Reply To:

Name - Reply Comment

By Nishel Fernando

Corporate earnings of Sri Lanka’s public quoted companies more than doubled indicating a strong performance in the second quarter of 2024/2025 FY facilitated by a notable growth in the top-line and steep reduction in finance costs, according to CAL Research.

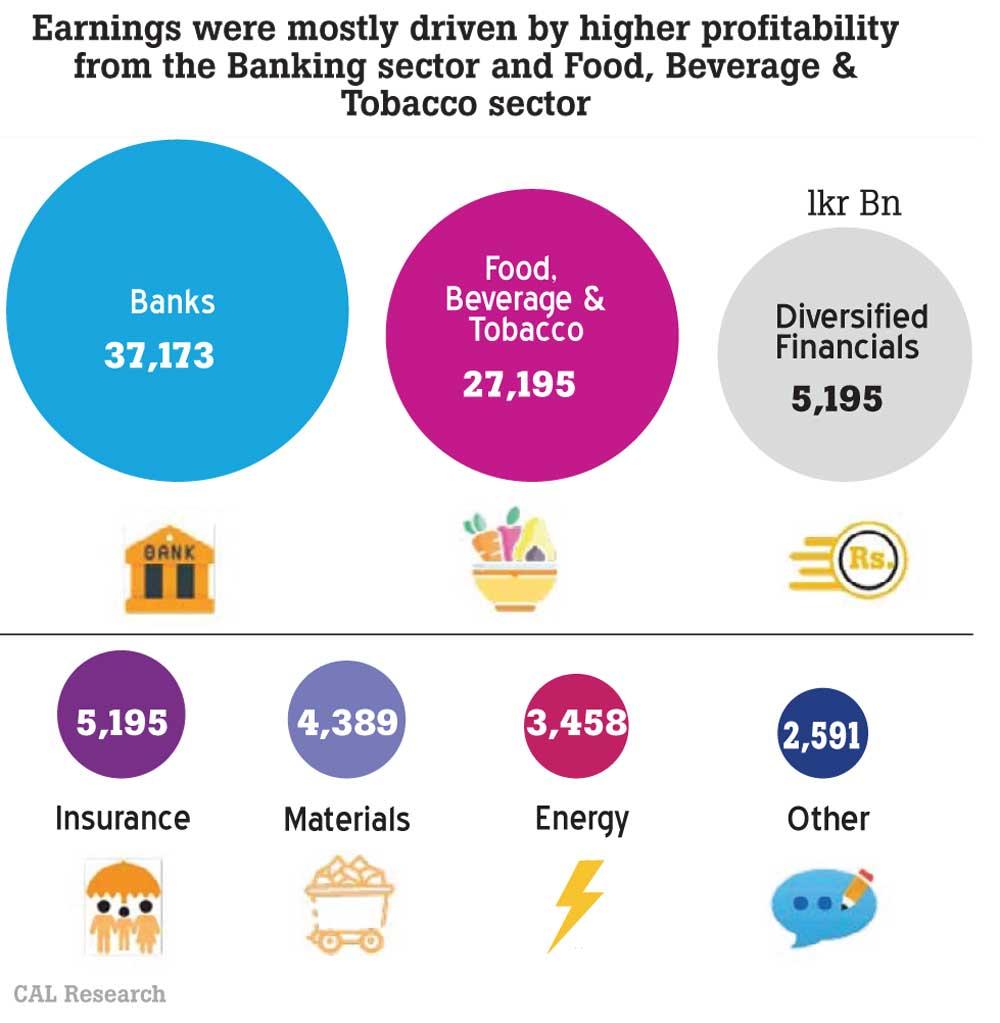

“Earnings were mostly driven by higher profitability from the Banking sector and Food, Beverage & Tobacco sector,” CAL said.

