Reply To:

Name - Reply Comment

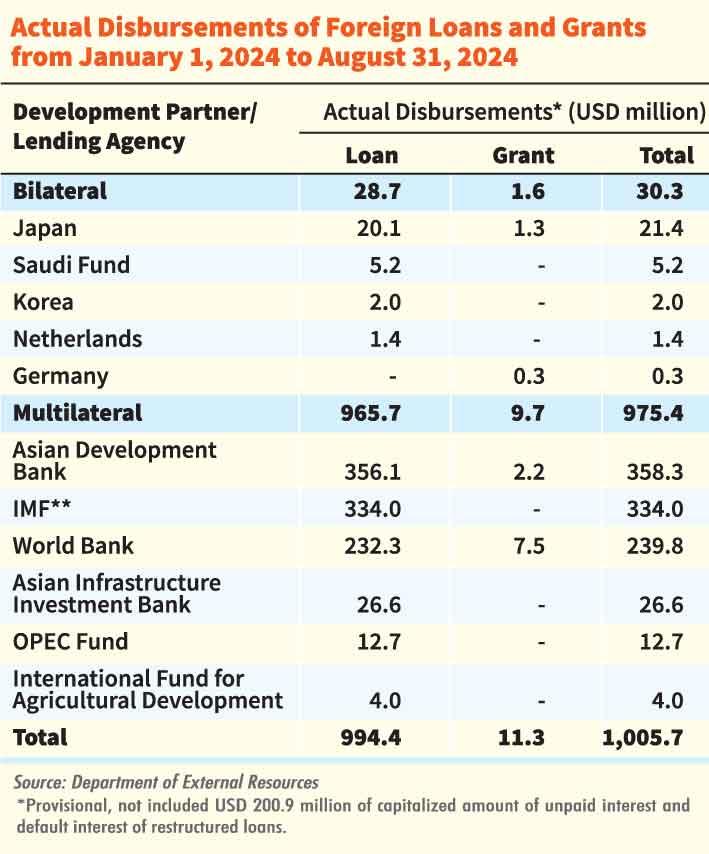

Japan and the Asian Development Bank (ADB) emerged as the largest bilateral and multilateral creditors to Sri Lanka during the first eight months of the year, according to the Finance Ministry.

During the eight-month period, the total foreign financing disbursements amounted to US $ 1,005.7 million, of which US $ 994.4 million was disbursed as loans and US $ 11.3 million was disbursed by way of grants.

The highest amount of the disbursements came from the ADB, which recorded 36 percent of the total disbursements, followed by the loan agreements signed with the International Monetary Fund (33 percent) and World Bank (24 percent).

Among the bilateral partners, the highest disbursement of US $ 21.4 million came from Japan, including a US $ 1.3 million grant; this was followed by the Saudi Fund, Korea, the Netherlands and Germany.

A major portion of the disbursements was utilised in the budget support sector, which accounted for 33 percent of the total disbursements, followed by the power and energy sector at 13 percent, the SME development sector at 10 percent and the finance sector at 7 percent.

At the end of August this year, the undisbursed balance of multilateral foreign financing, available from the already committed loans with the multilateral agencies that are to be utilised in the coming three to five years, stood at US $ 1,696 million.

“The undisbursed balance of foreign financing available for the already committed loans with the bilateral lenders have been affected due to the interim policy of temporary suspension of debt servicing,” the Finance Ministry noted.

Meanwhile, the government’s external debt stock stood at US $ 38.1 billion at the end of August this year, with US $ 5,784 million in principal amount and US $ 2,623 million accumulating in the period as unpaid debt service, owed to the bilateral and commercial creditors.

The government serviced US $ 676.4 million in debt payments, of which US $ 350.6 million was in lieu of principal repayments and the balance US $ 325.8 million for the interest payments in the eight-month period. (NF)