners for the year 2021.

Ceylinco Life crowned as Sri Lanka’s Most Valuable Life Insurance Brand in 2022

06 May 2022

0

0

Ceylinco Life has once again been adjudged as the Most Valuable Life Insurance Brand in Sri Lanka and has moved up five places in the 2022 brand value rankings published by Brand Finance, the world’s leading independent brand valuation consultancy.

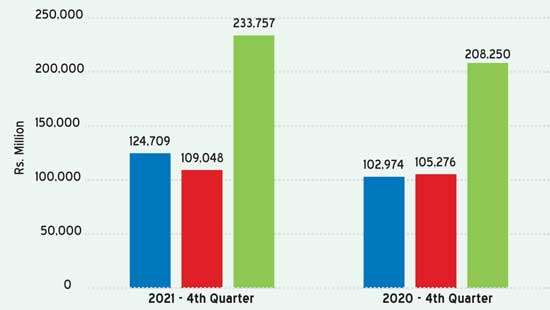

Insurance industry achieves 12.25% GWP growth in 4Q21

04 May 2022

0

0

The insurance industry had achieved a growth of 12.25 percent in terms of overall gross written premium (GWP) during the fourth quarter of 2021, recording a GWP increase of Rs.25,507 million when compared to the same period in the year 2020.

DFCC Bank partners with USAID to support local MSMEs

04 May 2022

0

0

DFCC Bank, the bank for everyone, has entered into a landmark partnership with USAID CATALYZE Private Sector Development Activity (PSD) PSD, implemented by The Palladium Group, to finance micro, small and medium enterprises (MSMEs), with a focus on women-led enterprises.

POTENZA-HNB partner to facilitate robotic process automation for mainstream banking

04 May 2022

0

0

POTENZA, the Sri Lanka-based global business technology consultancy group, recently announced a landmark partnership with Hatton National Bank (HNB), as its official implementation partner, to facilitate and support the bank on its journey of robotic process automation.

ComBank ranked as Strongest Bank Brand for 3rd successive year

04 May 2022

0

0

Commercial Bank of Ceylon has been ranked as the Strongest Bank Brand in Sri Lanka for the third consecutive year in the 2022 report on the country’s most valuable and strongest brands by Brand Finance, the world’s leading independent brand valuation consultancy.

Sri Lanka Insurance posts record pre-tax profit of Rs.11.7bn for FY21

28 Apr 2022

0

0

Sri Lanka Insurance yet again recorded stellar performance in the year 2021 to record a profit before taxation of Rs.11.7 billion for the year 2021, with a strong improvement in combined Gross Written Premium (GWP) of Rs. 43.2 billion denoting 9.7 percent growth.

ComBank Digital wins AFTA award for ‘Best Frictionless Credit Evaluation Initiative’

28 Apr 2022

0

0

A facility provided by the Commercial Bankof Ceylon for personal loans to be applied for online, has been adjudged the ‘Best Frictionless Credit Evaluation Initiative’ in Sri Lanka by the Asian FinTech Academy (AFTA).

BOC announces ‘Pita Pita Rata Thegi’ third edition with Rs.30mn grand price

28 Apr 2022

0

0

Incentivizing Sri Lankan expatriates to remit their hard-earned foreign currency earnings securely back to their families and loved ones, Bank of Ceylon (BOC) is announcing third season of its unique ‘Pita Pita Rata Thegi’ promotion in offering the expatriates to win back-to-back valuable gifts in daily, weekly and monthly draws including a grand price a Luxury Villa worth Rs.30 million.

Fitch downgrades SLIC; places seven non-life insurers on watch for possible downgrade

26 Apr 2022

0

0

While downgrading Sri Lanka Insurance Corporation Limited’s (SLIC) Insurer Financial Strength (IFS) Rating to ‘CC’, Fitch Ratings has placed IFS ratings on seven non-life insurance firms on watch for possible downgrades driven by elevated investment and liquidity risks combined with impact of high inflationary environment on financials.

ComBank offers WhatsApp and Viber Banking services in Sinhala, Tamil and English

26 Apr 2022

0

0

The Commercial Bank of Ceylon, the first bank in Sri Lanka to enable Social Network Banking services, has announced that it has enabled trilingual access to both its WhatsApp Banking and Bank with ComBank on Viber services, another first in Sri Lanka.

Fonterra to proceed with sale process for Consumer businesses

26 Apr 2022

0

0

BOI signs US$ 12.16mn deal with Celogen Lanka

26 Apr 2022

0

0

Nissan to lay off thousands of workers as sales drop

26 Apr 2022

0

0

EU Ambassador meets new BOI Chief to discuss economic ties

26 Apr 2022

0

0

SLCERT warns WhatsApp users against sharing OTPs to prevent hacking

26 Apr 2022

0

0

NPP heading for clear parliamentary majority

26 Apr 2022

0

0