Reply To:

Name - Reply Comment

The recent economic crisis has highlighted the need to address weaknesses in Sri Lanka’s economic policies forlong-term structural change. One significant issue is the financial burden of public sector pensions. The Public Services Pensions (PSP) is the largest pension scheme for permanent public sector employees in Sri Lanka.

The recent economic crisis has highlighted the need to address weaknesses in Sri Lanka’s economic policies forlong-term structural change. One significant issue is the financial burden of public sector pensions. The Public Services Pensions (PSP) is the largest pension scheme for permanent public sector employees in Sri Lanka.

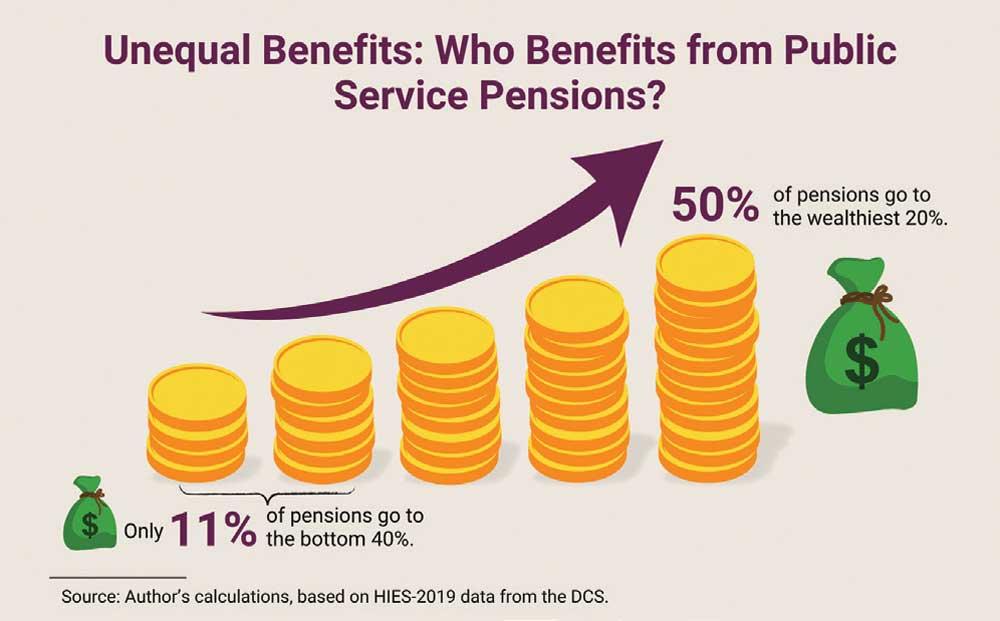

However, its non-contributory nature has become a critical burden on the country, wherein pension benefits are funded directly from government revenue, supported by general taxation.With around 700,000 public sector pensioners, this system places a significant financial burden on the government. On top of that, an IPS analysis reveals that public service pensions are not a progressive welfare programme, with half of the pension benefitting the top 20 percent income bracket. Such obligations further exacerbate inefficient fiscal policies, constraining resources available for crucial areas like health and education services. This blog aims to provide a comprehensive overview of the current challenges and potential solutions for easing the pension burden in Sri Lanka.

Understanding the Current Pension Burden

As of 2023, the total PSP payments amounted to Rs. 372.3 billion, which accounted for 7.9 percent of the government’s recurrent expenditure and 12.1 percent of its revenue. Withover 1.35 million public sector employees, the financial demands are increasing, particularly for new pensioners who receive higher payments than existing and deceased pensioners.

For example, the total pension payments have increased by 20.5 percent in 2023 mainly due to the net increase in the number of pensioners by 4.2 percent. This situation is unsustainable, particularly in light ofthe country’s constrained fiscal capacities.

Who benefits from the Pensions?

