Reply To:

Name - Reply Comment

By First Capital Research

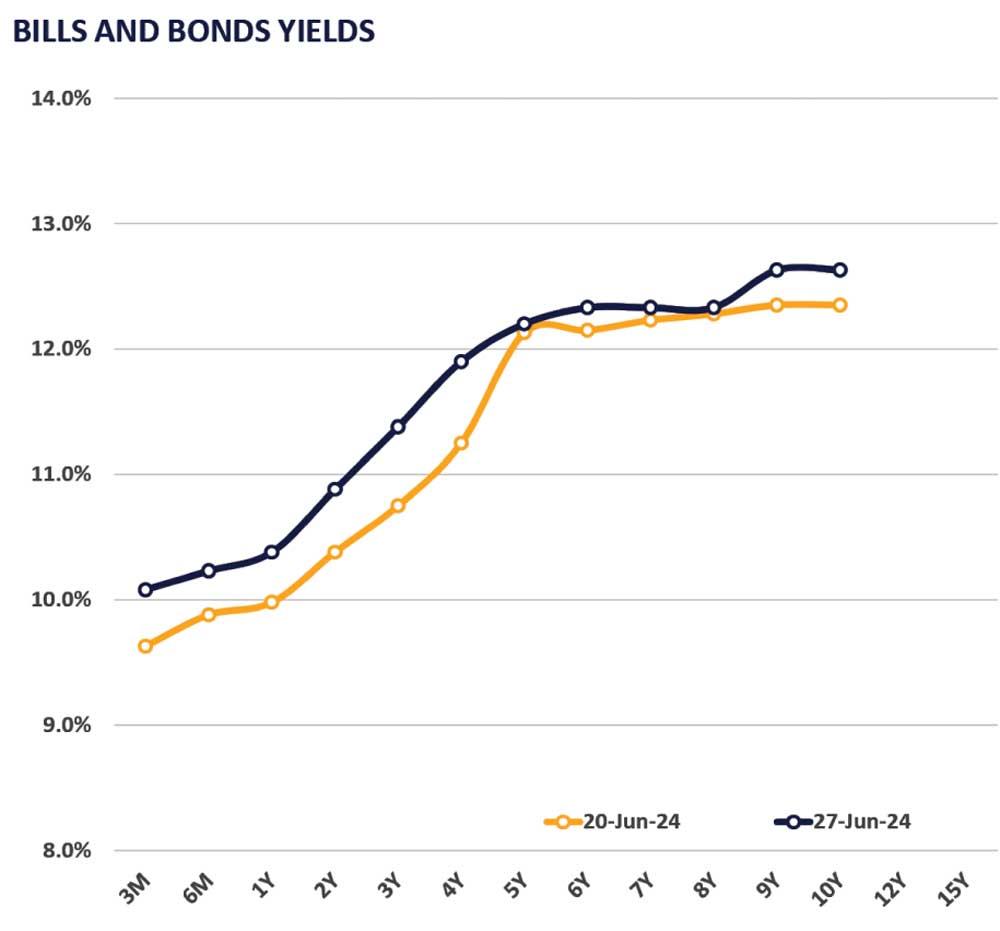

Despite Sri Lanka’s announcement of a final restructuring agreement for USD 10.0 bn of debt with China and bilateral creditors’ Official Creditors Committee in Paris, the secondary bond market saw a further upward shift in the yield curve amidst low trading volumes.

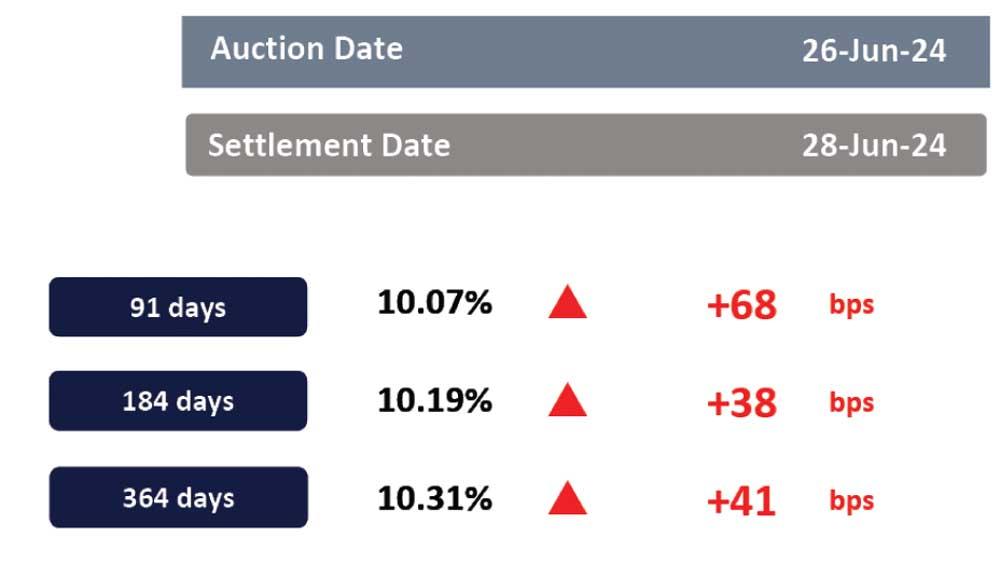

Investor caution persisted due to elevated yields observed at today’s T-bond auction, further backed by ongoing market sentiment uncertainty. In the midst of limited trading activity, short-term bonds maturing on 01.08.26 and 15.12.26 traded at 11.00%.

