Reply To:

Name - Reply Comment

By First Capital Research

By First Capital Research

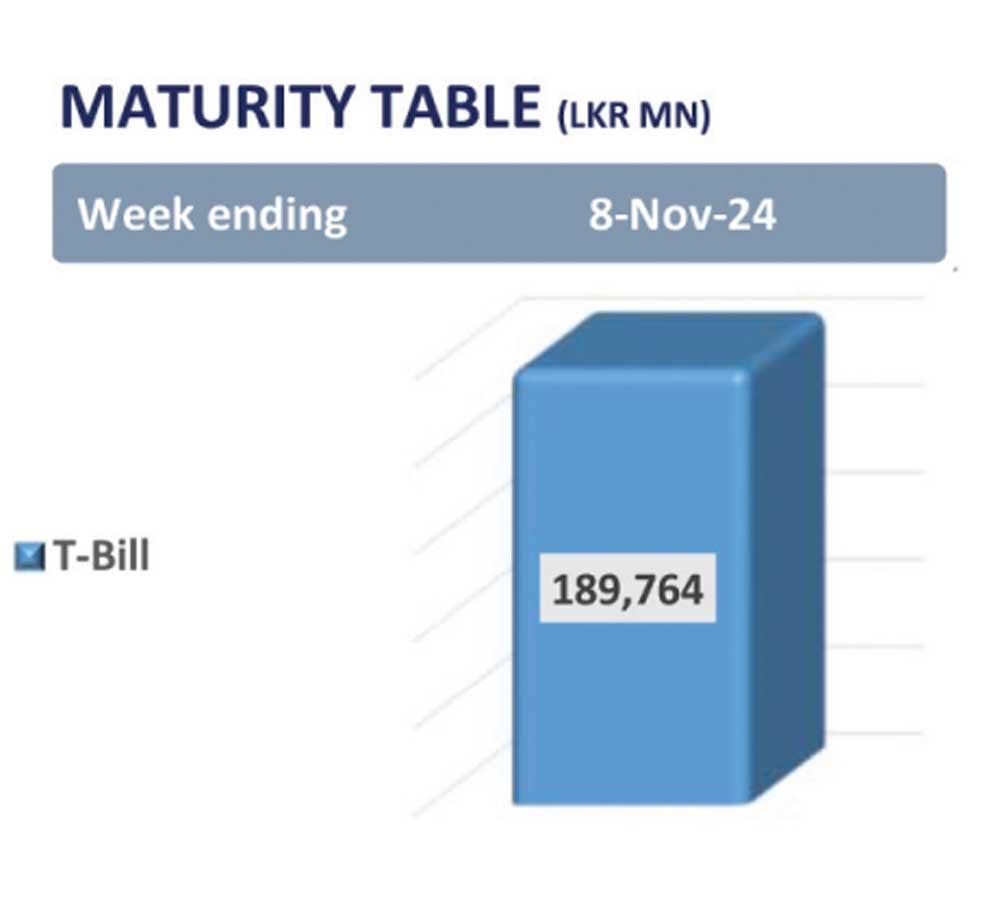

At the Rs. 145.0bn weekly T-Bill auction held yesterday, the CBSL fully subscribed to the entire offered amount.

The 3M T-Bill received the highest demand, leading to an oversubscription, while CBSL accepted Rs. 53.2bn of 6M T-Bill. In contrast, the 1Y T-Bill saw minimal interest, with only Rs. 2.7bn accepted.

