Reply To:

Name - Reply Comment

By First Capital Research

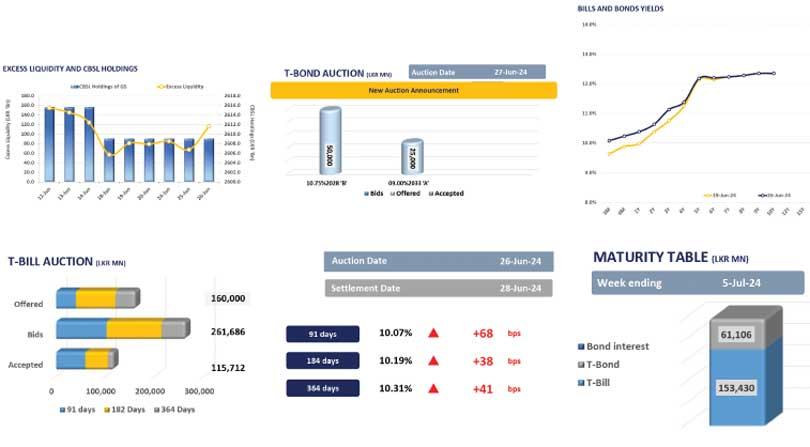

The secondary market further continued its lacklustre sentiment from the previous sessions yesterday as investors further sought clarity on the market sentiment, backed by the Rs. 75.0bn T-Bond auction that is scheduled for today 27th June. Limited trades and low investor interaction was witnessed during the day whilst 15.10.27 traded at 11.03% prior to the T-Bill auction which was held yesterday.

Meanwhile, CBSL held its weekly T-Bill auction yesterday where only Rs. 115.7bn was accepted from the Rs. 160.0bn offered. Notably, weighted average yield rates (WAYR) at the auction surged higher for the 4th consecutive week.

Accordingly, 91- day maturity witnessed higher acceptance during the auction recording a WAYR of 10.07% (+68bps), whilst both 182 -day and 364 -day maturities recorded lower acceptance recording WAYR of 10.19% (+38bps) and 10.31% (+41bps) respectively. Furthermore, post T-Bill auction liquid tenor 15.09.29 traded at 12.15%.

Overnight liquidity improved to Rs. 155.8bn whilst CBSL holdings remained stagnant at Rs. 2,609.1bn.

On the external side LKR slightly depreciated against the USD recording at Rs. 305.4 compared to Tuesday’s closing.