Reply To:

Name - Reply Comment

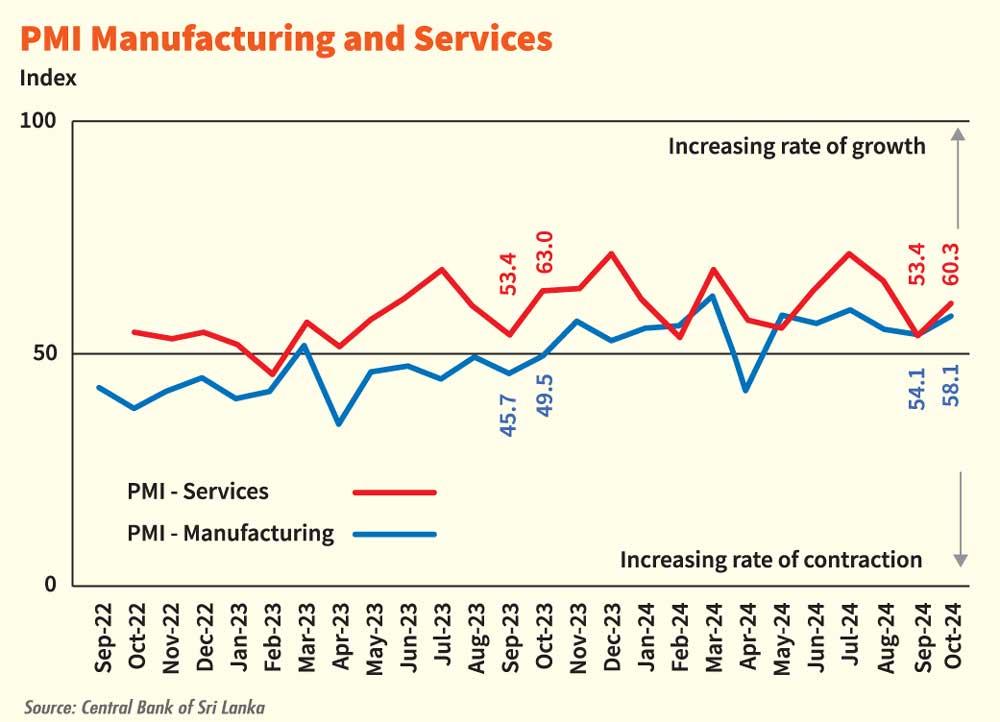

Sri Lanka’s Purchasing Managers’ Index (PMI) for October saw continued expansion in the activities in both manufacturing and services sectors at an accelerated pace from September, as some took a wait-and-see approach due to the Presidential election that month.

The manufacturing sector PMI recorded an index value of 58.1 for October, up from 54.1 index points in September as manufacturing received a seasonal pop, particularly from the food and beverage sector.

“…the firms had ramped up their production processes, increasing the Production sub-index during the month”, the Central Bank said releasing the latest data.

The services sector PMI also recorded an index value of 60.3 for October, rising from 53.4 index points in September as the banks ramped up lending as they grew more confident about the economy as well as on the borrowers’ capacity to repay under a low interest rate environment.

Under PMI, an activity is split between an expansion and a contraction at an index value of 50.0, while 50.0 indicates a neutral level.

Manufacturing activities have now extended their continued expansion for more than a year despite the April contraction due to the extended holidays.

Meanwhile, services activities have been expanding since March 2023 despite its employment sub-index remaining in the contraction territory.

In manufacturing, however, employment returned to expansionary phase and more so in October in line with the new orders they have been receiving as factories need more manpower to run the production.

Cooler inflation readings, lower interest rates and the overall positive sentiments have helped consumers to increase spending and thereby the manufacturers to ramp up their production.

The forgoing September 2024 earnings season saw that the companies have in general increased their top-lines reflecting these increased consumer spending translating into better corporate results.

As the rates come down the companies also save a lot of money if otherwise would have gone to repay their loans, which now goes into either increasing production or to return to their shareholders by way of dividends which in turn are spent elsewhere in the economy.

The future expectations by both the manufacturers and service providers remain positive with the upcoming festive season and also favourable macro-economic conditions.