Reply To:

Name - Reply Comment

By First Capital Research

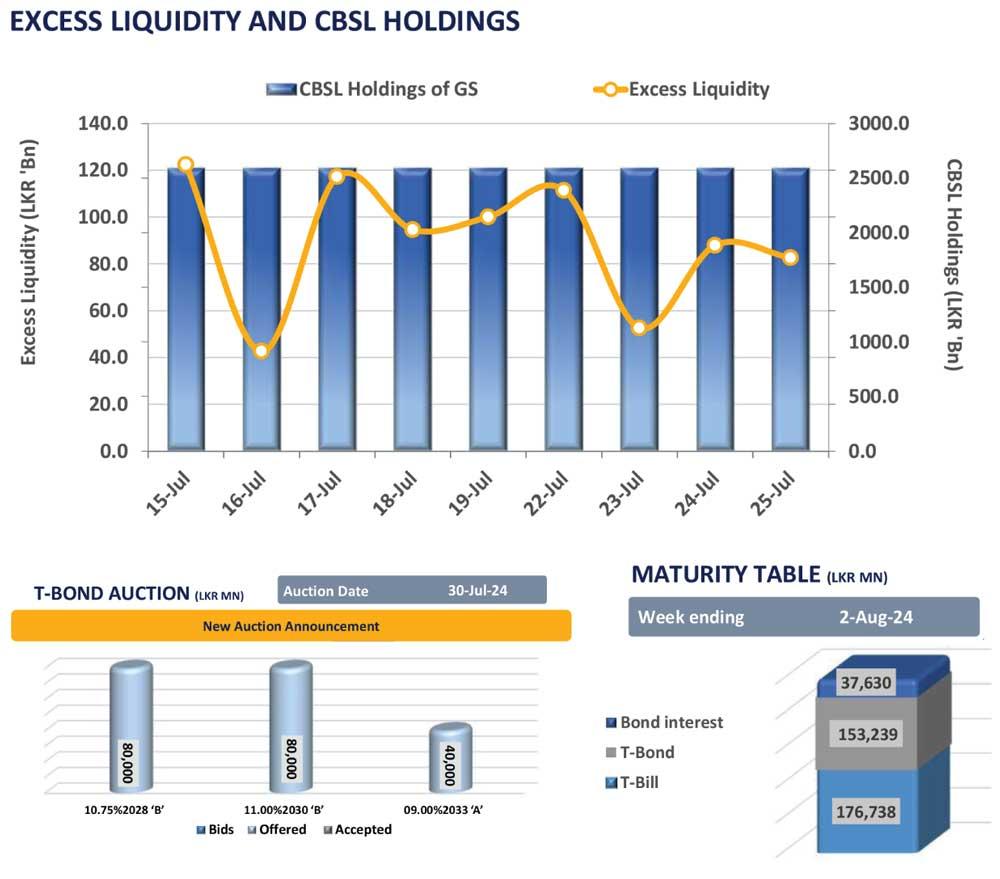

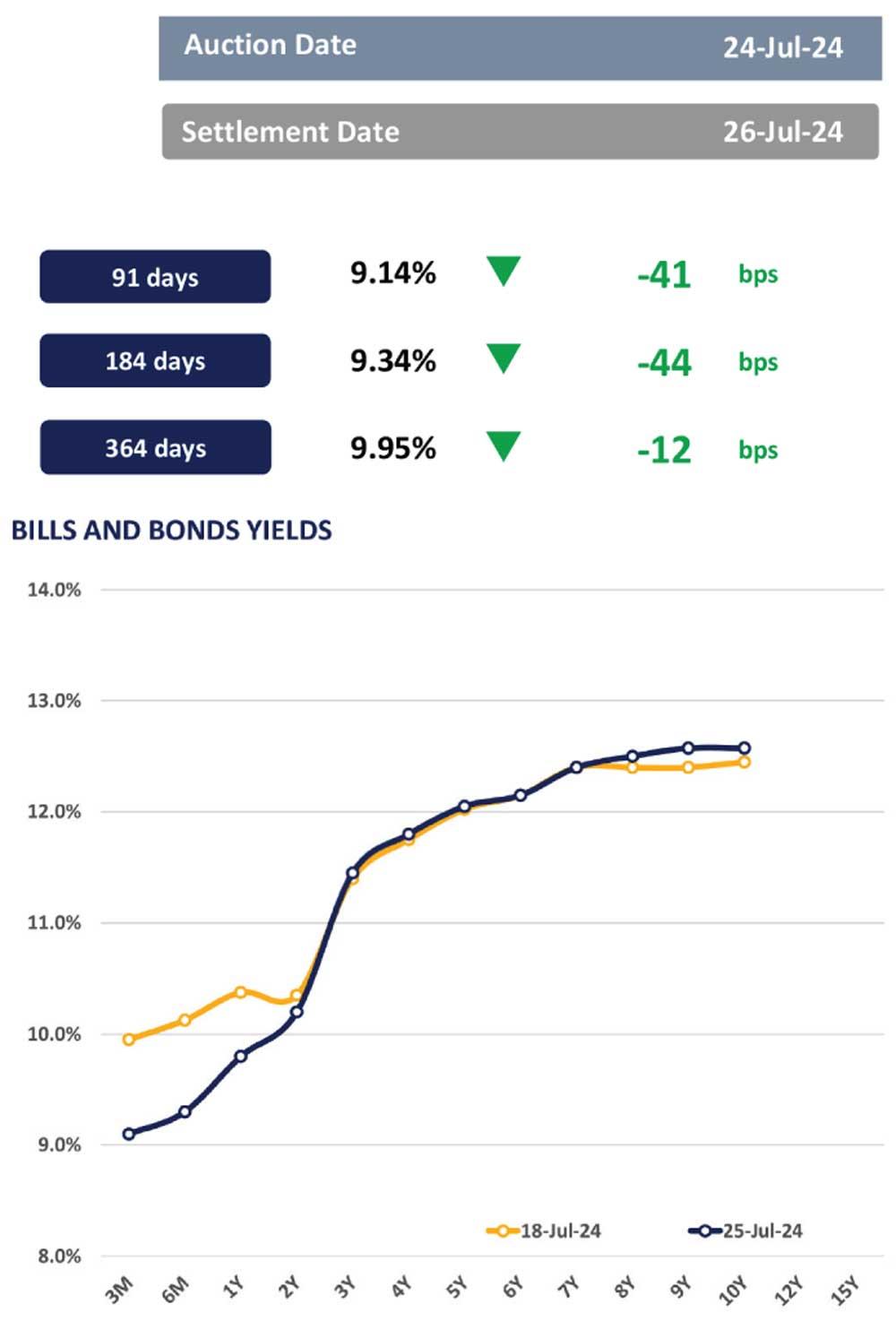

The secondary market yield curve remained broadly stable while market activities were at a complete standstill yesterday. Investors remained cautious ahead of the Treasury bond auction scheduled for 30th Jul 2024.

Limited trades were observed during the day, with the 01.06.26 maturity trading at 10.20% and ultra-thin volumes noted on the 15.05.30 maturity at 12.20%.

Moreover, the Central Bank of Sri Lanka (CBSL) announced the issuance of Rs. 200.0bn worth of T-Bonds through an auction scheduled for 30th Jul 2024.

This issuance includes Rs. 80.0bn, Rs. 80.0Bn, and Rs. 40.0bn to be issued under the maturities of 15.02.28, 15.10.30, and 01.06.33, respectively.

Meanwhile, the overnight liquidity for the day was recorded at Rs. 82.6bn, whilst CBSL holdings remained steady at Rs. 2,595.6bn.

In the forex market, LKR depreciated against the USD yesterday and settled at Rs. 303.6. This movement mirrored broader trends as the LKR also depreciated against other major currencies such as the AUD, GBP, and EUR.

However, on a YTD basis, the LKR has appreciated against the USD by 6.3%, reflecting a strong overall performance despite recent fluctuations.