Reply To:

Name - Reply Comment

By First Capital Research

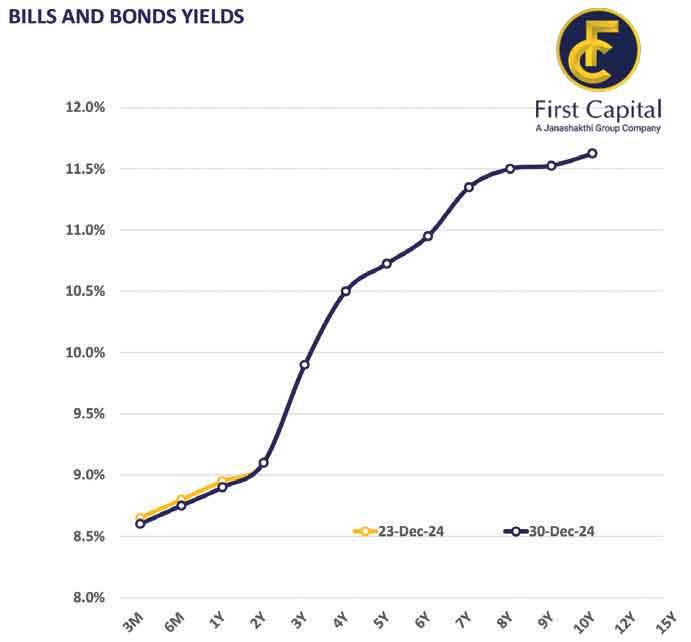

The secondary market experienced a lethargic trading session towards the year end as the secondary market yield curve remained broadly unchanged.

The trades were limited to the 15.10.28 maturity, which traded at 10.45 percent prior to the T-bond auction results. Meanwhile, the Central Bank conducted a T-bond auction worth Rs.80.0 billion, where the bids exceeded the total offered amount by 2.8 times and the full offered amount was accepted by the Central Bank. Furthermore, the weighted average yield rates stood at 10.42 percent and 11.47 percent for the 15.10.28 and 01.06.33 maturities, respectively. On the external front, the Sri Lankan rupee appreciated against the US dollar, closing at Rs.292.75/US dollar, compared to Rs.294.33/US dollar recorded the previous day.

Additionally, the Sri Lankan rupee also appreciated against other major currencies such as the GBP, EUR, AUD, CNY and JPY. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday. Overnight liquidity in the banking system declined to Rs.158.37 billion, from Rs.173.27 billion recorded the previous day.