Reply To:

Name - Reply Comment

The construction sector continued to make strides, further accelerating its speed as the projects, both which had to be halted and new, are becoming increasingly available, especially with the availability of the funding from the multilateral agencies.

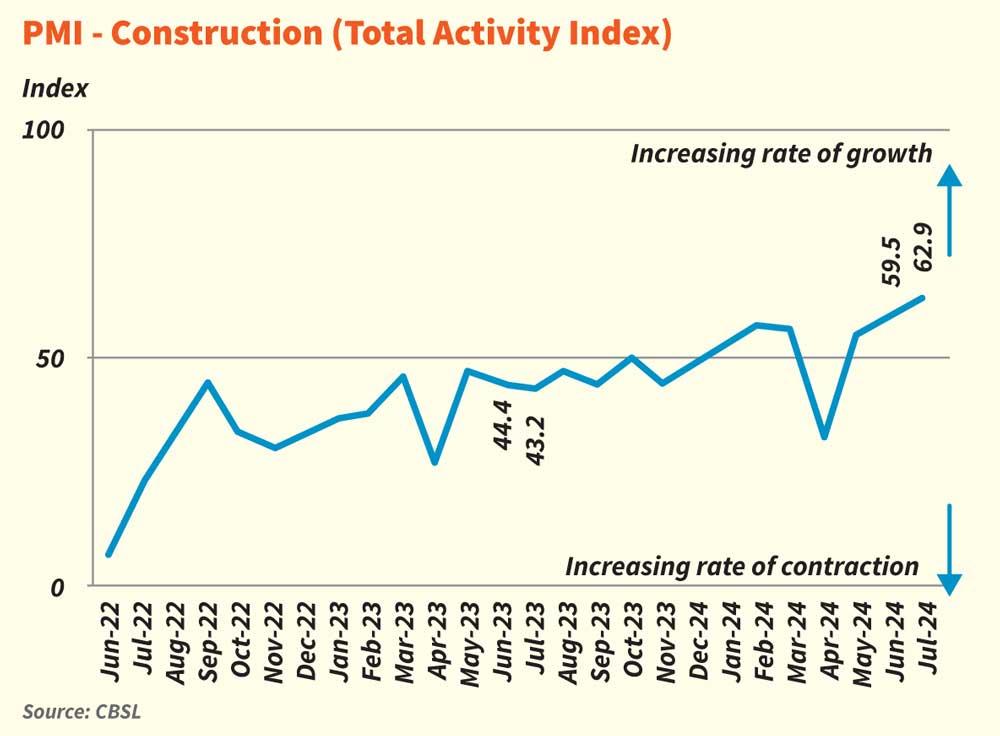

According to Purchasing Managers’ Index (PMI) for July, the sector has recorded an index value 62.9, rising further from an already high of 59.5 index points in June.

The index value was the highest in 30 months in June and July’s higher value signalled that the sector is adding more fire power after the country turned around more quickly than anybody expected from the foreign currency shortage in 2022.

But the policies thereafter prolonged, deepened and made it more painful for both the construction sector and for the whole economy as people and businesses are still grappling with higher prices in both 2022 and 2023, although the official inflation has been largely tamed.

In PMI, an activity is separated between an expansion and a contraction at an index value of 50.0.

The construction has been on an expansion since the final months of last year, accelerating its expansion in the most recent months with the exception of April which took a temporary dip due to extended holidays and closed building sites.

The respondents have continued to cite the increase in the construction work, led especially by the projects funded by the multilateral agencies.

The new orders sub-index which is the closest proxy for the new projects, have expanded reflecting continuously high availability of projects.

The employment sub-index meanwhile contracted, although at a slower pace than was in June, signalling that the sector is re-hiring people at a measured pace.

Several construction sector respondents cited the short supply of bitumen, a key input for constriction work.

Further, the construction sector has continued to see its material costs easing. The declining interest rates could further add a tailwind to the sector which had been in decline for roughly two years.

Meanwhile, the sentiments of the sector continued to remain upbeat for the next three months, especially due to the increased availability of workers.