Reply To:

Name - Reply Comment

By First Capital Research

At the end of the week, the secondary market yield curve remained broadly stable while the market activities were at a complete standstill.

The investor sentiment paused momentarily after the substantial buying momentum witnessed in previous sessions, following the negotiations regarding the external debt restructuring agreement with the international sovereign bondholders.

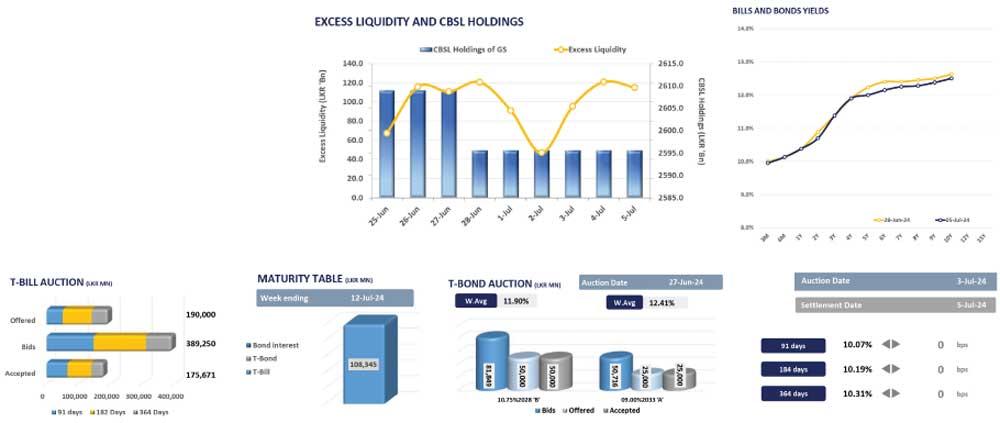

As a result, the investors opted for a cautious approach, allowing for reflection and strategic positioning. Furthermore, the Central Bank has announced a Treasury bill issuance totalling Rs.105.0 billion through an auction scheduled for July 10, 2024, slightly below the Rs.108.3 billion T-bill maturing for the week ending July 12, 2024.

Meanwhile, out of the total auction, Rs.30.0 billion is to be raised from the 91-day maturity, Rs.40.0 billion is expected to be raised from the 182-day maturity while Rs.35.0 billion is to be raised from the 364-day maturity.

Simultaneously, in the forex market, the Sri Lankan rupee experienced a modest depreciation against the US dollar for the third consecutive day, settling at Rs.304.5. This movement mirrored broader trends as the Sri Lankan rupee also depreciated against the other major currencies such as the AUD, GBP and EUR.