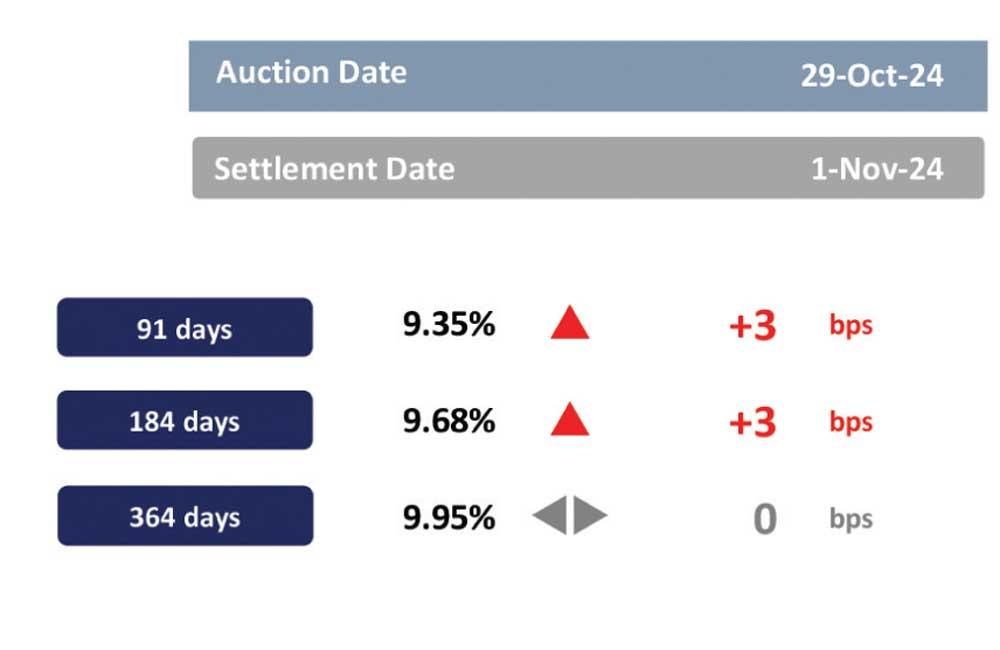

Meanwhile, weighted average yields edged higher after five weeks, with the 3M and 6M T-Bills closing at 9.35% (+3bps) and 9.68% (+3bps) respectively. However, the WAYR on the 1Yr T-Bill remained steady at 9.95%.

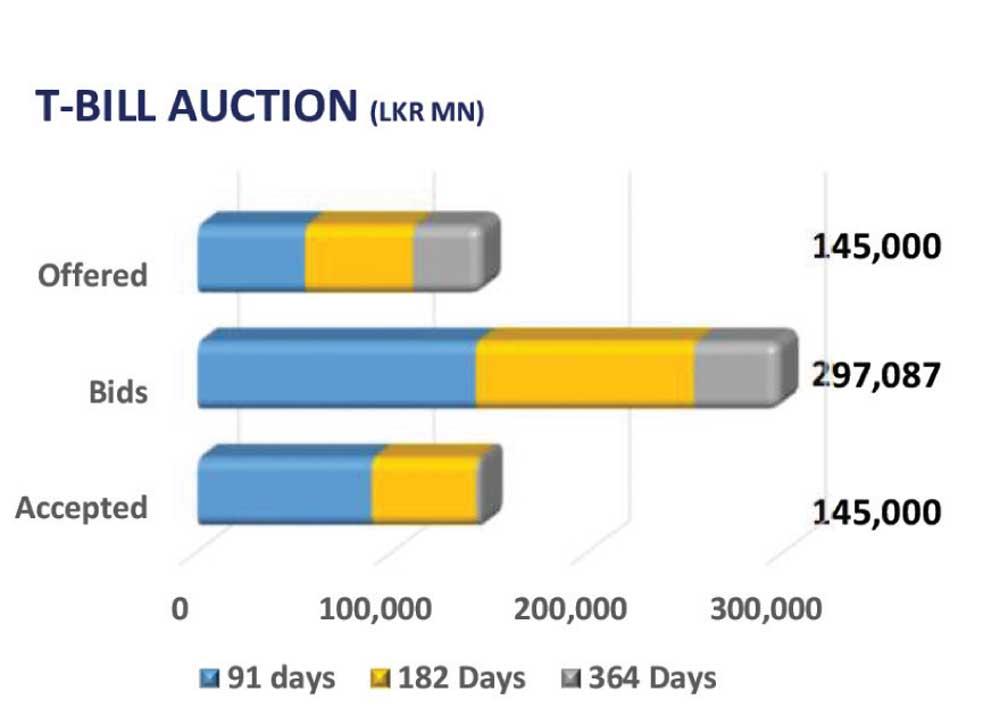

Meanwhile, in the secondary market, bond yields remained relatively stable amid limited investor activities and thin trading volumes. Amid mixed sentiment, mid-tenor bonds maturing on 01.07.28 and 15.12.28 traded at 11.80% and 11.95%, respectively.

