Reply To:

Name - Reply Comment

By First Capital Research

By First Capital Research

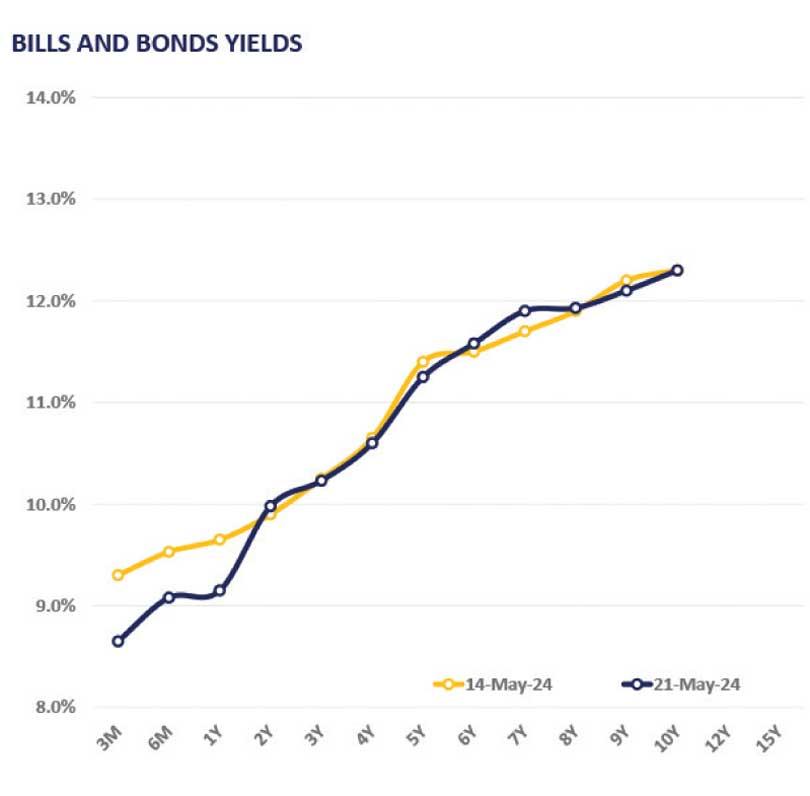

The secondary bond market witnessed a shift in momentum, with buying interest emerging across the short to mid tenors.

Investor interest was notably witnessed on liquid tenors, mainly, 2026 maturities, including 15.05.26, 01.06.26, 01.08.26, and 15.12.26, traded within the range of 10.20% to 10.00%, while 15.09.27 traded at 10.32%.

Additionally, 2028 maturities, such as 15.03.28, 01.05.28, 01.07.28, and 15.12.28, attracted buying sentiment, trading between 10.60% to 10.75%.

Mid-end maturities including 15.05.30 and 15.10.30 transacted between 11.65% to 11.60%, while the tail-end maturity of 01.10.32 traded lower between 11.90% to 11.85%.

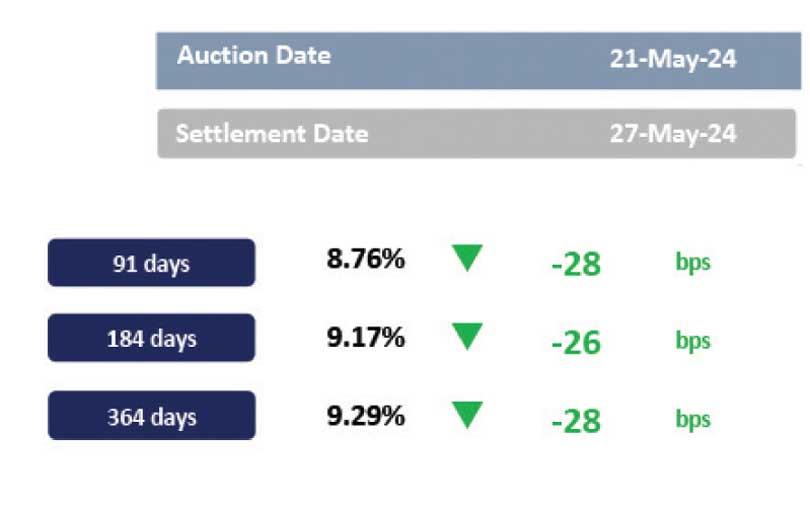

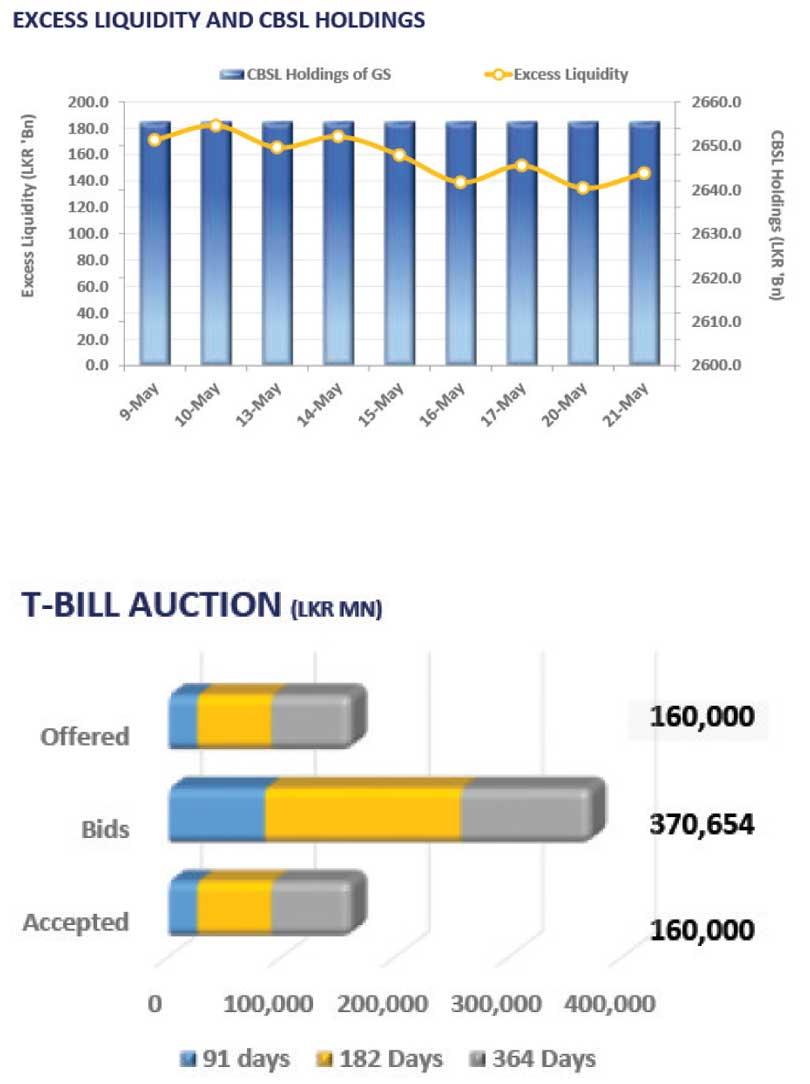

Moreover, at the Rs. 160.0bn T-Bill auction, total offerings were fully accepted, leading to a decline in the WAYR across all tenors.

Accordingly, 3M bill dropped below 9.00% and was accepted at 8.76% (-28bps), while the 6M and 1Yr T-Bills closed at 9.17% (-26bps) and 9.29% (-28bps), respectively. On the external side, LKR remained broadly stable against the greenback closing the day at Rs. 299.83/USD.