Reply To:

Name - Reply Comment

By First Capital Research

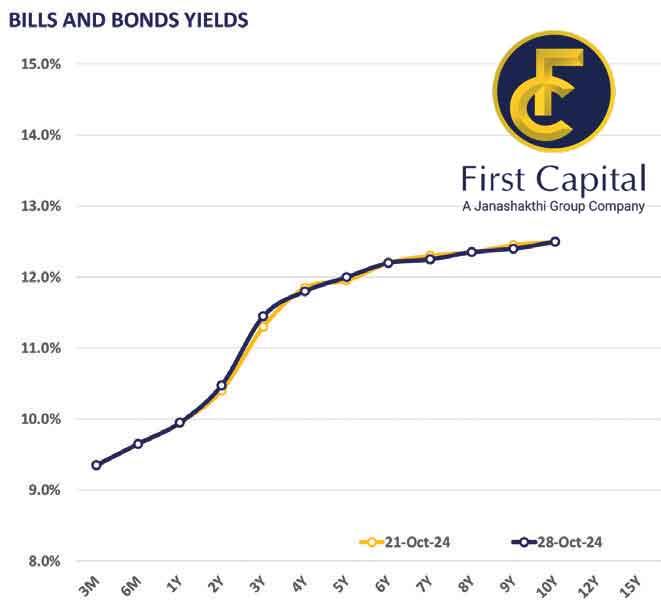

The secondary market experienced a notable reversal in investor sentiment as modest buying interest emerged after a week of sustained selling pressure. This uptick in buying appetite, albeit on low volumes, was particularly evident in mid-tenure bonds, 2028 and 2029, following yesterday’s bond auction. Specifically, trading activity was observed in the 2028 tenure, with bonds such as 15.02.2028 and 15.03.2028 closing transactions between 11.76 percent to 11.70 percent. The other maturities, including 01.05.2028 and 01.07.2028, hovered around 11.85 percent to 11.80 percent, while 15.12.2028 registered trades between 11.95 percent to 11.90 percent. On the 2029 bonds, both 15.06.2029 and 15.09.2029 closed trades at 12.00 percent.

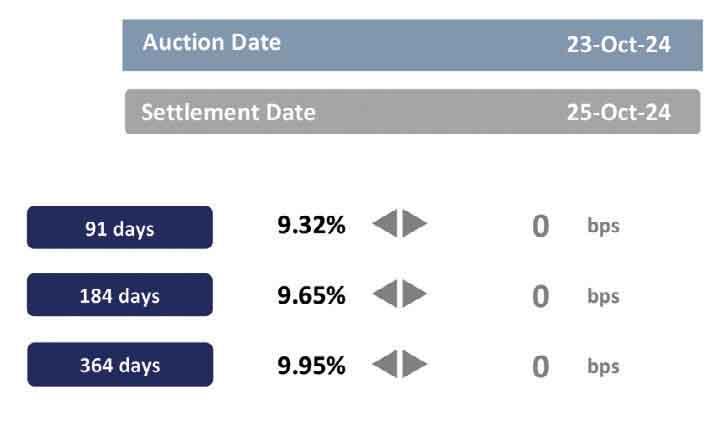

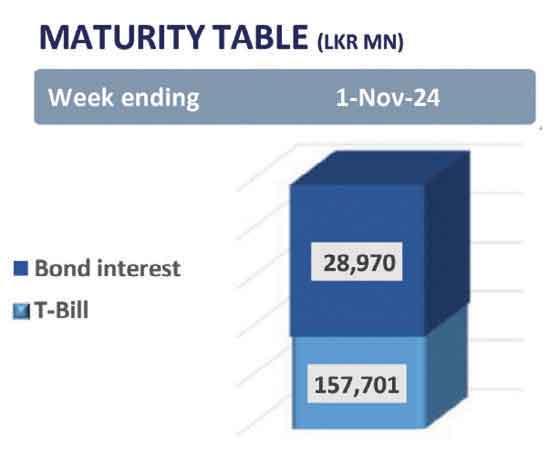

Additionally, yesterday’s treasury bond auction raised Rs.32.5 billion, yielding full acceptance in both maturities offered. The 15.10.2028 bond closed with a weighted average yield rate of 11.84 percent, while the 01.06.2033 bond saw a slightly higher rate of 12.36 percent. Meanwhile, the Central Bank aims to raise Rs.145.0 billion in today’s weekly treasury bill auction.

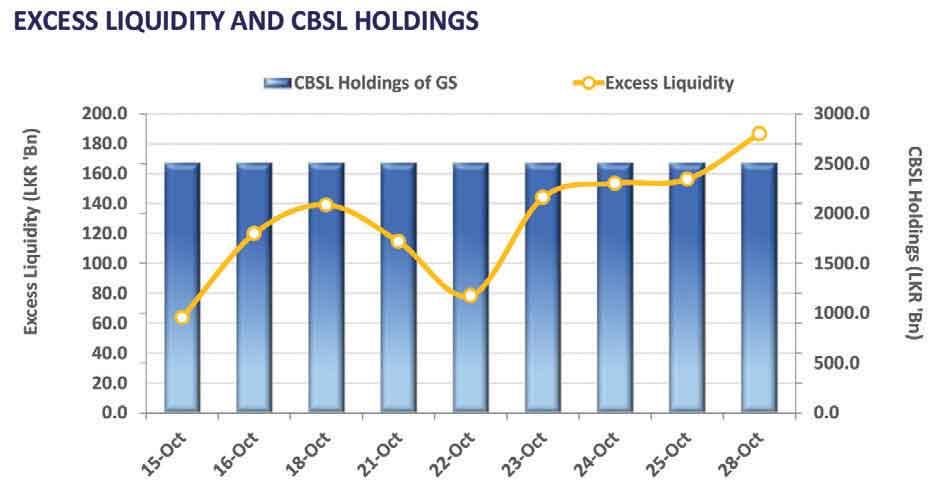

On the external side, the Sri Lankan rupee remained broadly stable against the US dollar, closing at Rs.293.7/US dollar compared to the previous day’s closing. Moreover, overnight liquidity improved to Rs.186.62 billion while the Central Bank holdings remained stagnant at Rs.2,515.62 billion.