Reply To:

Name - Reply Comment

By First Capital Research

The secondary market saw limited activity during yesterday’s trading session ahead of the Rs.132.5 billion worth T-bond auction scheduled for today.

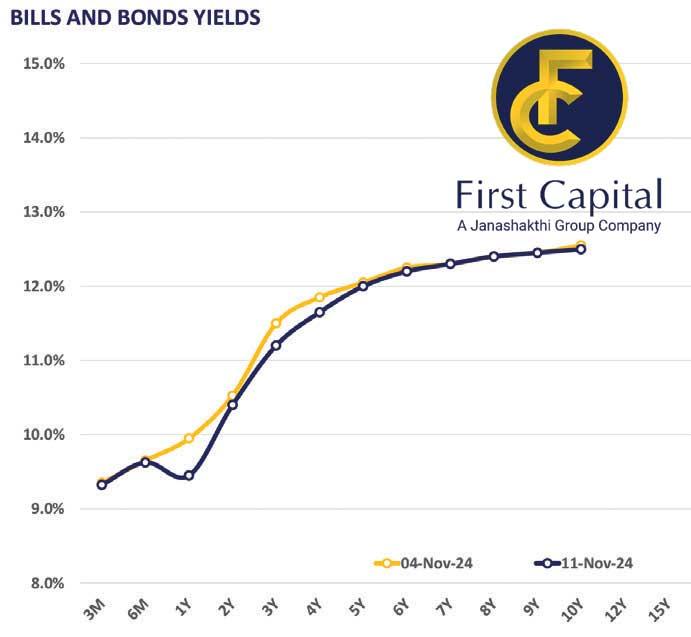

However, short to mid tenures saw some activity, resulting in a slight downward shift in the yield curve.

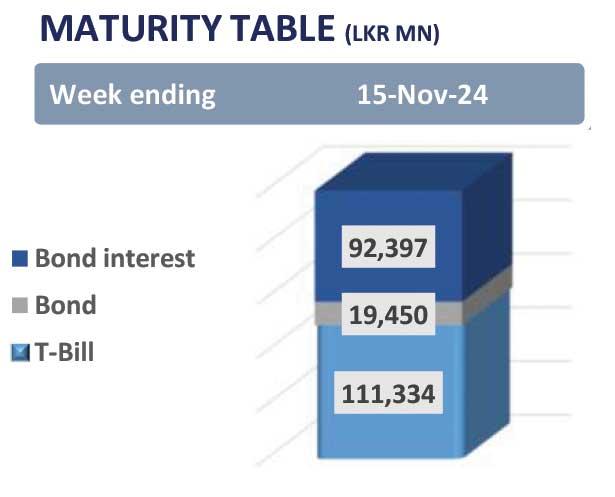

Accordingly, on the 2027 bond, 15.12.2027 registered trades at 11.30 percent. Moreover, on the 2028 bond, 01.05.2028, 15.10.2028 and 15.12.2028 saw trades at 11.60 percent, 11.75 percent and 11.80 percent, respectively. Meanwhile, the Central Bank is raising a cumulative of Rs.280.0 billion during this week from the primary auctions, where Rs.132.5 billion is raised from today’s bond auction whilst Rs.147.5 billion is being raised from the weekly T-bill auction.

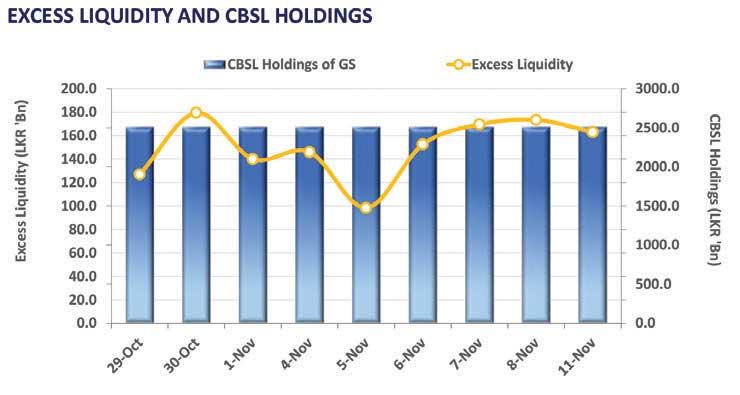

On the external side, the Sri Lankan rupee appreciated against the US dollar for the third consecutive day, closing at Rs.292.65/US dollar. Similarly, the GBP, EUR, JPY and AUD too appreciated against the Sri Lankan rupee during the day. Overnight liquidity closed at Rs.162.93 billion, compared to the previous day’s closing of Rs.173.37 billion while the Central Bank holdings remained unchanged at Rs.2,515.62 billion. Weekly AWPLR for the week ending November 8, 2024 increased by 11bps to 9.16 percent compared to the previous week.