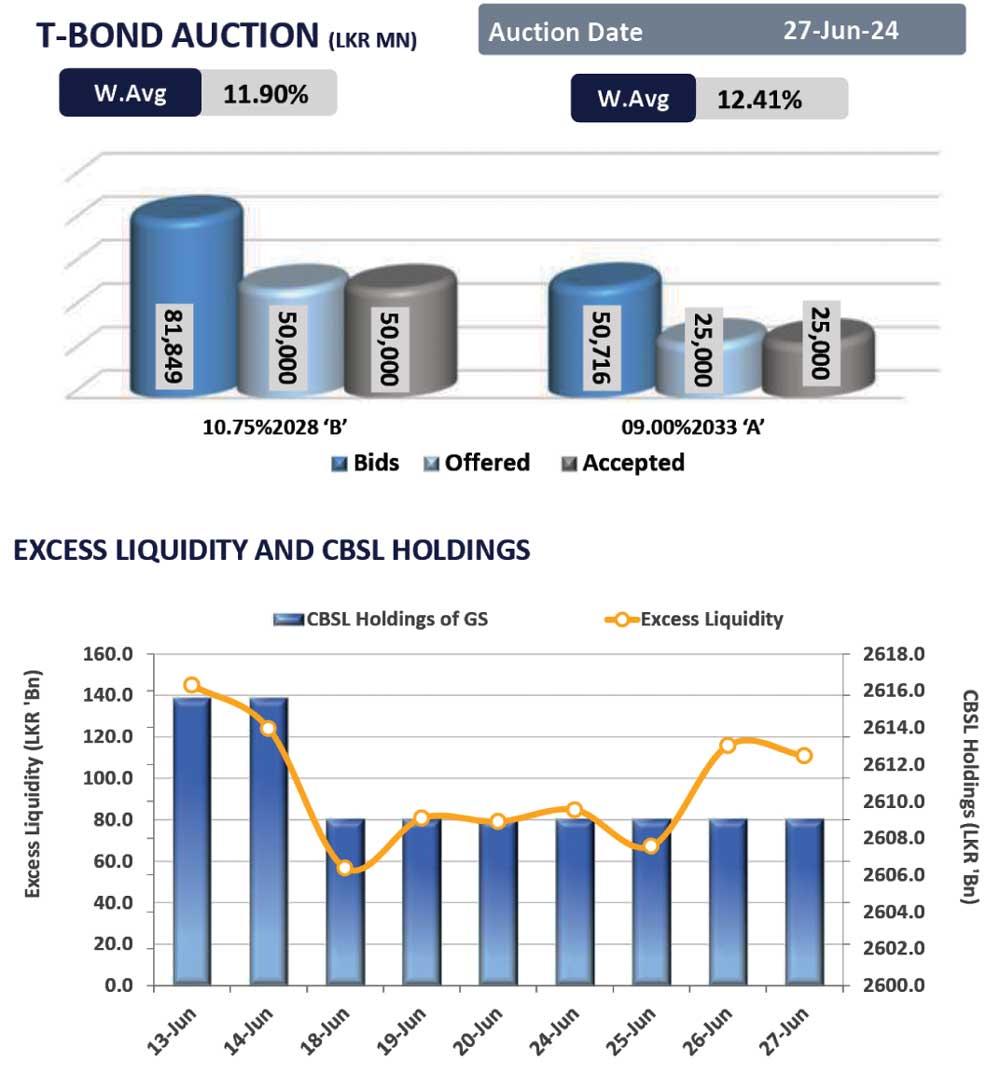

Meanwhile, at the Rs. 75.0bn bond auction, weighted average yields surged across the maturities. Notably, the 15.02.28 maturity was accepted at 11.90%, and the 01.06.33 maturity at 12.41%, with the total offered amount fully subscribed.

In response to the auction results, investors remained cautious, leading the rates to edge high in the secondary market. Accordingly, mid-term maturity 15.09.29 traded slightly higher at 12.20%. On the external front, the LKR slightly appreciated against the USD, closing at Rs. 305.3/USD.

Moreover, overnight liquidity for the day witnessed a slight decline and recorded at Rs. 110.8bn while CBSL holdings remained steady at Rs. 2,609.1bn.