On the longer end, bonds maturing on 15.09.29 and 15.05.30 changed hands at 12.00% and 12.20%, respectively.

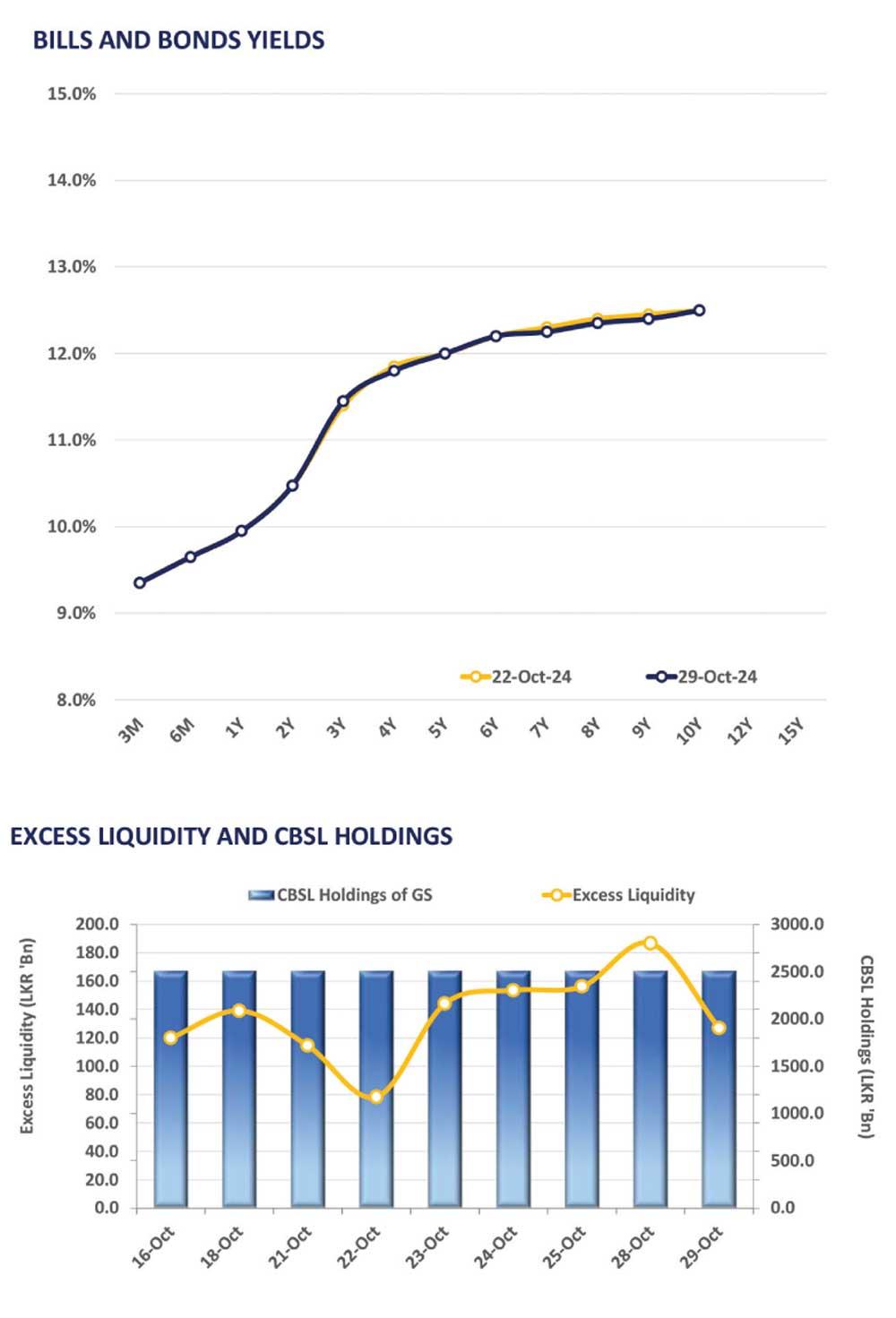

On the external side, the LKR slightly appreciated against the greenback closing at Rs. 293.5. Meanwhile, overnight liquidity recorded at Rs. 126.9bn while CBSL Holdings remained unchanged at Rs. 2,515.6bn.