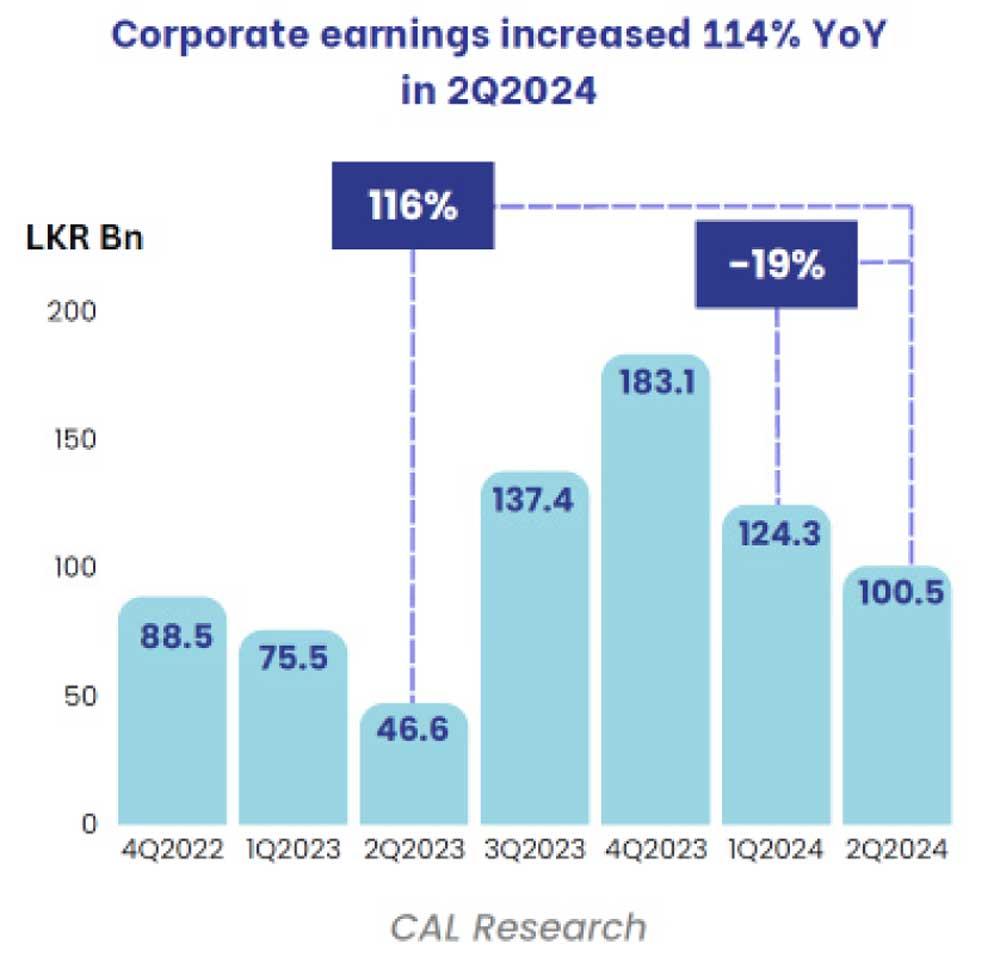

Corporate earnings grew by 116 percent YoY to Rs.100.5 billion. However, corporate earnings were down by 19 percent on a quarter-on-quarter basis and fell to the lowest level seen since 2Q2023.

Banks led the earnings chart reporting a 86 percent increase in profitability for the sector primarily due to lower impairments, followed by Food, Beverage & Tobacco, and Diversified Financials.

Meanwhile, revenue of the listed entities rose by 44 percent YoY to Rs. 1.98 trillion for 2Q2024 with the highest top-line contribution coming from the Banking sector.

According to CAL, the net finance costs across the listed corporates declined by 38 percent YoY in the quarter (excluding banking, insurance and financial service sector companies).

Hatton National Bank, Sampath Bank, Commercial Bank, Ceylon Tobacco Company , and LOLC Holdings were top five gainers, whereas Dialog, Hela Apparel, Softlogic Holdings Limited, Brown and Company, and Browns Investment where top five losers.

Despite strong earnings, CAL noted that equity market remains bearish, with a notable decline in the Banking sector index.

“The ASPI shows its steepest pre-election down trend in 20 years, with low market turnover,” it added.

In particular, it shared concerns on possible delays in completing the debt restructuring process with no updates on private bondholders front for two months, likely pushing finalisation to post election.

“Delays could mean renegotiations on the repayment structure and a postponed of IMF review and tranche release,” it said.