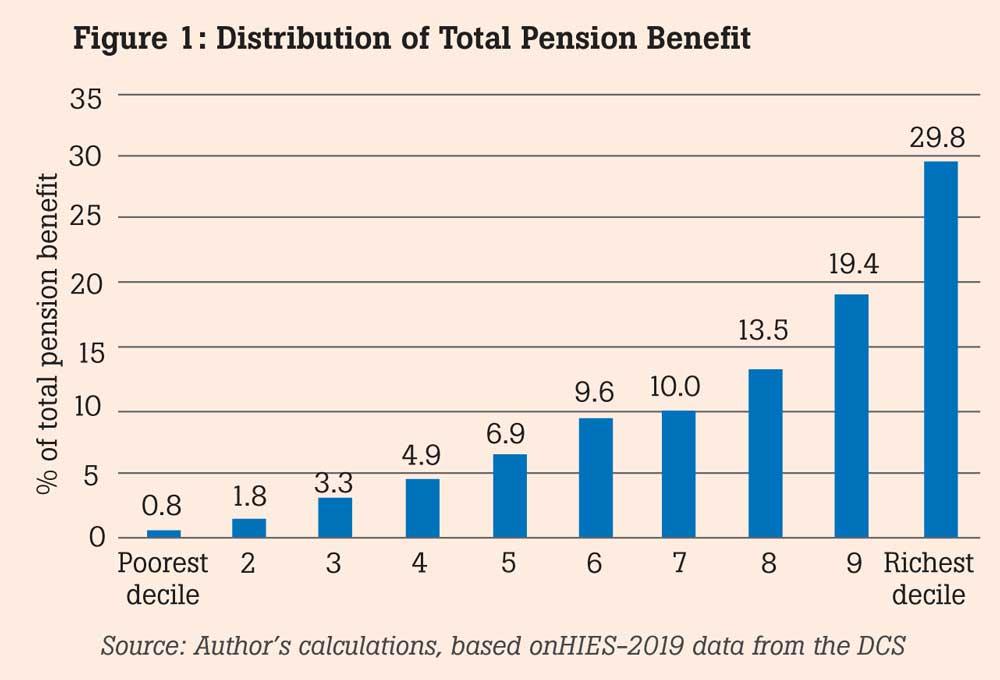

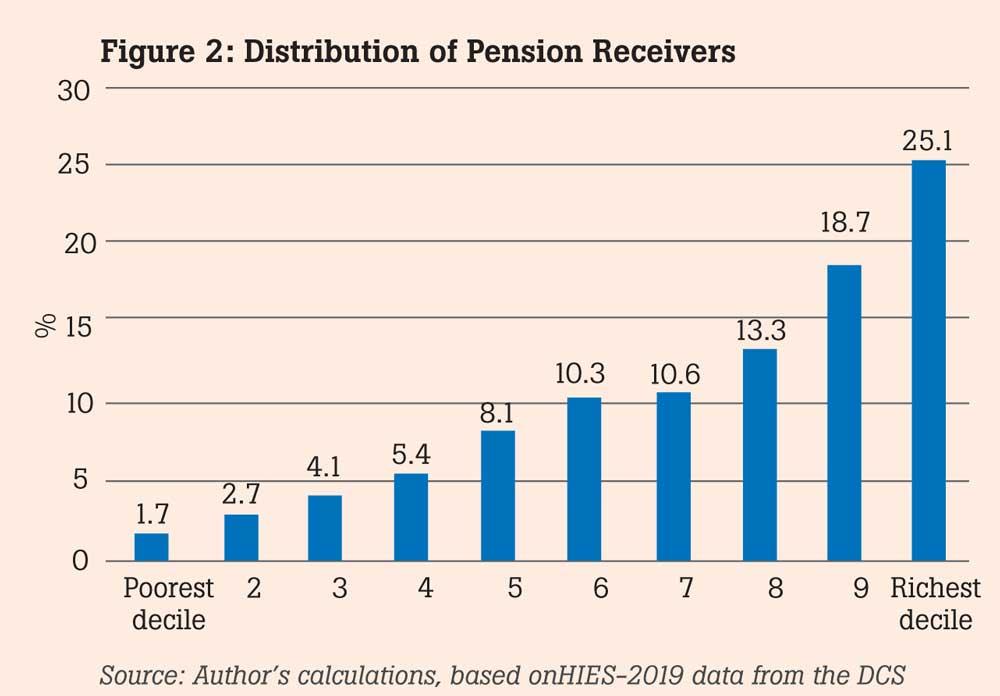

The better-off people enjoy the lion’s share of the PSP benefits. Employing a framework developed by the Commitment to Equity (CEQ), the distributional analysis shows that around 50 percent of PSP benefits go to individuals in the top 20 percent income bracket, while only 11 percent of the benefits reach the bottom 40 percent (Figure 1). This is mainly because PSP beneficiaries are from the better-off segment – around 44 percent of PSP receivers belong to the wealthiest 20 percent of the population (Figure 2). This analysis clearly shows that PSP is not a pro-poor spending programme.

Furthermore, public service sector workers represent 15 percent of the employed population and benefit from secure, stable incomes throughout their careers, unlike the 67 percent of Sri Lankans in informal, unstable employment. This raises the question: Shouldthe governmentshoulder the social security of the most stable public sector employees?

Proposed National Contributory Pension Fund for easing Pension Burden

To address these challenges, the government has initiatedthe establishment of a Contributory Pension Fund to ensure an appropriate environment in which to spend pensioners’ retirement without burdening the country’s budget.The proposed fund would require contributions from employees and the government, creating a more sustainable financial structure for pension payments. Specifically, it is proposed that 8 percent of the employee’s basic salary and 12 percent from the governmentbe credited to this fund. The proposed national contributory pension scheme would apply to individuals newly recruited to the government service.

Way Forward: The Role of Policy and Legislation

Addressing the PSP burden in Sri Lanka requires a multifaceted approach that includes structural reforms and a shift towards a contributory pension system. By implementing these changes, Sri Lanka can create a more sustainable and equitable retirement system that balances the needs of both current and future generations.

Establishing a National Contributory Pension Fund: Effective implementation of the proposed Contributory Pension Fund requires strong policy and legislative support. Although acontributory pension scheme was implemented in 2003 to strengthen the state finances, it was revoked in 2006.The government must enact laws that mandate contributions and regulate pension fund management. Regular reviews and adjustments to the pension system should be conducted to adapt to changing demographic and economic conditions.

Gradual transition to contributory scheme: Implementing a gradual transition from the current non-contributory system to a contributory scheme can help mitigate immediate financial constraints while setting the stage for long-term sustainability. New public sector employees could be enrolled in the contributory scheme, while existing employees might have the option to switch voluntarily, with appropriate incentives.

Enhancing pension fund management: Efficient management of pension funds is crucial for ensuring their sustainability. This includes adopting best investment management practices to ensure the funds generate adequate returns. Transparent and accountable governance structures should be established to oversee the management of these funds.

This article is drawn from an analysis of ‘Progressivity and Pro-poorness of Taxes and Welfare Spending’ in the forthcoming Sri Lanka: State of the Economy 2024 report published by the IPS.

(The writer is a Research Economist at IPS with research interests in skills and education, demographics, health,and labour markets. Priyanka has around 15 years of research experience at IPS. She has worked as a consultant to international organisations including World Bank, ADB and UNICEF. She holds a BSc (Hons) specialised in Statistics and an MA in Economics, both from the University of Colombo. (Talk with Priyanka - [email protected])