Reply To:

Name - Reply Comment

By First Capital Research

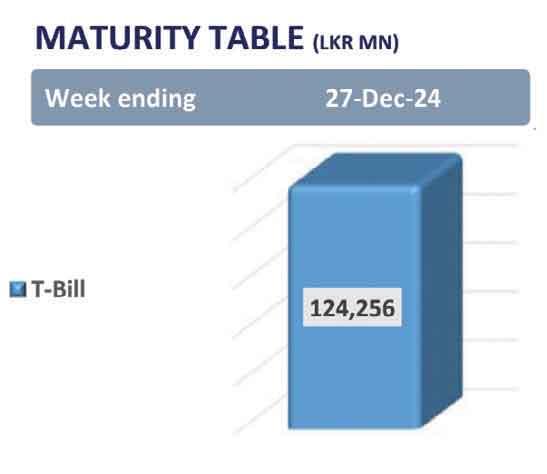

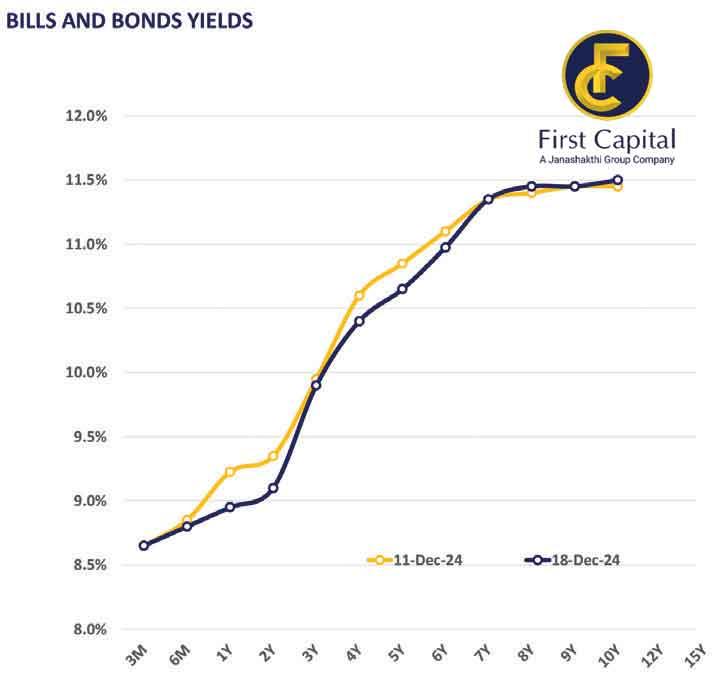

The Central Bank of Sri Lanka conducted its weekly T-bill auction yesterday, successfully raising Rs.185.0 billion, with the total offered amount being fully accepted across all maturities. The six-month bill attracted the most interest, while the weighted average yield rates declined across the board for the second consecutive week. The three-month bill closed at 8.66 percent (-03bps), the six-month bill at 8.81 percent (-07bps) and the one-year bill at 9.02 percent (-05bps).

In the secondary market, buying appetite persisted, predominantly focused on the 2028 bond maturities. The 15.01.2028 bond closed at 10.05 percent, while the 15.02.2028 and 15.03.2028 maturities traded at 10.10 percent. Meanwhile, the 01.05.2028 and 01.07.2028 bonds registered at 10.15 percent and 10.25 percent, respectively. The other notable trades included the 15.09.2029 bond, which closed at 10.65 percent, while the 01.12.2031 and 01.07.2032 maturities registered at 11.35 percent and 11.48 percent, respectively.

On the external front, the Sri Lankan rupee continued its depreciation against the US dollar for the third consecutive session, closing at Rs.290.94/US dollar. Meanwhile, the rupee exhibited a mixed performance against the other major currencies, weakening against the GBP and JPY while strengthening against the EUR and AUD. Meanwhile, the overnight liquidity improved at yesterday’s session to Rs.187.85 billion while the Central Bank holdings continued to remain stagnant at Rs.2,515.62 billion.